Blofin FAQ - BloFin Blog

Account

Why Can’t I Receive Emails from BloFin?

If you are not receiving emails sent from BloFin, please follow the instructions below to check your email’s settings:-

Are you logged in to the email address registered to your BloFin account? Sometimes you might be logged out of your email on your device and hence can’t see BloFin emails. Please log in and refresh.

-

Have you checked the spam folder of your email? If you find that your email service provider is pushing BloFin emails into your spam folder, you can mark them as “safe” by whitelisting BloFin email addresses. You can refer to How to Whitelist BloFin Emails to set it up.

-

Is the functionality of your email client or service provider normal? To be sure that your firewall or antivirus program isn’t causing a security conflict, you can verify the email server settings.

-

Is your inbox packed with emails? You won’t be able to send or receive emails if you have reached the limit. To make room for new emails, you can remove some of the older ones.

-

Register using common email addresses like Gmail, Outlook, etc., if at all possible.

How come I can’t get SMS verification codes?

BloFin is always working to improve the user experience by expanding our SMS Authentication coverage. Nonetheless, certain nations and regions aren’t currently supported.Please check our global SMS coverage list to see if your location is covered if you are unable to enable SMS authentication. Please use Google Authentication as your primary two-factor authentication if your location is not included on the list.

The following actions should be taken if you are still unable to receive SMS codes even after you have activated SMS authentication or if you are currently living in a nation or region covered by our global SMS coverage list:

- Make sure there is a strong network signal on your mobile device.

- Disable any call blocking, firewall, anti-virus, and/or caller programs on your phone that might be preventing our SMS Code number from working.

- Turn your phone back on.

- Instead, try voice verification.

How to Change My Email Account on BloFin?

