Verify Blofin - BloFin Blog

Verifying your account on BloFin is a crucial step to unlock a range of features and benefits, including higher withdrawal limits and enhanced security. In this guide, we'll walk you through the process of verifying your account on the BloFin cryptocurrency exchange platform.

What is KYC BloFin?

KYC stands for Know Your Customer, emphasizing a thorough understanding of customers, including the verification of their real names.

Why is KYC important?

- KYC serves to fortify the security of your assets.

- Different levels of KYC can unlock varying trading permissions and access to financial activities.

- Completing KYC is essential to elevate the single transaction limit for both buying and withdrawing funds.

- Fulfilling KYC requirements can amplify the benefits derived from futures bonuses.

BloFin KYC Classifications Differences

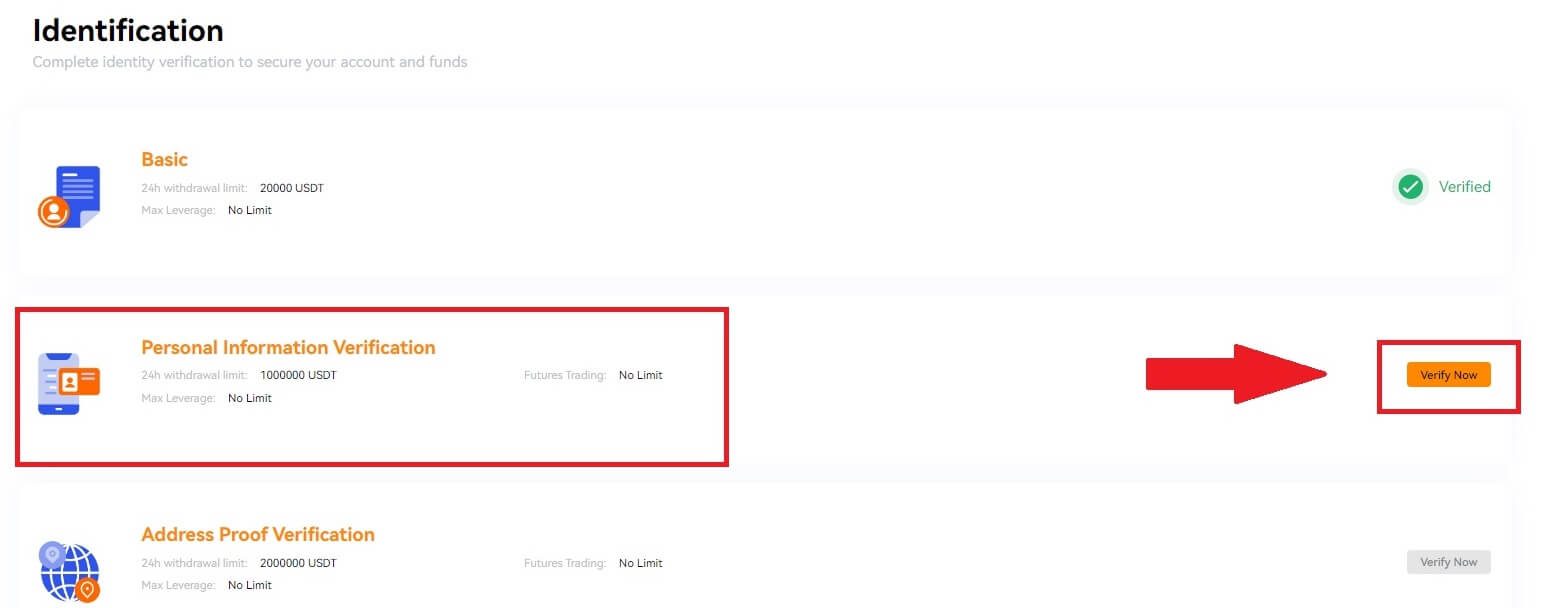

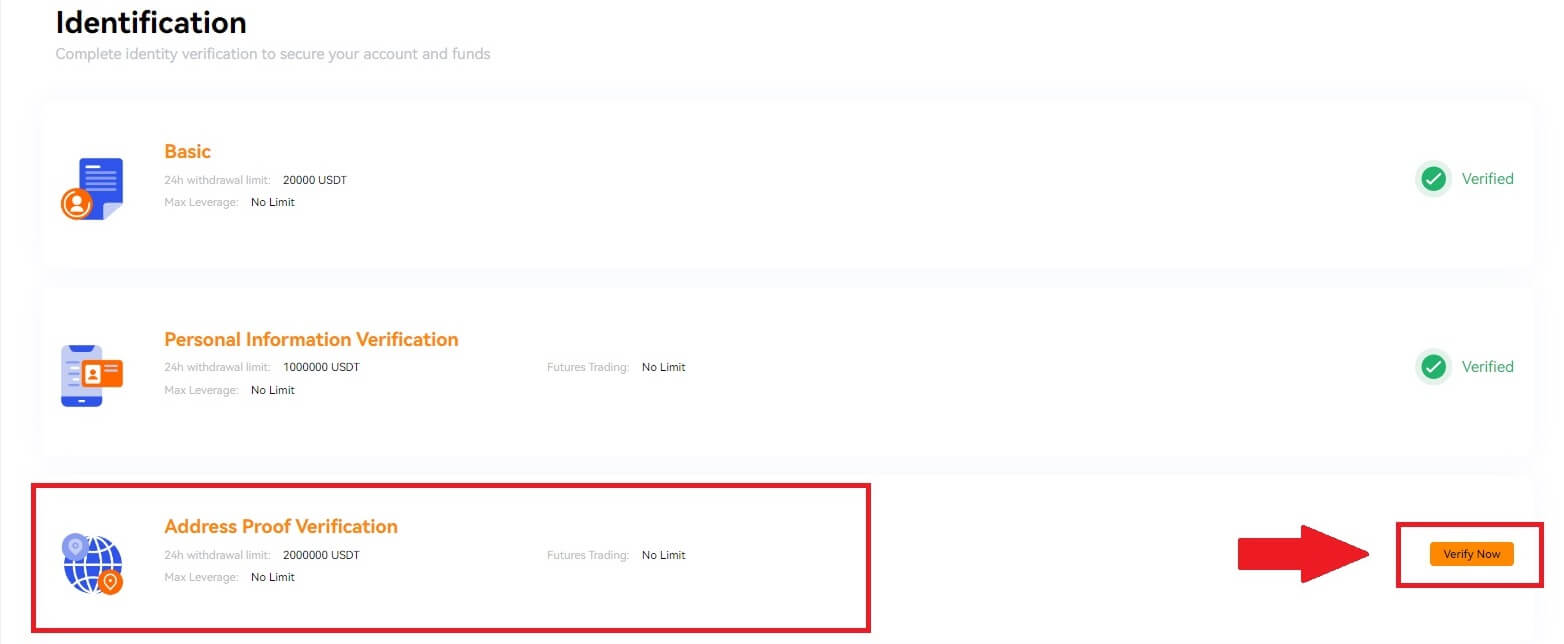

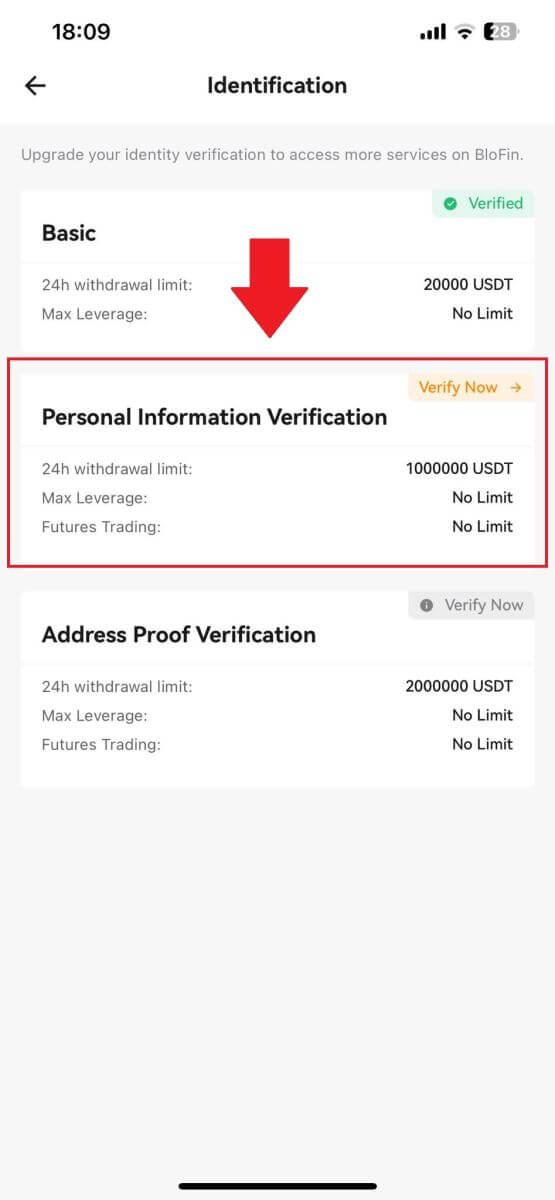

BloFin employs two KYC types: Personal Information Verification (Lv 1) and Address Proof Verification (Lv 2).

- For Personal Information Verification (Lv 1), basic personal information is mandatory. Successful completion of primary KYC results in an increased 24-hour withdrawal limit, reaching up to 20,000 USDT, no limit in Future Trading and Max Leverage.

- For Address Proof Verification (Lv 2), you need to fill up your proof of resident. Accomplishing advanced KYC leads to an elevated 24-hour withdrawal limit of up to 2,000,000 USDT, no limit in Future Trading and Max Leverage.

How to complete Identity Verification on BloFin? A step-by-step guide (Web)

Personal Information Verification (Lv1) KYC on BloFin

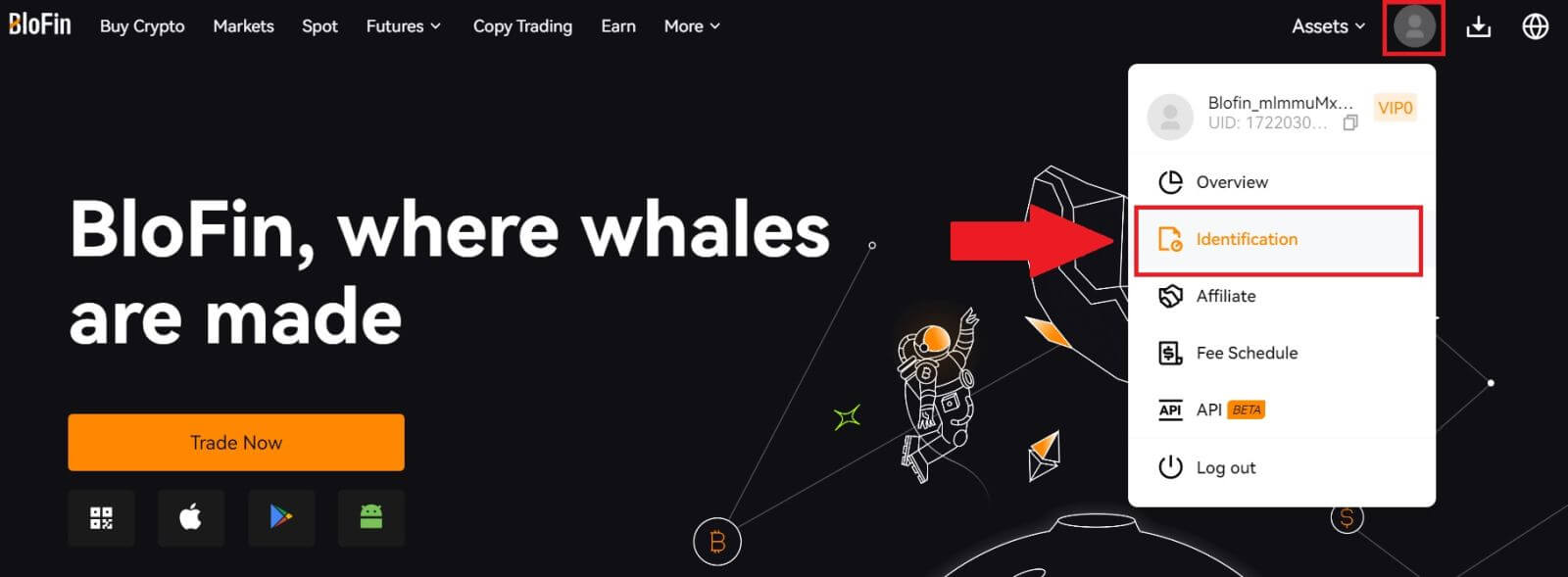

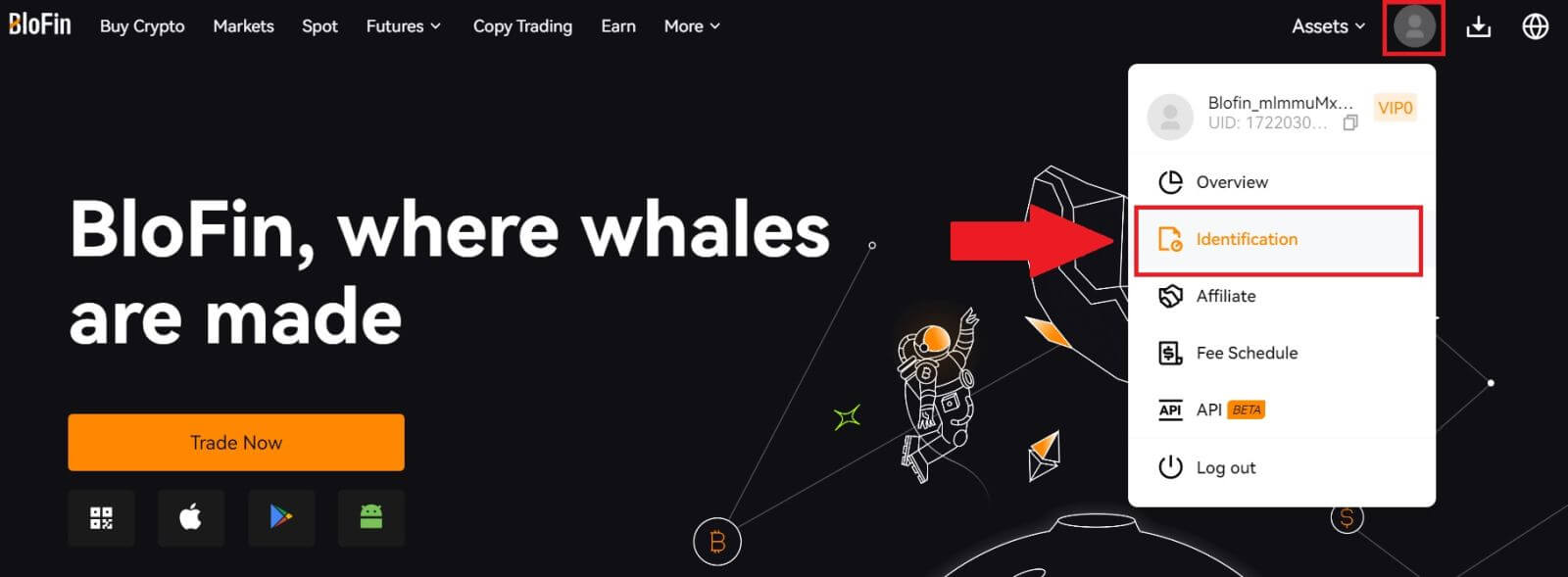

1. Log in to your BloFin account, click on the [Profile] icon, and select [Identification].

2. Choose [Personal Information Verification] and click on [Verify Now].

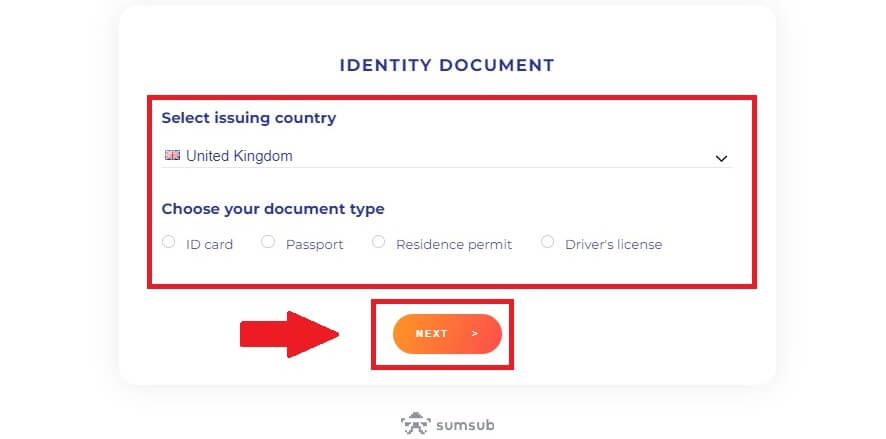

3. Access the verification page and indicate your issuing country. Select your [document type] and click on [NEXT].

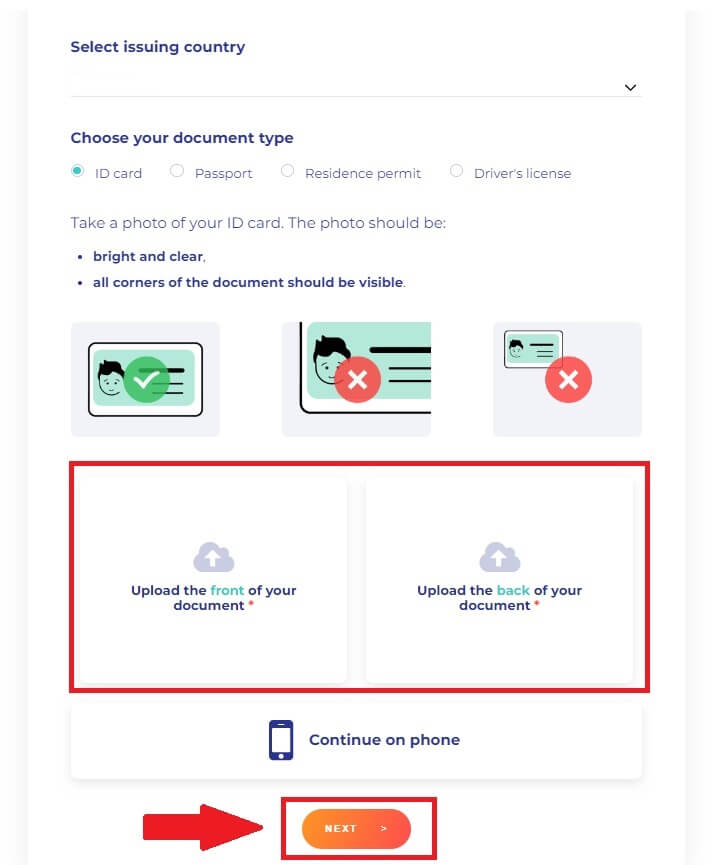

4. Begin by taking a photo of your ID card. Following that, upload clear images of both the front and back of your ID into the designated boxes. Once both pictures are distinctly visible in the assigned boxes, click [NEXT] to proceed to the facial verification page.