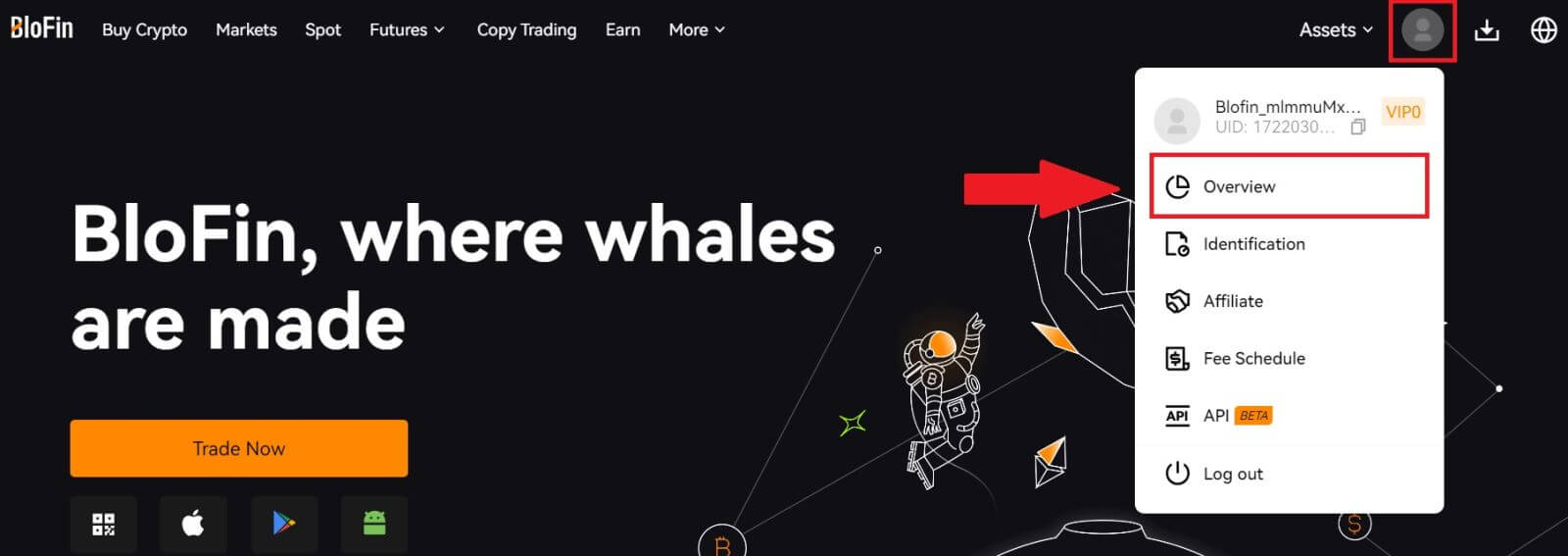

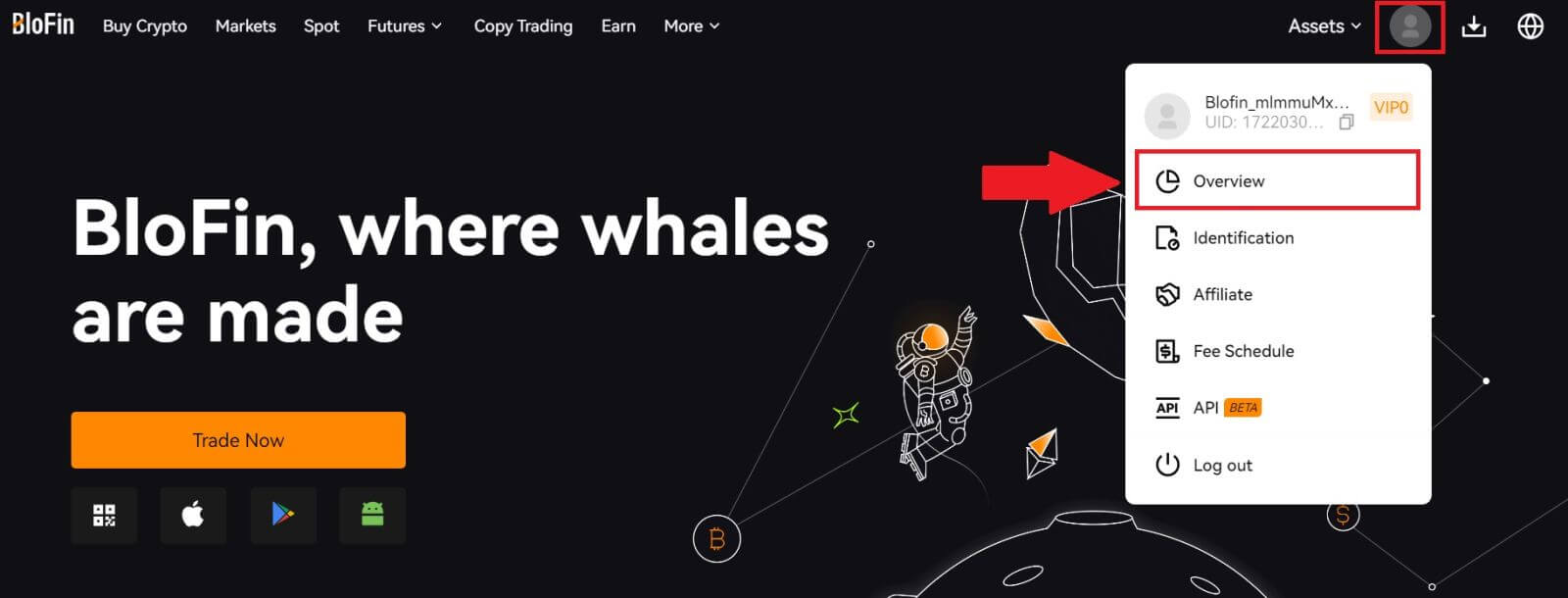

1. Log in to your BloFin account, click on the [Profile] icon, and select [Overview].

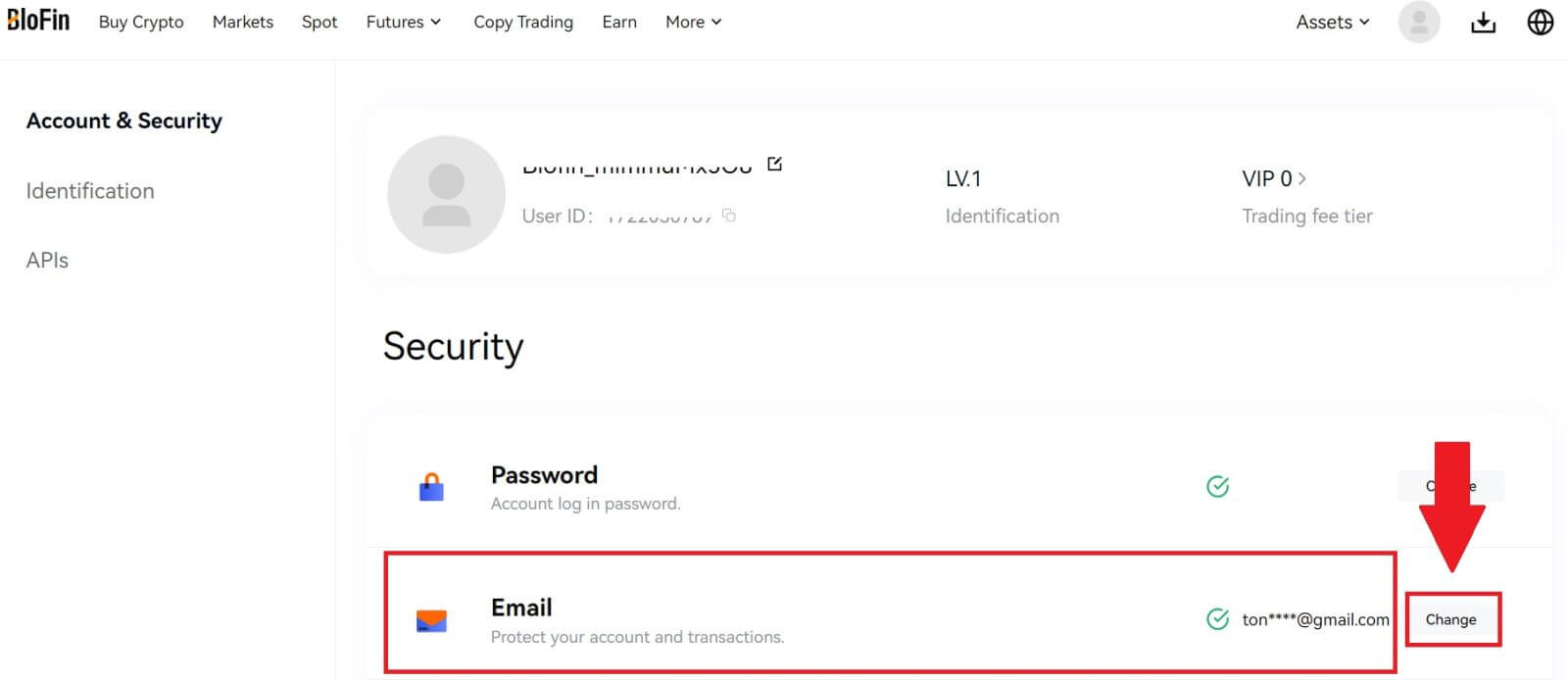

2. Go to the [Email] session and click [Change] to enter the [Change Email] page.

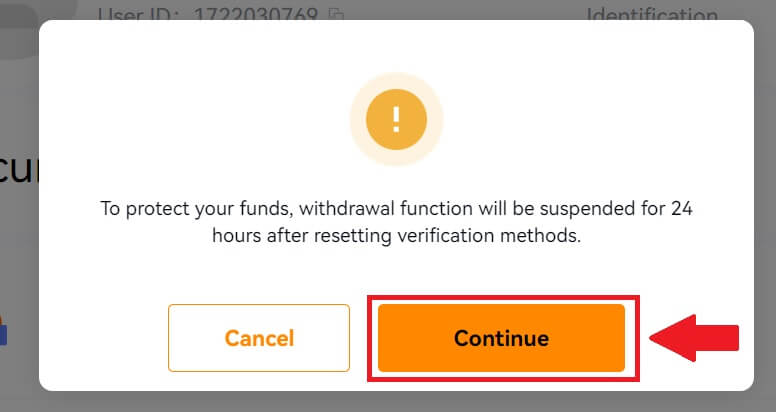

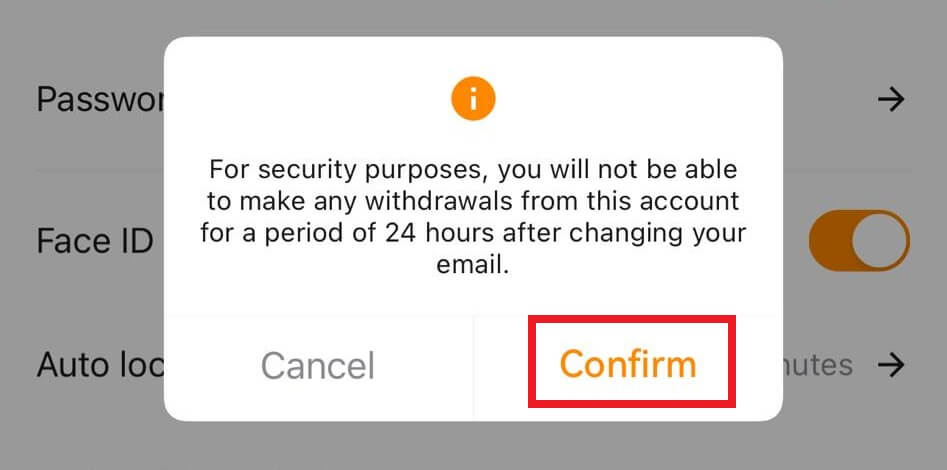