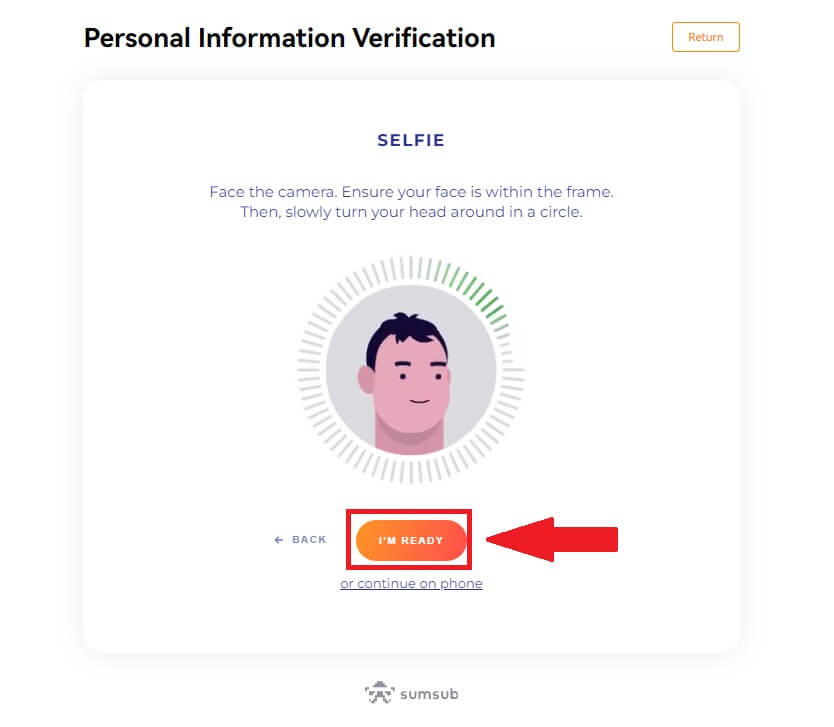

5. Next, start taking your selfie by clicking on [I’M READY].

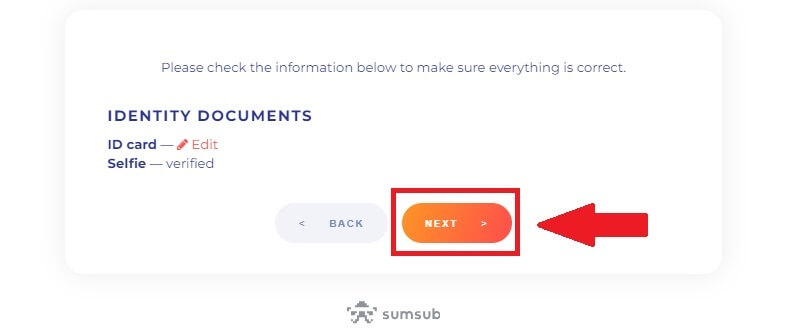

6. Lastly, check out your document information, then click [NEXT].

6. Lastly, check out your document information, then click [NEXT].

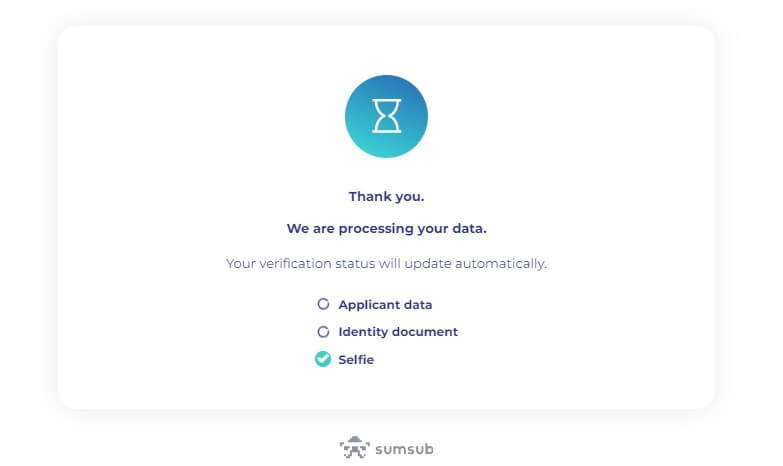

7. After that, your application has been submitted.

Address Proof Verification (Lv2) KYC on BloFin

1. Log in to your BloFin account, click on the [Profile] icon, and select [Identification].

2. Choose [Address Proof Verification] and click [Verify Now].

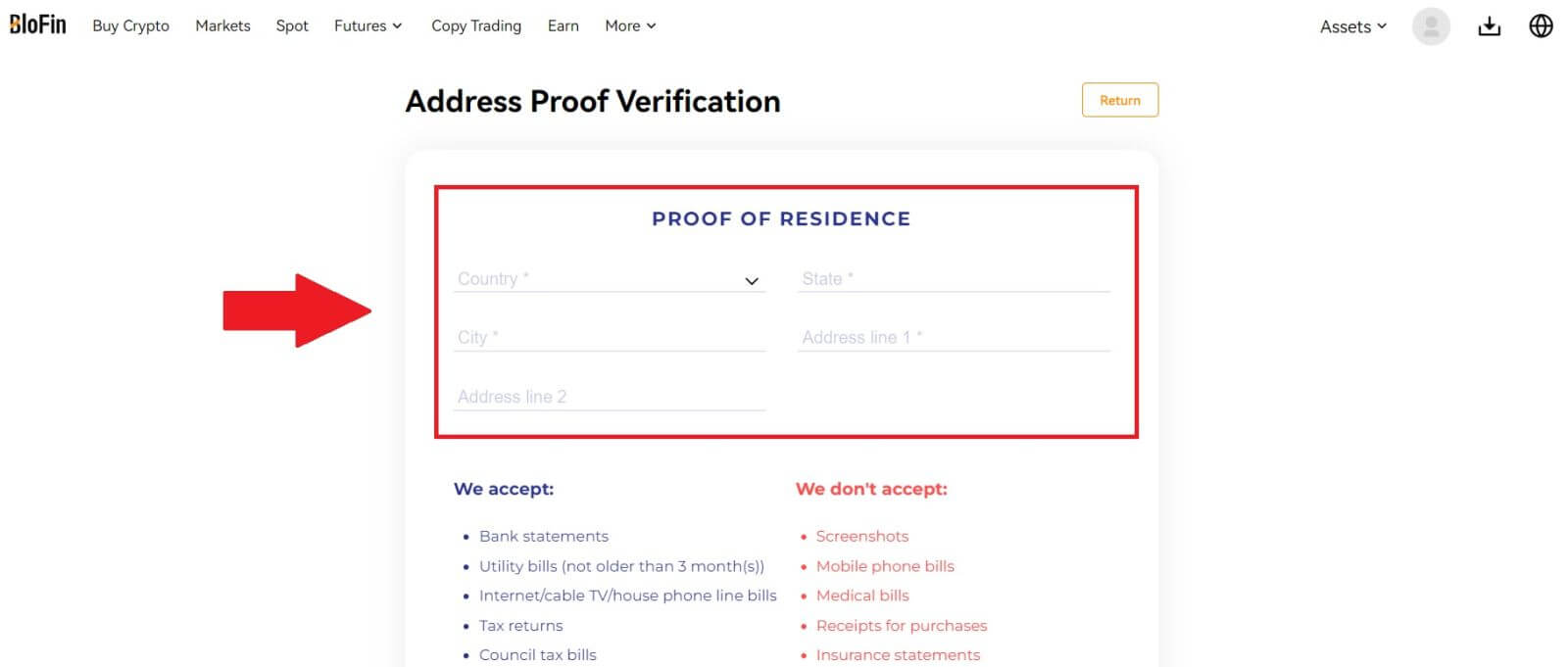

3. Enter your permanent address to continue.

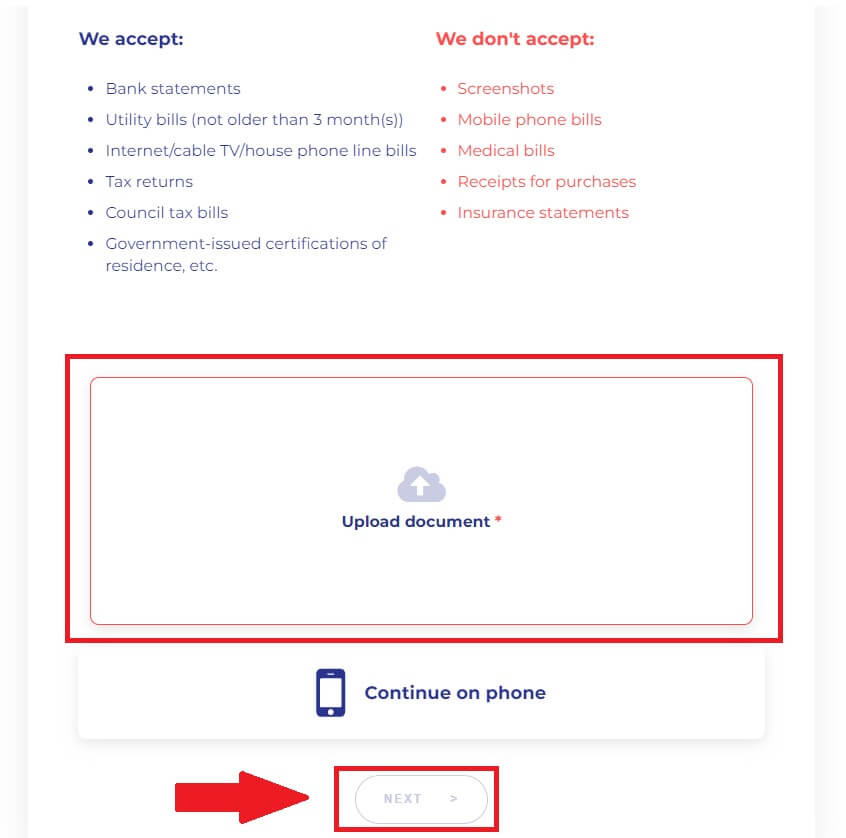

4. Upload your document and click [NEXT].

*Please refer to the acceptance document list below.

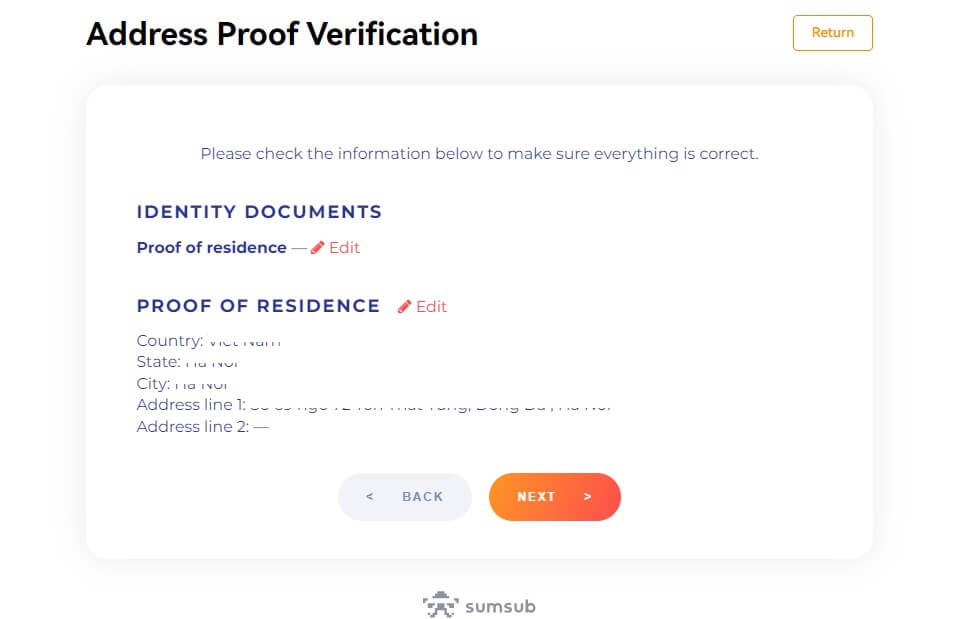

5. Lastly, check out your proof of residence information, then click [NEXT].

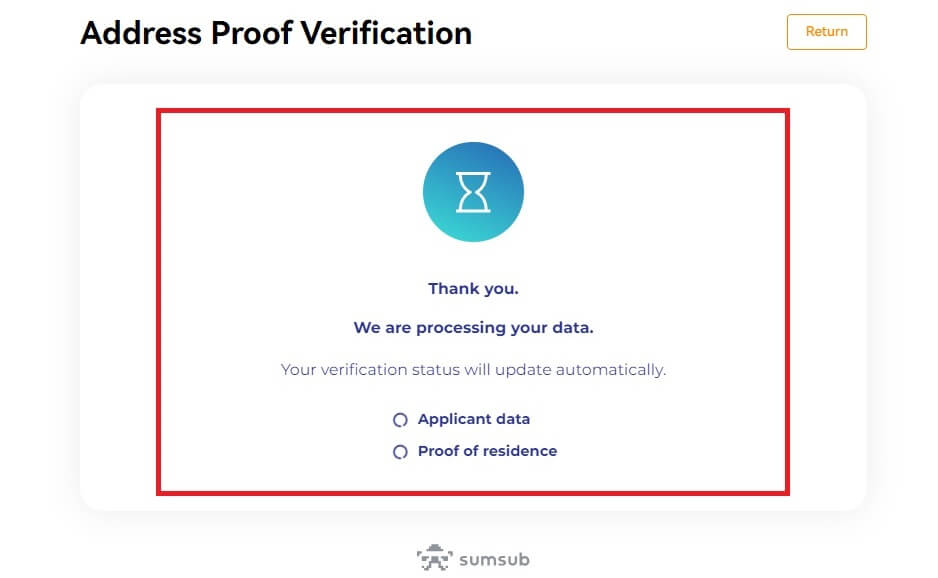

6. After that, your application has been submitted.

How to complete Identity Verification on BloFin? A step-by-step guide (App)