3. To protect your funds, withdrawals will be unavailable within 24 hours after resetting the security features. Click [Continue] to move on to the next process.

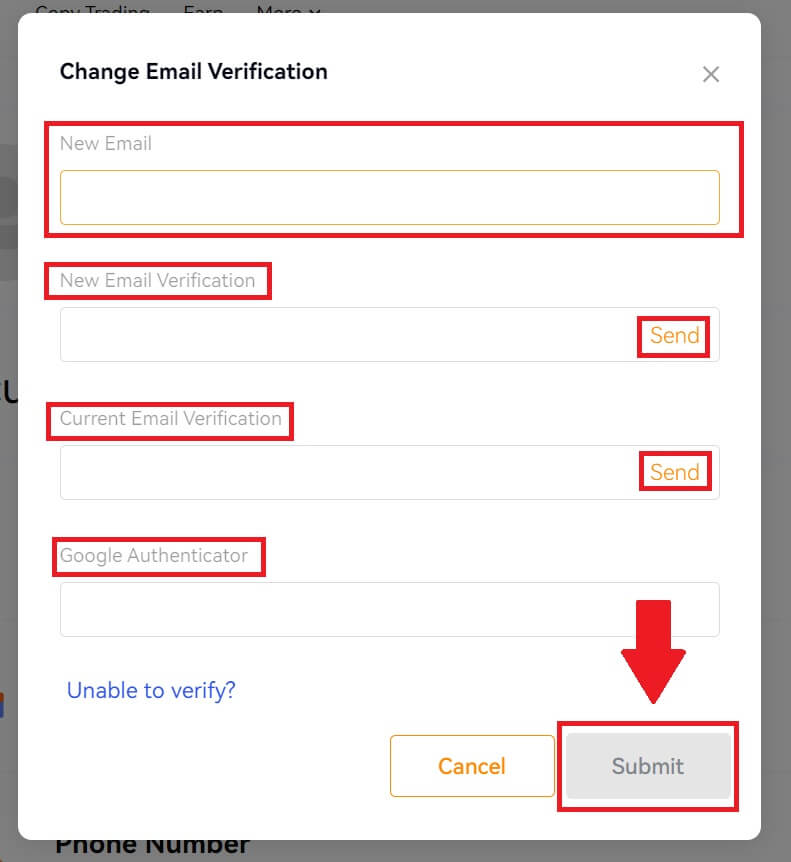

4. Enter your new email, click on [Send] to get a 6-digit code for your new and current email verification. Input your Google Authenticator code and click [Submit].

5. After that, you have successfully change your email.

Or you can also change your account email on BloFin App

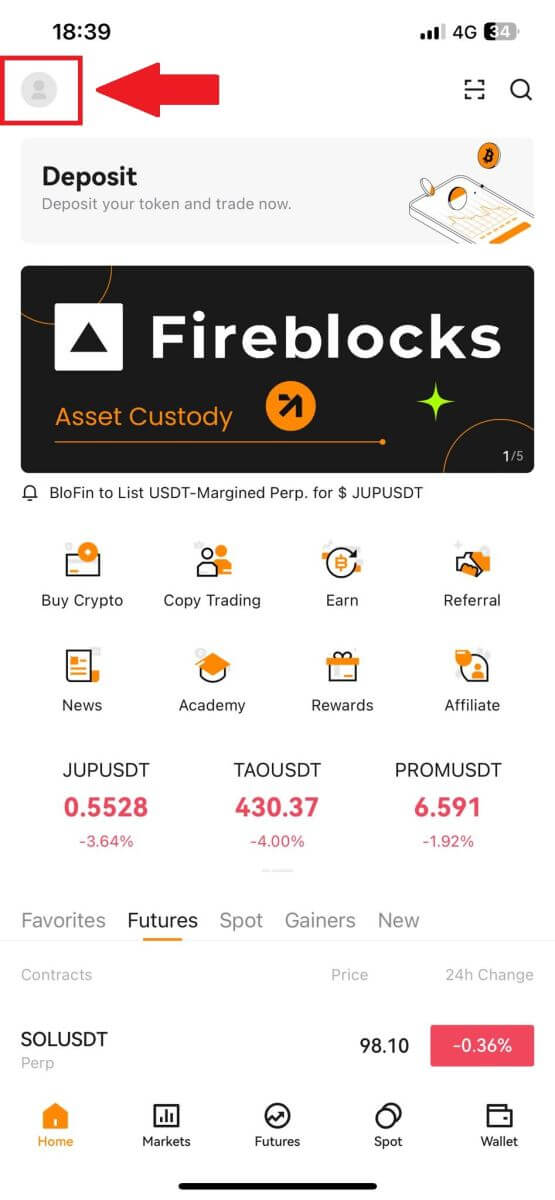

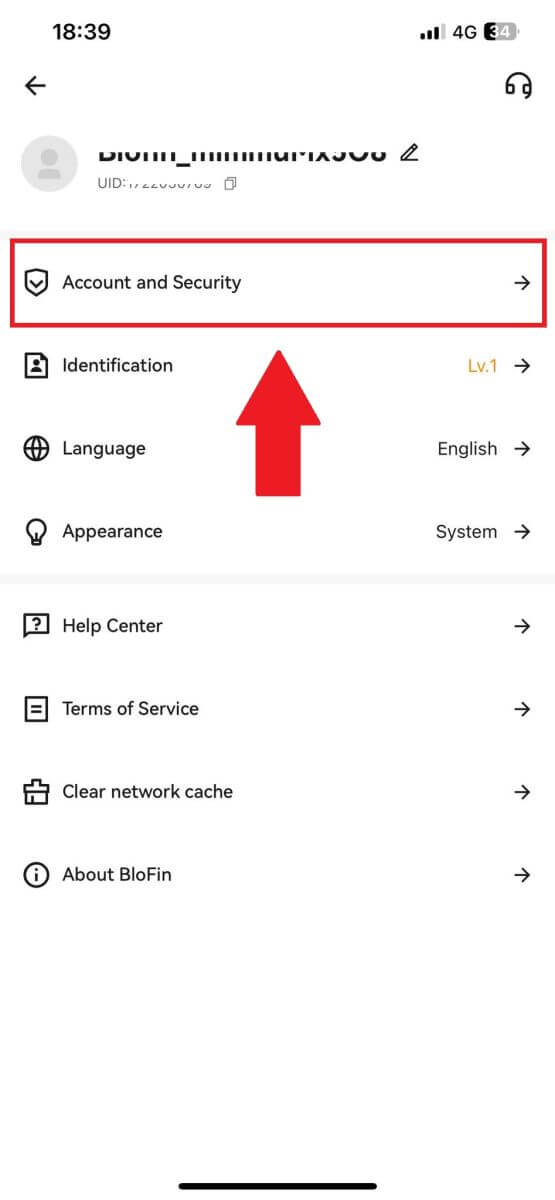

1. Log in to your BloFin app, tap on the [Profile] icon, and select [Account and Security].

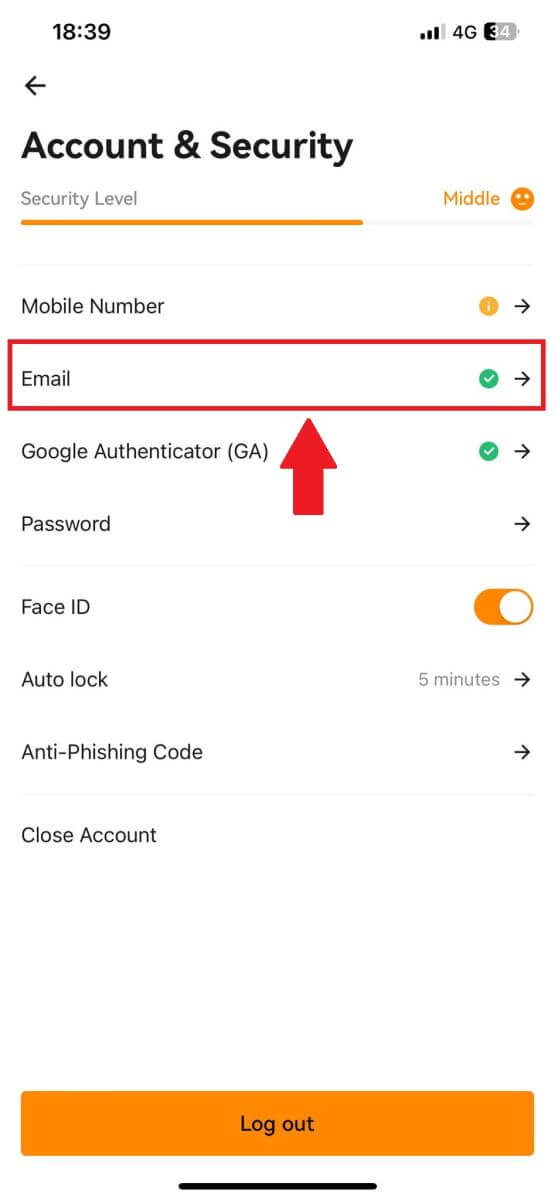

2. Click on [Email] to continue.

3. To protect your funds, withdrawals will be unavailable within 24 hours after resetting the security features. Click [Continue] to move on to the next process.

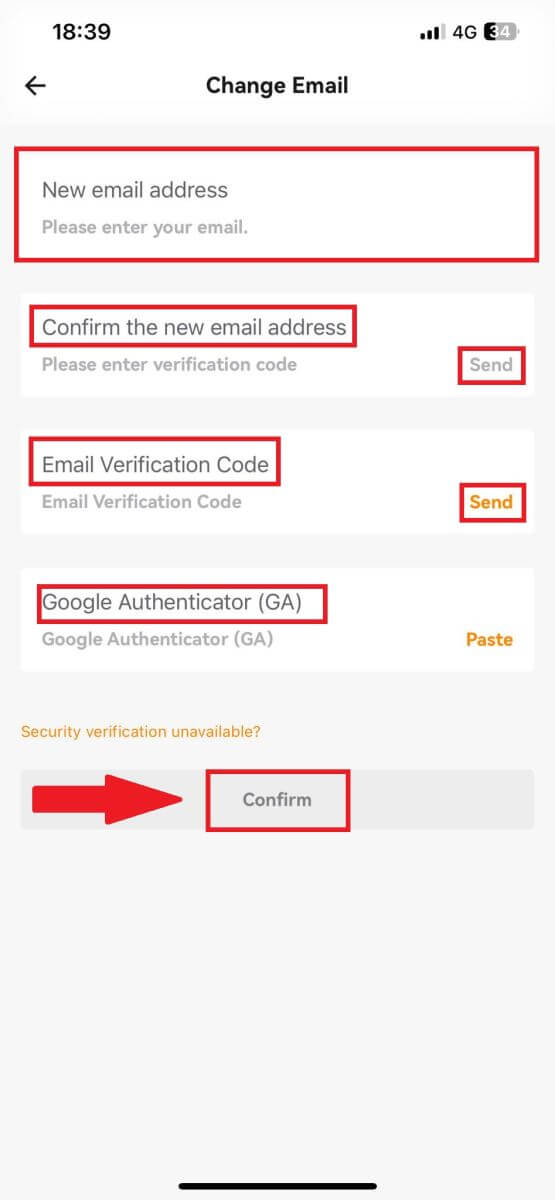

4. Enter your new email, click on [Send] to get a 6-digit code for your new and current email verification. Input your Google Authenticator code and click [Confirm].