Personal Information Verification (Lv1) KYC on BloFin

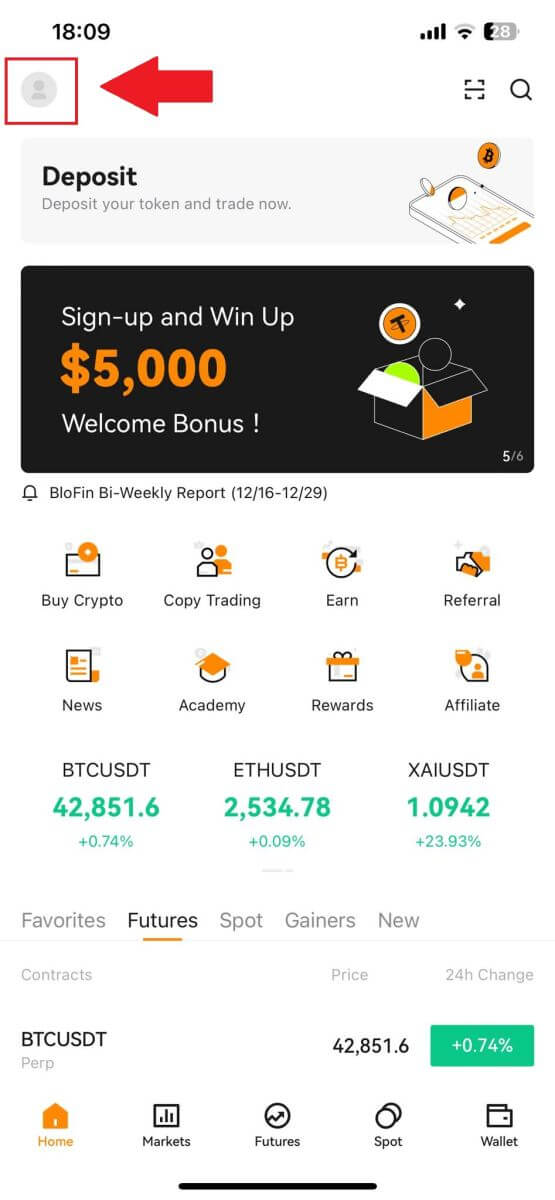

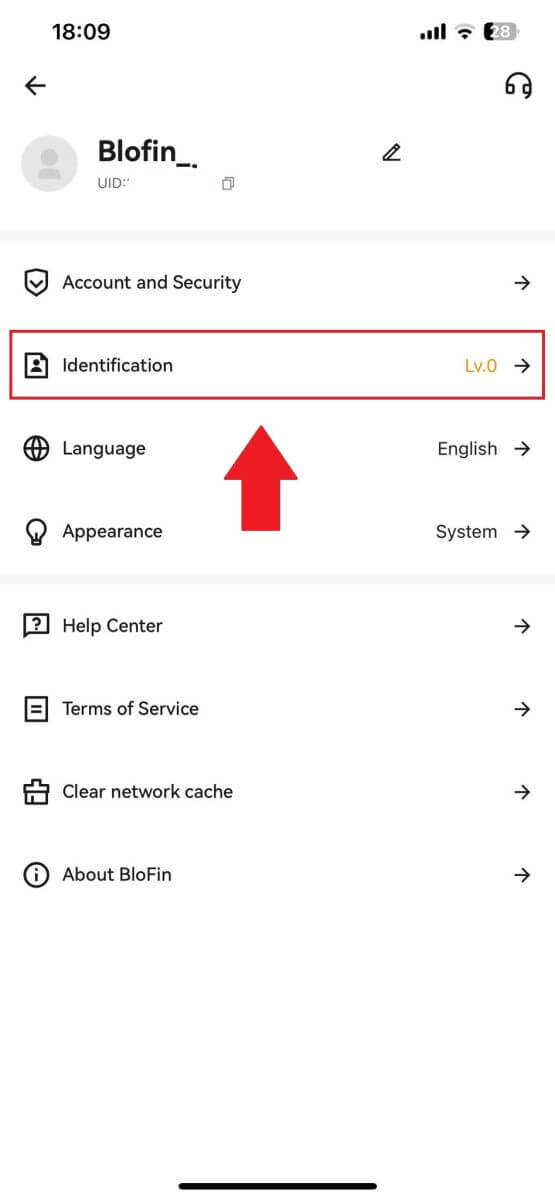

1. Open your BloFin app, tap on the [Profile] icon, and select [Identification].

2. Choose [Personal Information Verification] to continue

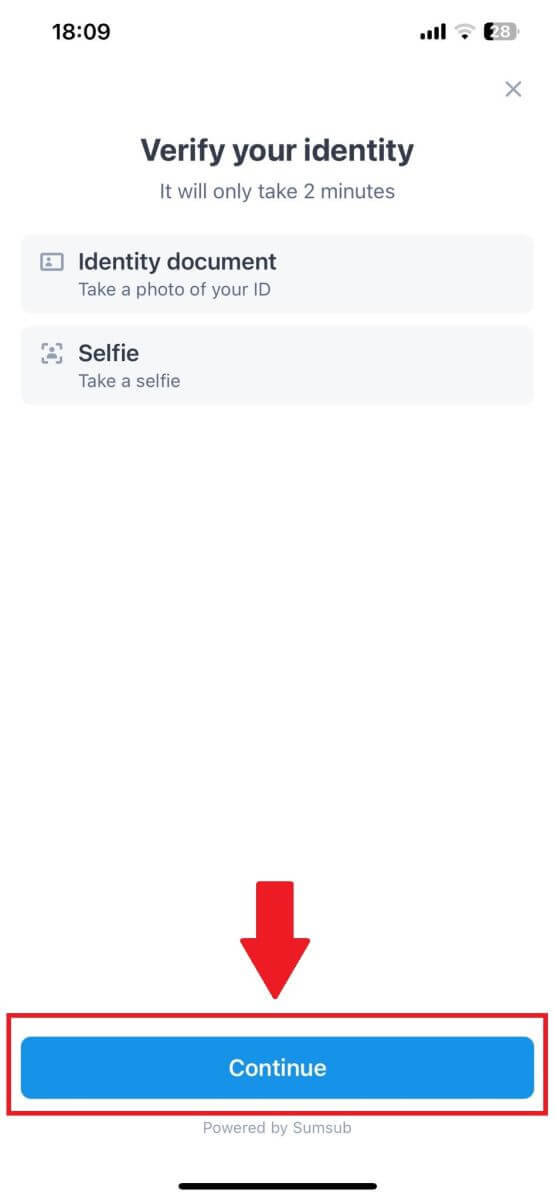

3. Continue your process by tapping [Continue].

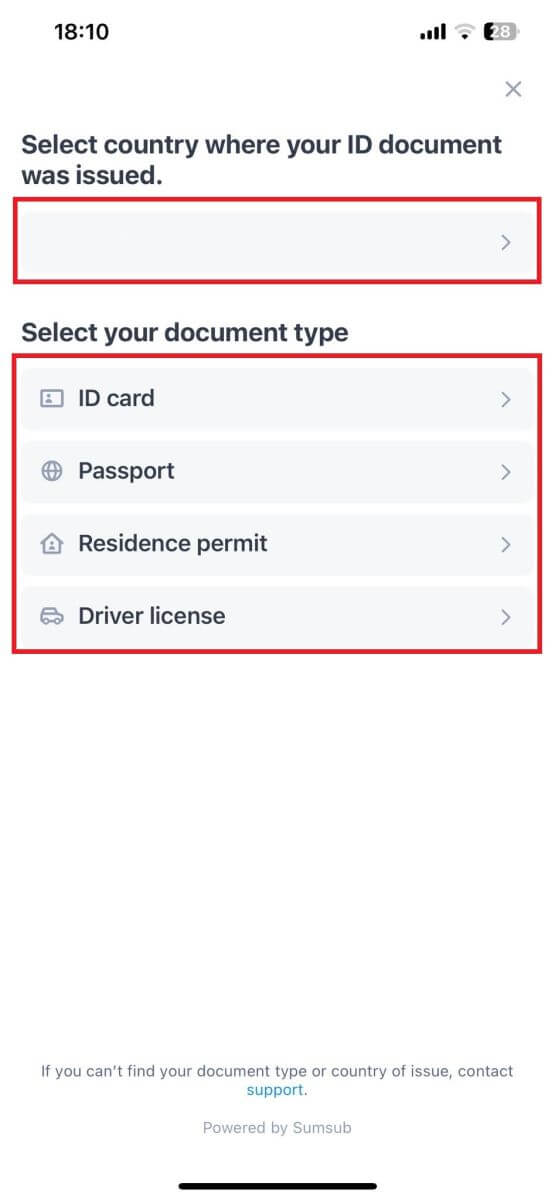

4. Access the verification page and indicate your issuing country. Select your [document type] to continue.