5. After that, you have successfully changed your email.

What is Two-Factor Authentication?

Two-Factor Authentication (2FA) is an additional security layer to email verification and your account password. With 2FA enabled, you will have to provide the 2FA code when performing certain actions on the BloFin platform.

How does TOTP work?

BloFin uses a Time-based One-time Password (TOTP) for Two-Factor Authentication, it involves generating a temporary, unique one-time 6-digit code* that is only valid for 30 seconds. You will need to enter this code to perform actions that affect your assets or personal information on the platform.

*Please keep in mind that the code should consist of numbers only.

How to Link Google Authenticator (2FA)?

1. Go to the BloFin website, click on the [Profile] icon, and select [Overview].

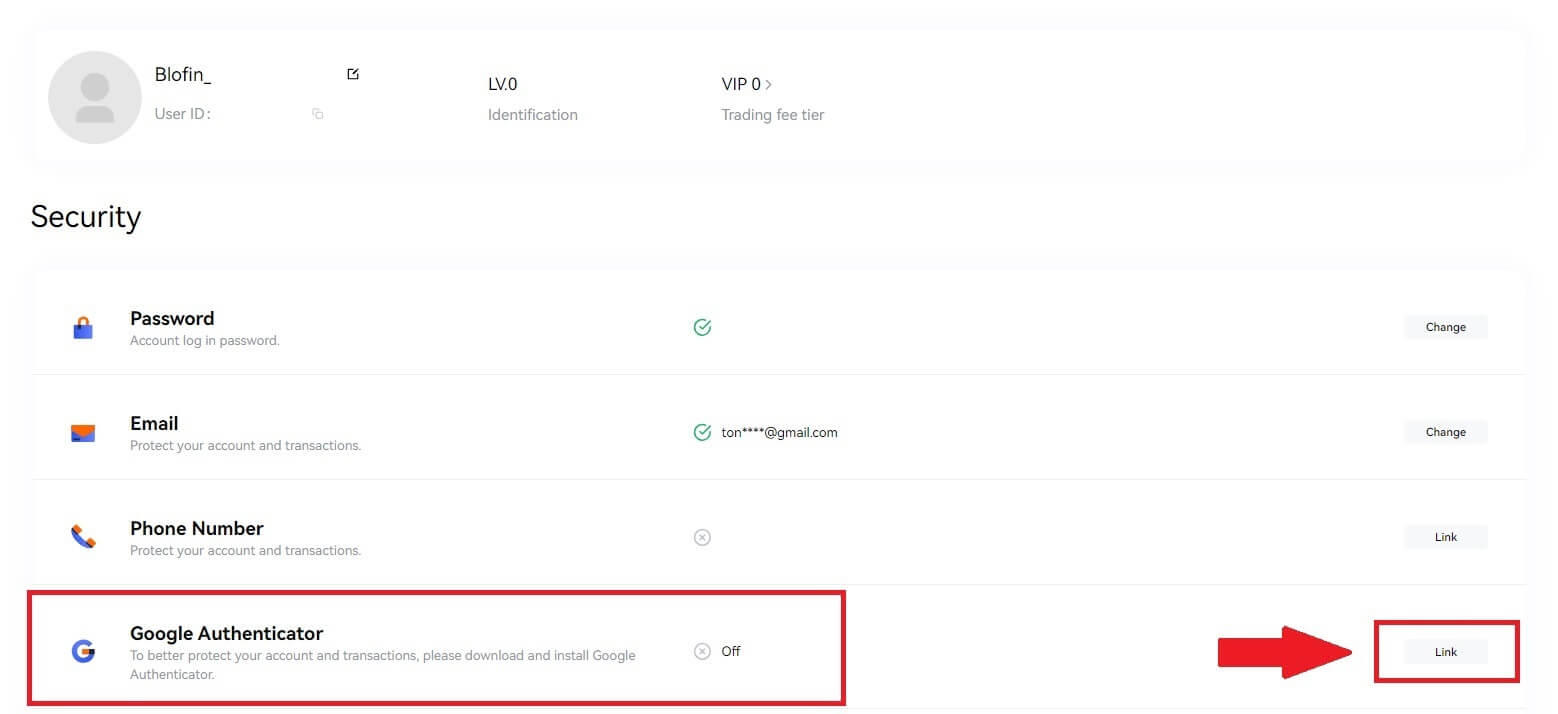

2. Select [Google Authenticator] and click on [Link].

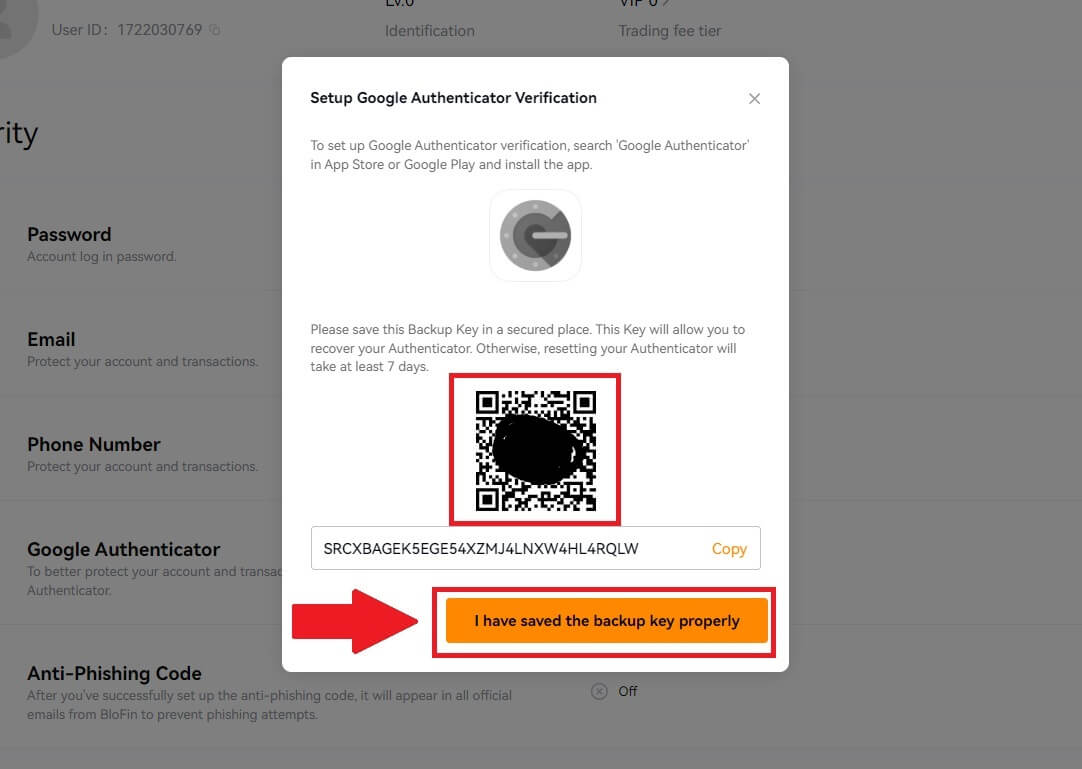

3. A pop-up window will appear containing your Google Authenticator Backup Key. Scan the QR code with your Google Authenticator App.

After that, click on [I have saved the backup key properly].

Note: Safeguard your Backup Key and QR code in a secure location to prevent any unauthorized access. This key serves as a crucial tool for recovering your Authenticator, so it’s important to keep it confidential.

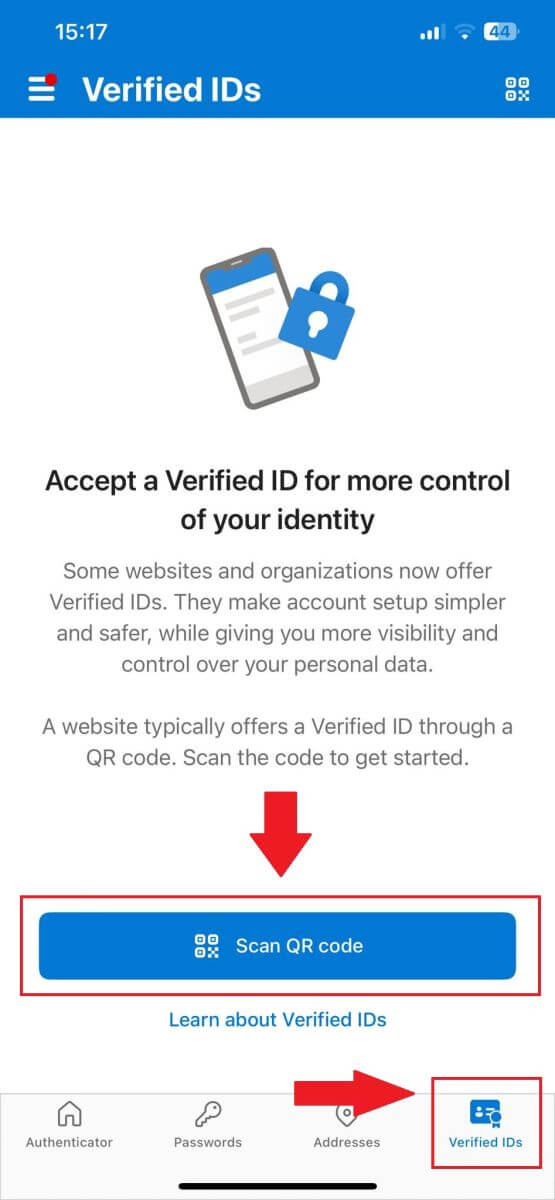

How to add your BloFin account to the Google Authenticator App?

Open your Google authenticator App, on the first page, select [Verified IDs] and tap [Scan QR code].

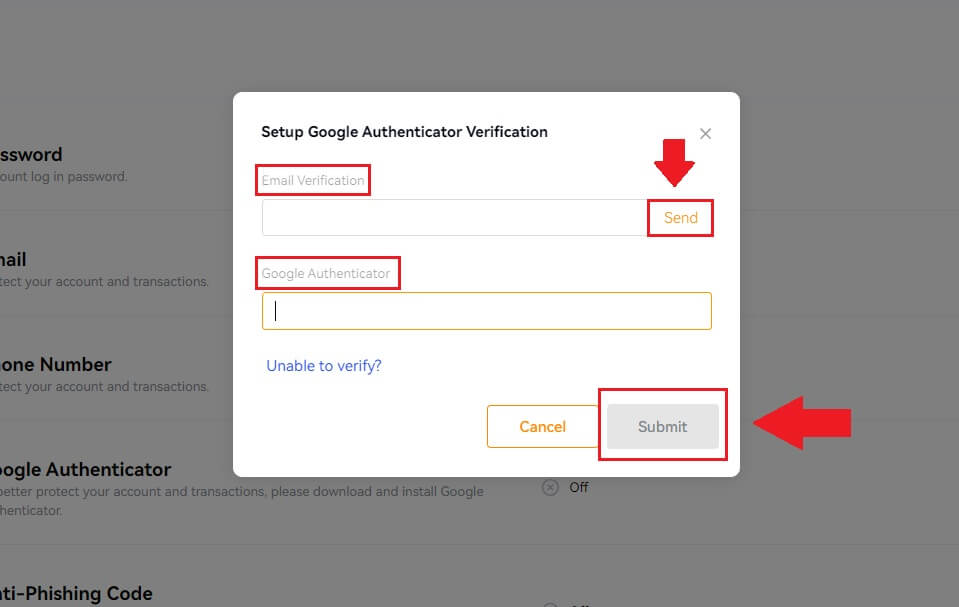

4. Verify your email code by clicking on [Send], and your Google Authenticator code. Click [Submit].

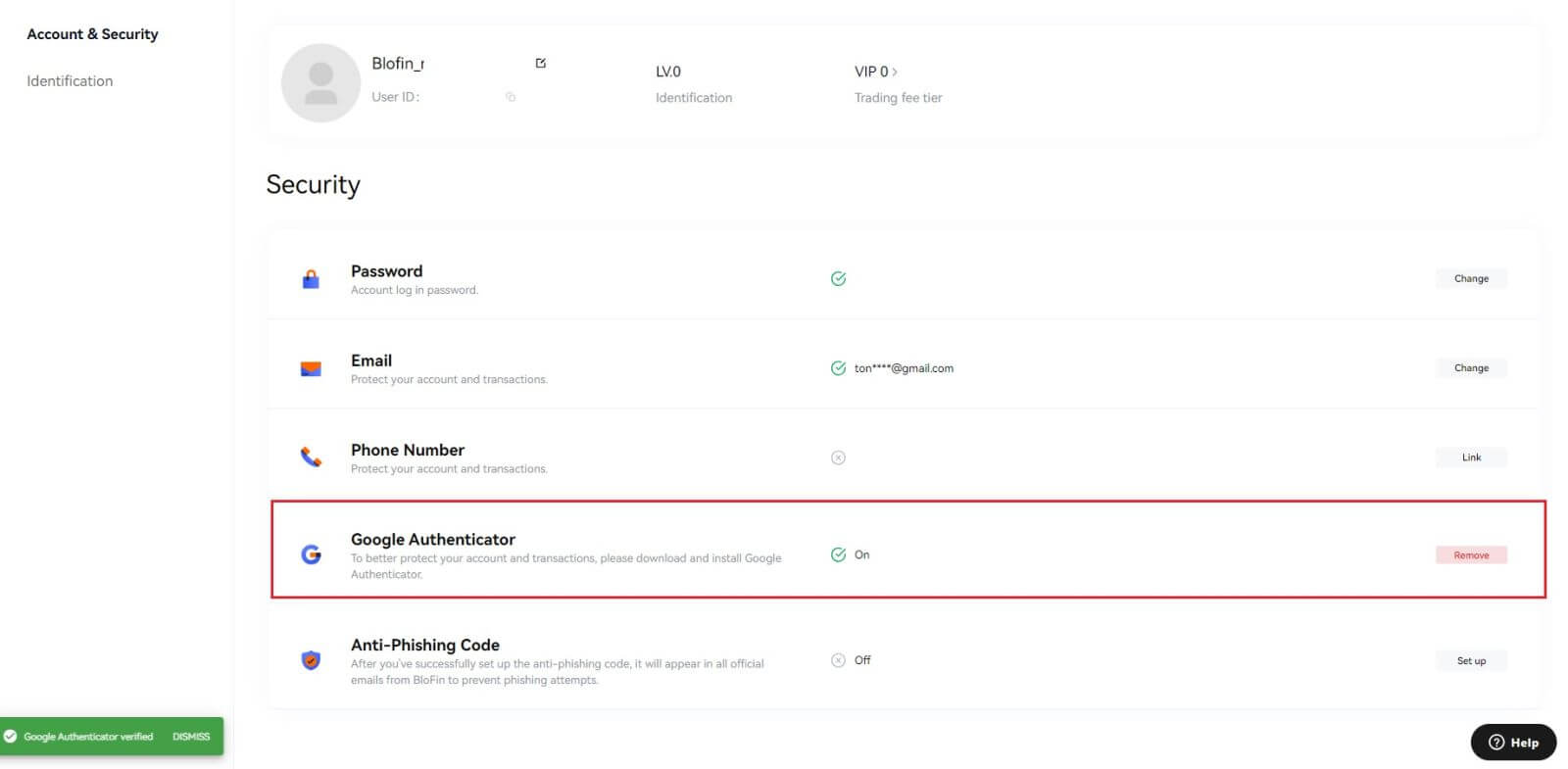

5. After that, you have successfully linked your Google Authenticator for your account.

Verification

How to complete Identity Verification on BloFin? A step-by-step guide (Web)