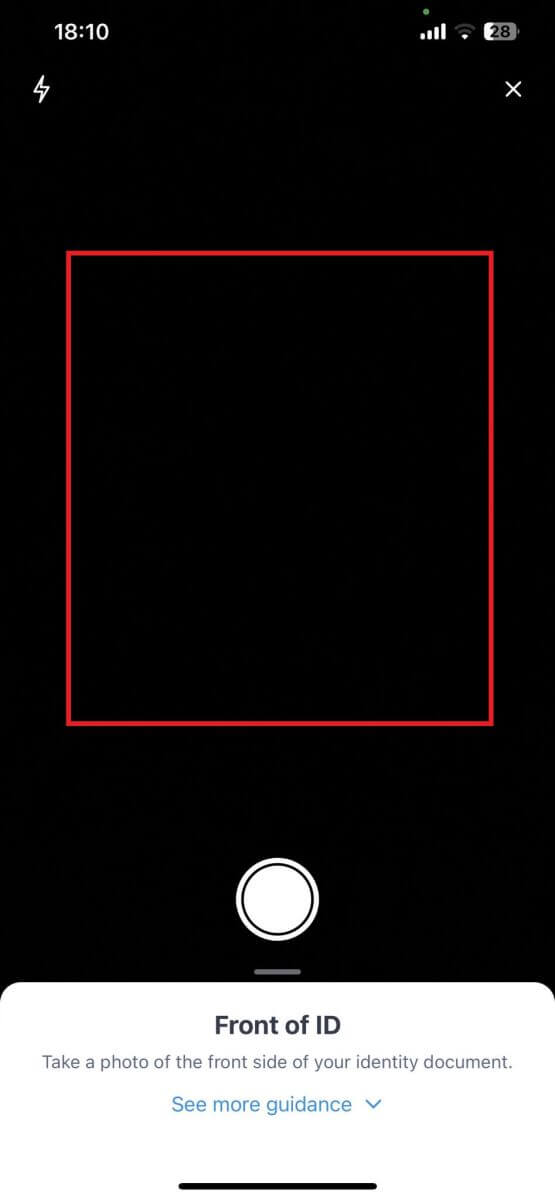

5. Next, place and take both side of your ID-type photo on the frame to continue.

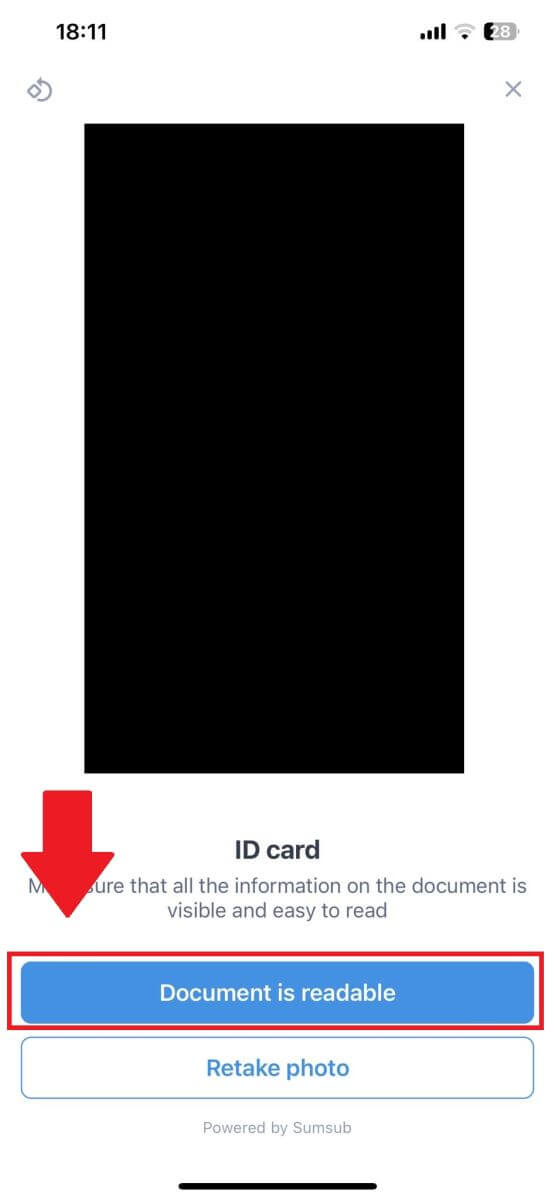

6. Make sure all the information in your photo is visible, and tap [Document is readable].

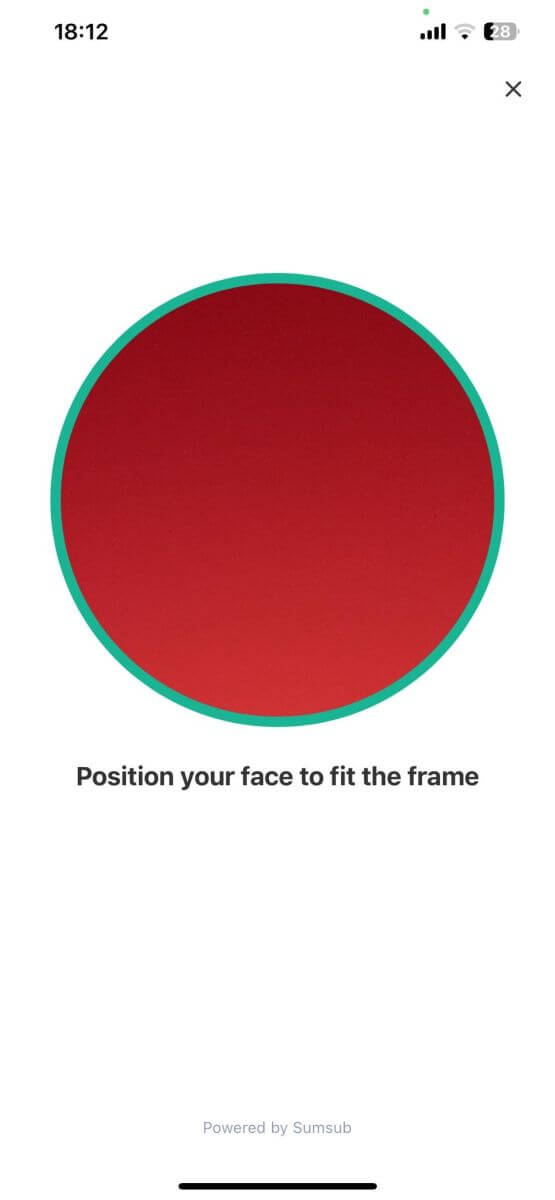

7. Next, take a selfie by putting your face into the frame to complete the process.

.

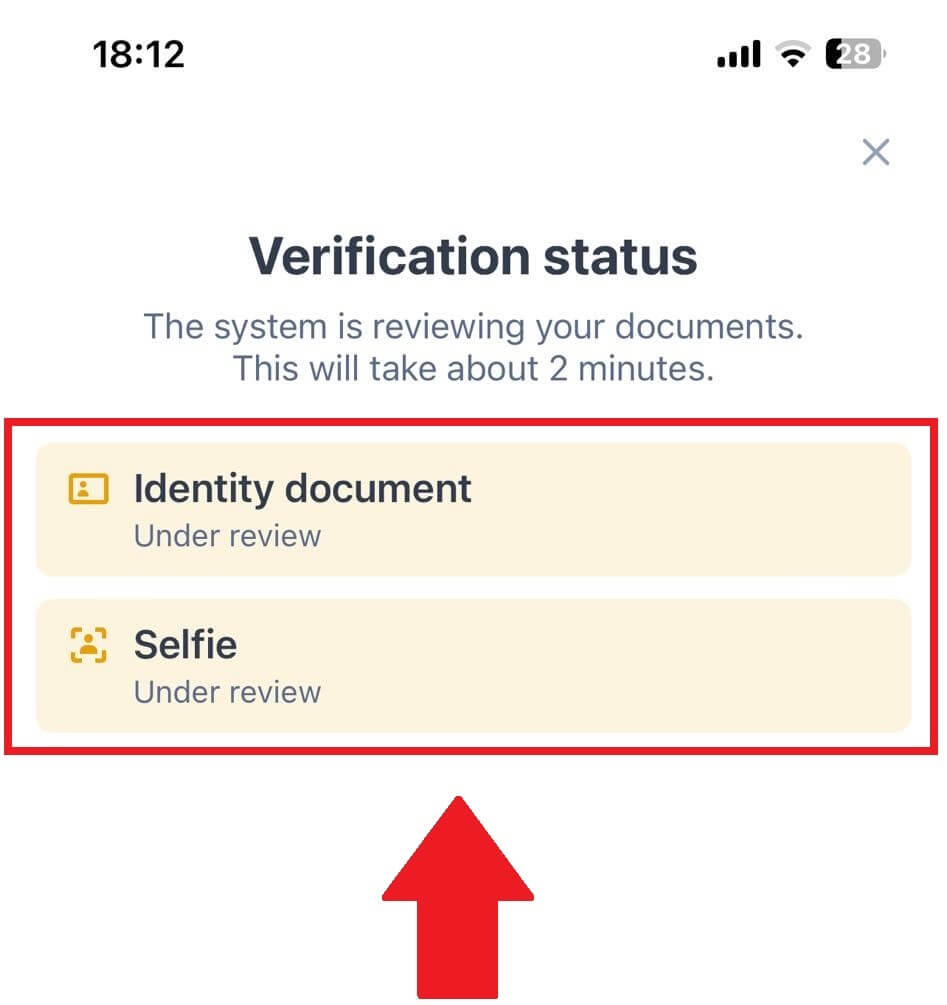

. 8. After that, your verification is under review. Wait for the confirmation email or access your profile to check the KYC status.

Address Proof Verification (Lv2) KYC on BloFin

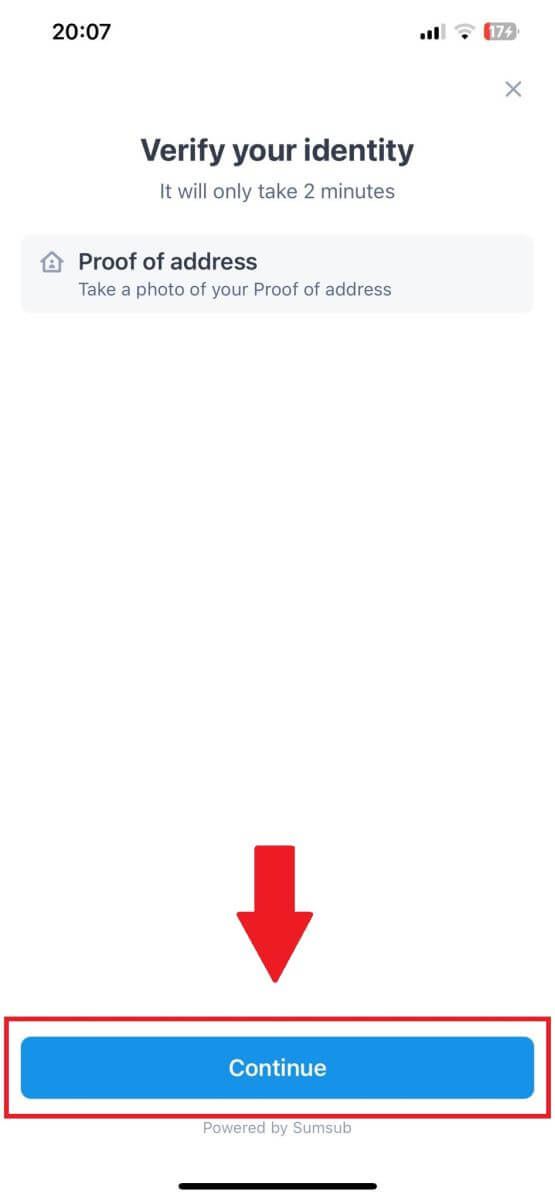

1. Open your BloFin app, tap on the [Profile] icon, and select [Identification].

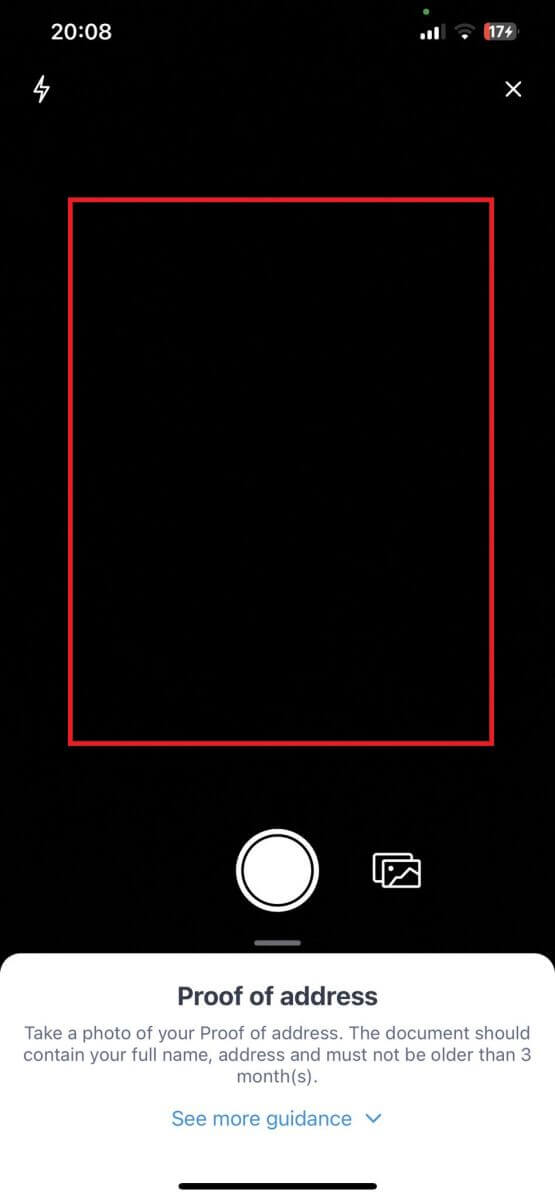

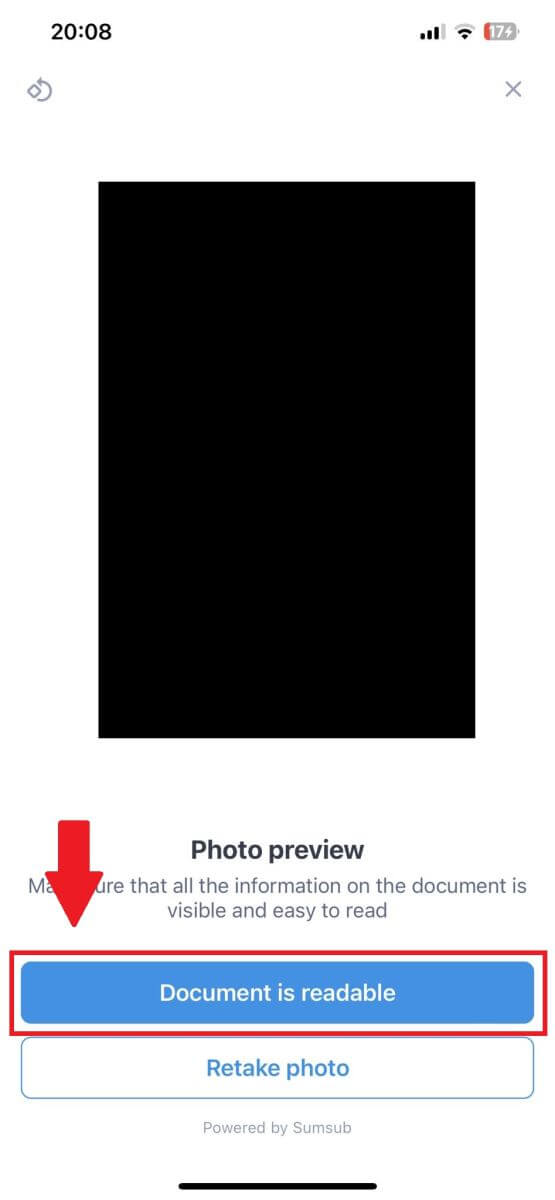

3. Take a picture of your Proof of address to continue.

4. Make sure all the information in your photo is visible, and tap [Document is readable].

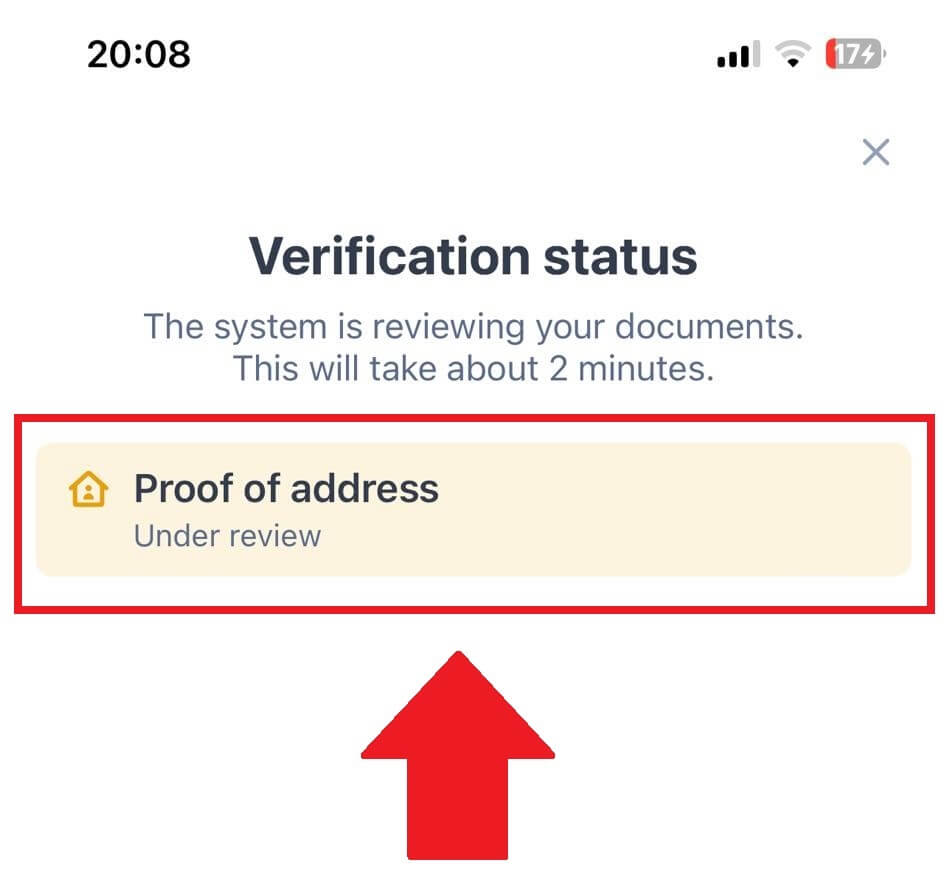

5. After that, your verification is under review. Wait for the confirmation email or access your profile to check the KYC status.

Frequently Asked Questions (FAQ)

Unable to upload photo during KYC Verification

If you encounter difficulties uploading photos or receive an error message during your KYC process, please consider the following verification points:- Ensure the image format is either JPG, JPEG, or PNG.

- Confirm that the image size is below 5 MB.

- Use a valid and original ID, such as a personal ID, driver’s license, or passport.

- Your valid ID must belong to a citizen of a country that allows unrestricted trading, as outlined in "II. Know-Your-Customer and Anti-Money-Laundering Policy" - "Trade Supervision" in the BloFin User Agreement.

- If your submission meets all the above criteria but KYC verification remains incomplete, it might be due to a temporary network issue. Please follow these steps for resolution:

- Wait for some time before resubmitting the application.

- Clear the cache in your browser and terminal.

- Submit the application through the website or app.

- Try using different browsers for the submission.

- Ensure your app is updated to the latest version.

Why can’t I receive the email verification code?

Please check and try again as follows:

- check the blocked mail spam and trash;

- add the BloFin notification email address ([email protected]) to the email whitelist so that you can receive the email verification code;

- wait for 15 minutes and try.

Common Errors During the KYC Process

- Taking unclear, blurry, or incomplete photos may result in unsuccessful KYC verification. When performing face recognition, please remove your hat (if applicable) and face the camera directly.

- KYC process is connected to a third-party public security database, and the system conducts automatic verification, which cannot be manually overridden. If you have special circumstances, such as changes in residency or identity documents, that prevent authentication, please contact online customer service for advice.

- If camera permissions are not granted for the app, you will be unable to take photos of your identity document or perform facial recognition.