Personal Information Verification (Lv1) KYC on BloFin

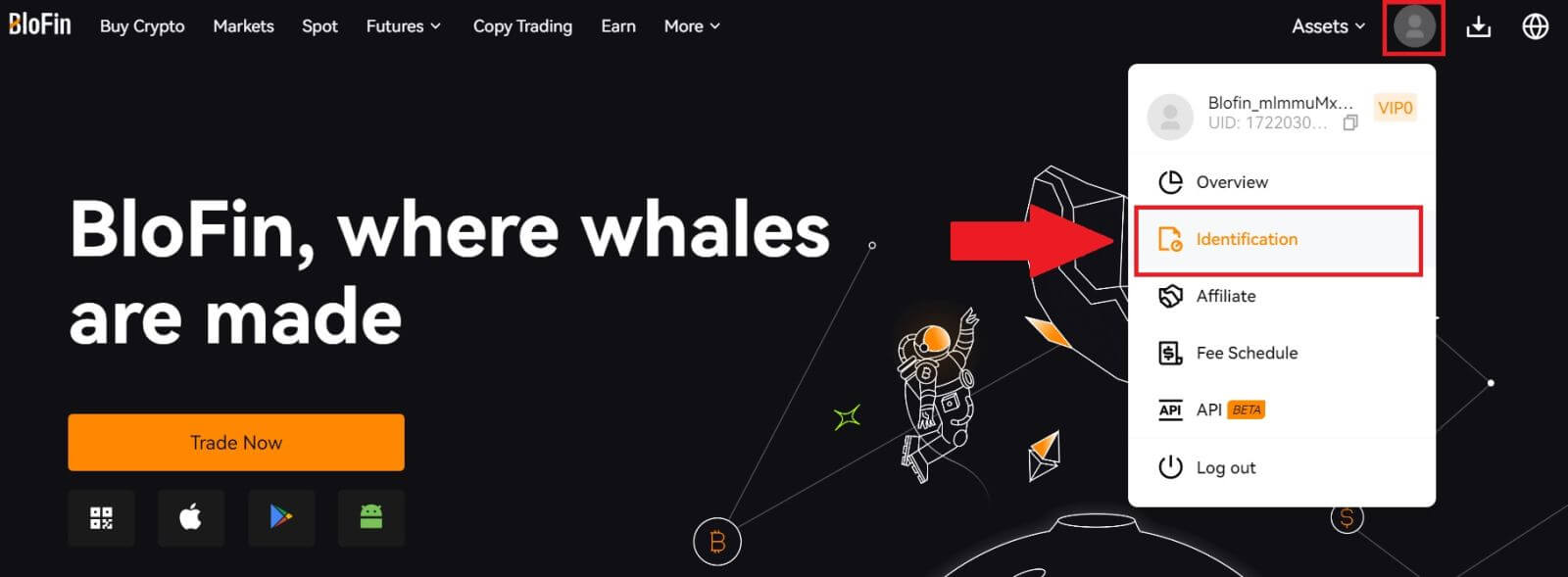

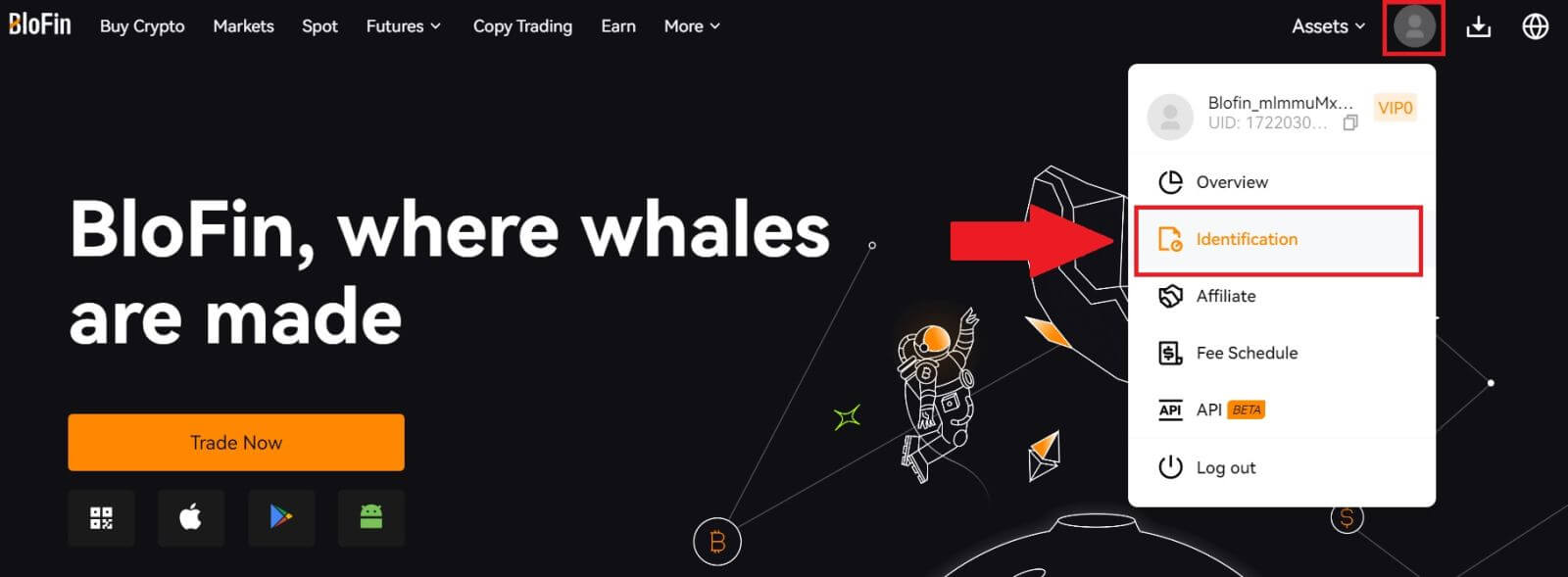

1. Log in to your BloFin account, click on the [Profile] icon, and select [Identification].

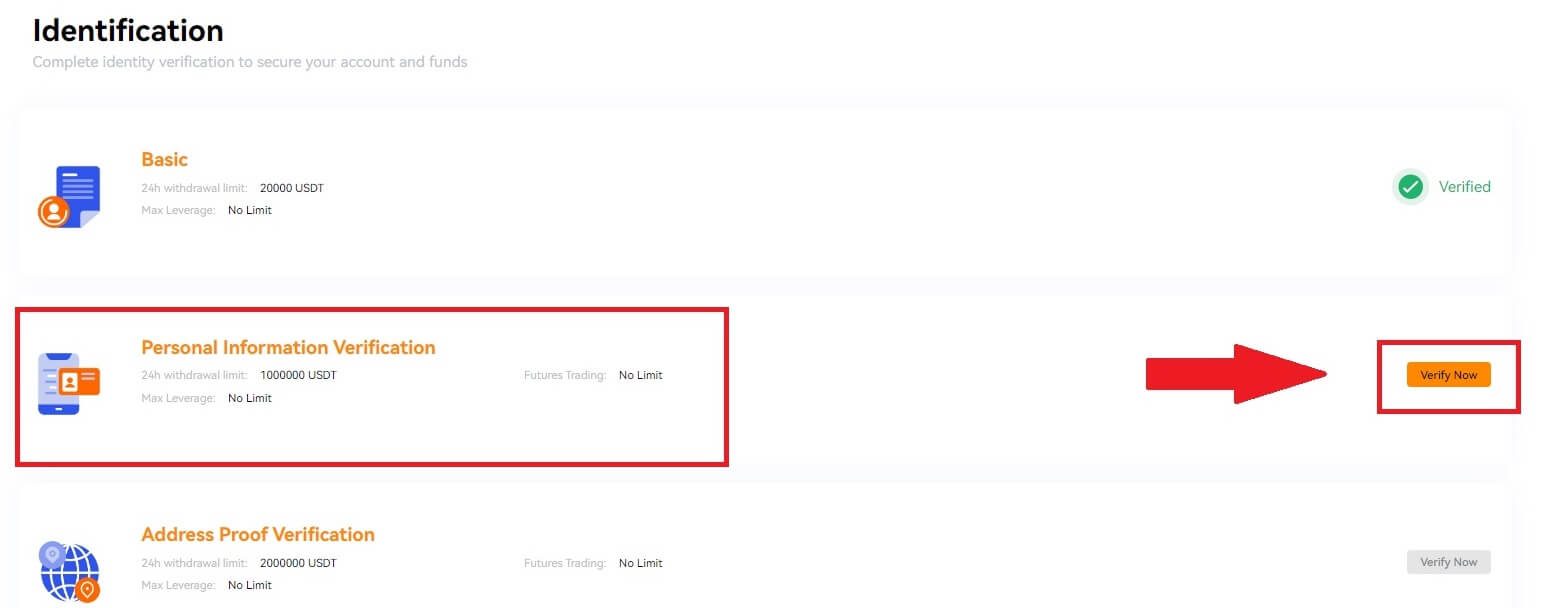

2. Choose [Personal Information Verification] and click on [Verify Now].

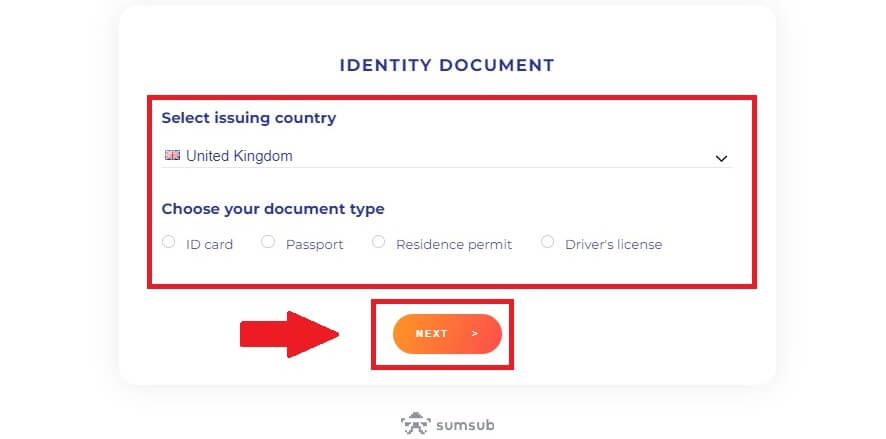

3. Access the verification page and indicate your issuing country. Select your [document type] and click on [NEXT].

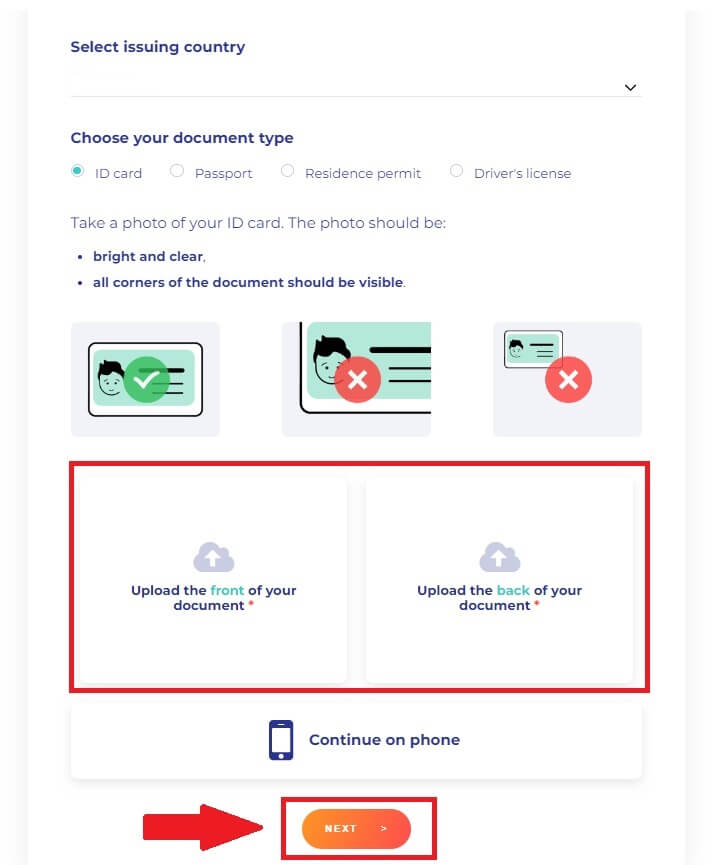

4. Begin by taking a photo of your ID card. Following that, upload clear images of both the front and back of your ID into the designated boxes. Once both pictures are distinctly visible in the assigned boxes, click [NEXT] to proceed to the facial verification page.

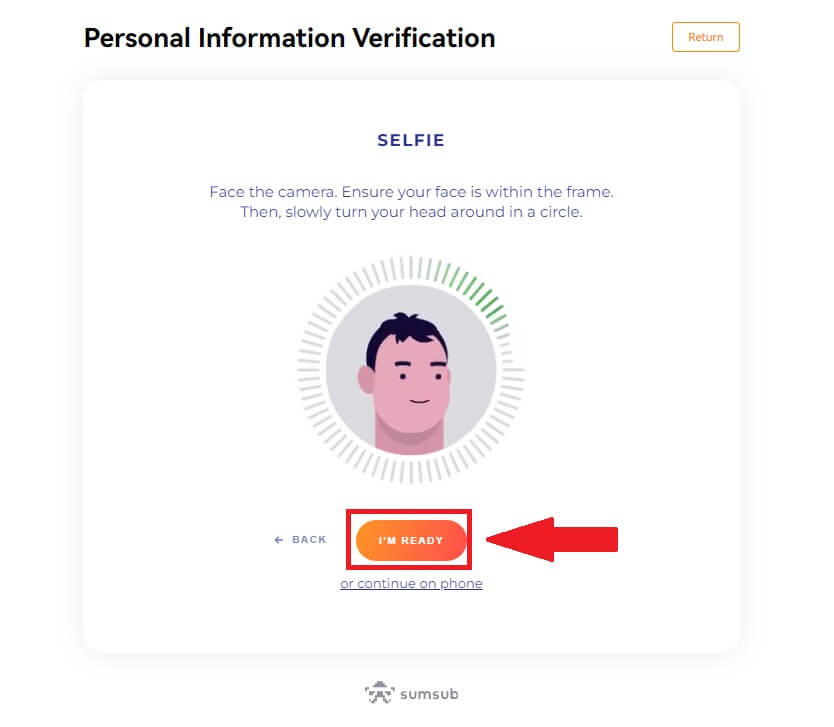

5. Next, start taking your selfie by clicking on [I’M READY].

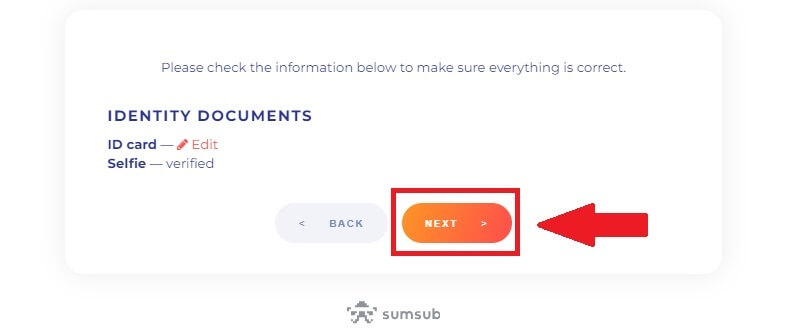

6. Lastly, check out your document information, then click [NEXT].

6. Lastly, check out your document information, then click [NEXT].

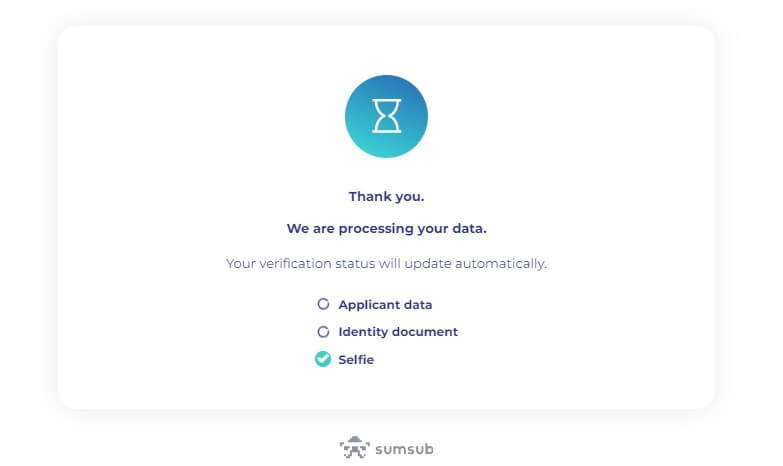

7. After that, your application has been submitted.

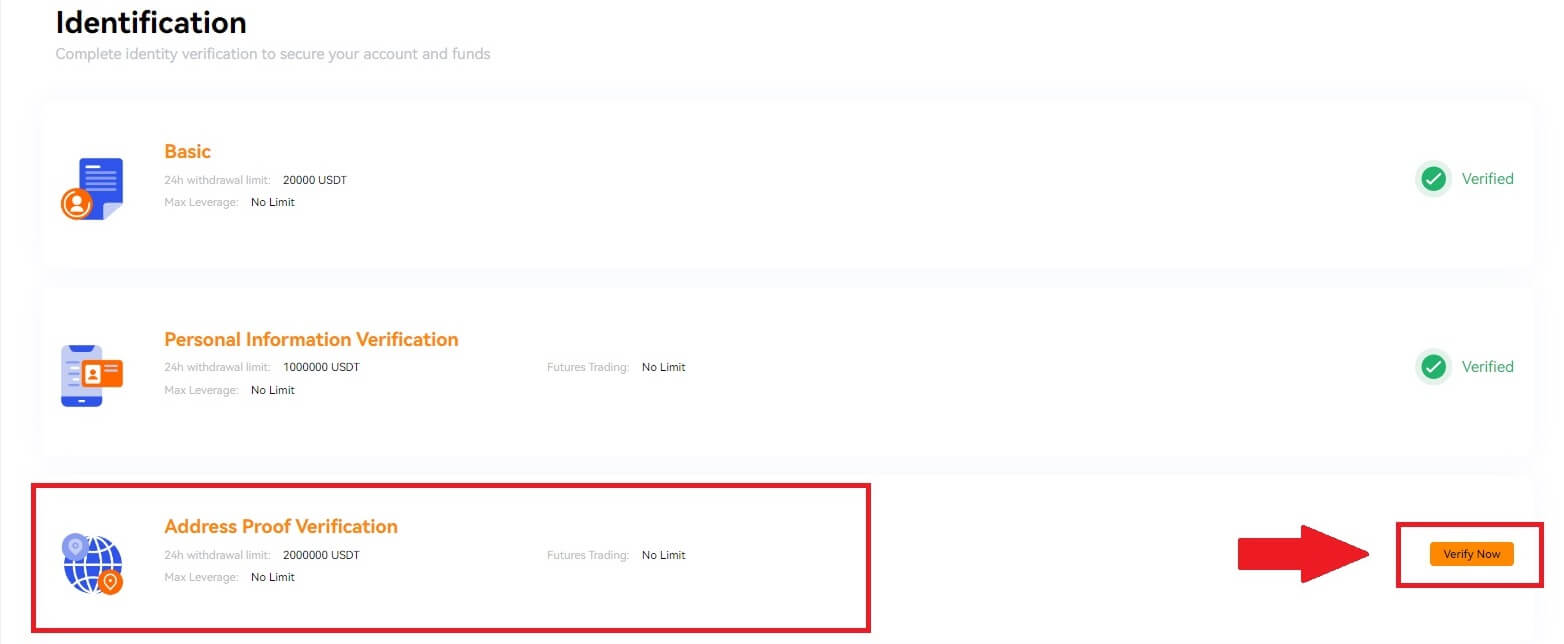

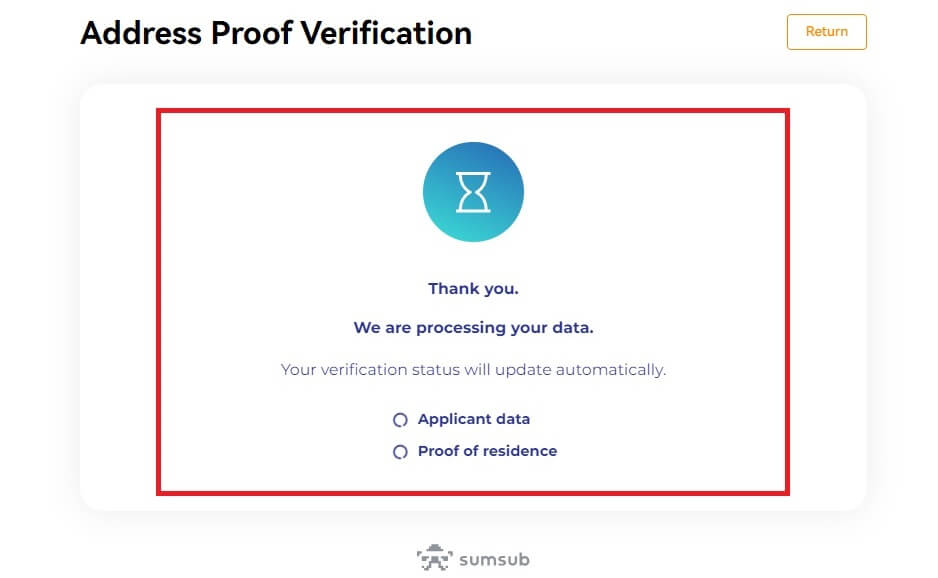

Address Proof Verification (Lv2) KYC on BloFin

1. Log in to your BloFin account, click on the [Profile] icon, and select [Identification].

2. Choose [Address Proof Verification] and click [Verify Now].

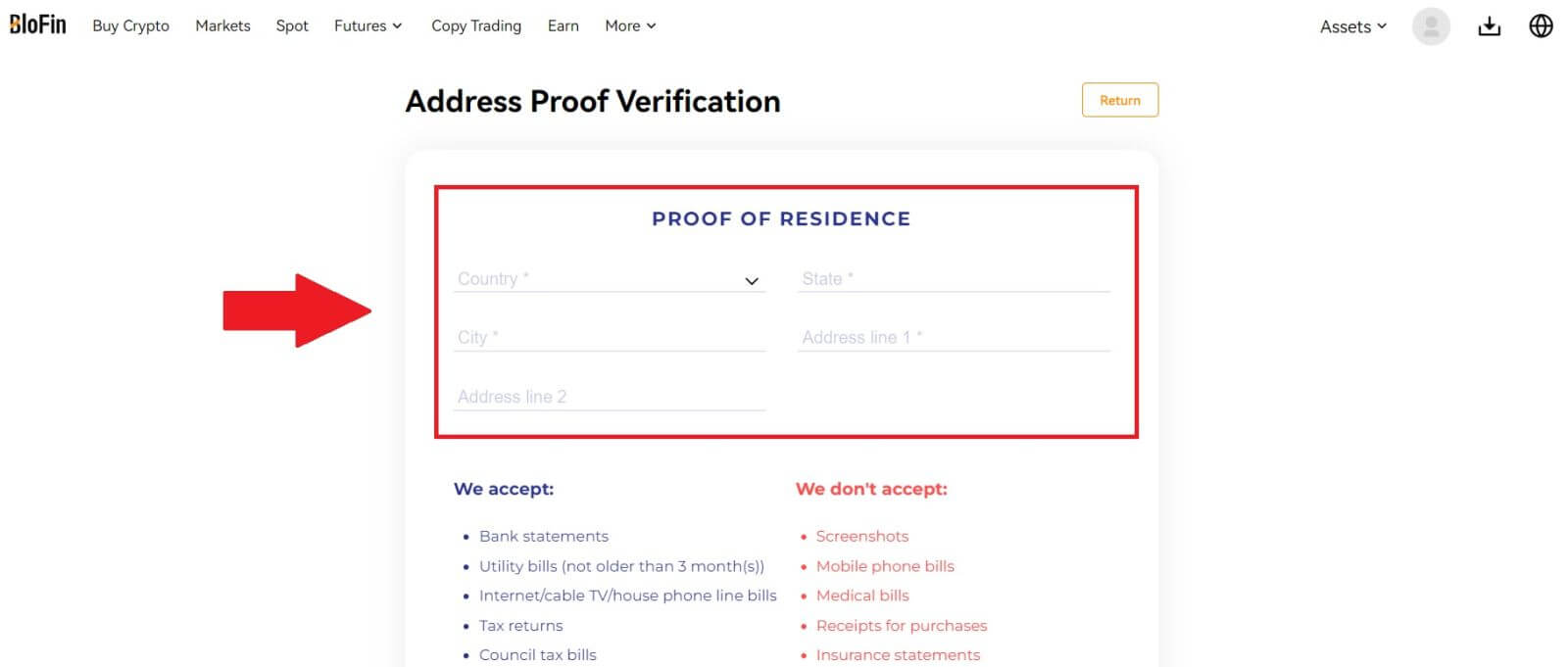

3. Enter your permanent address to continue.

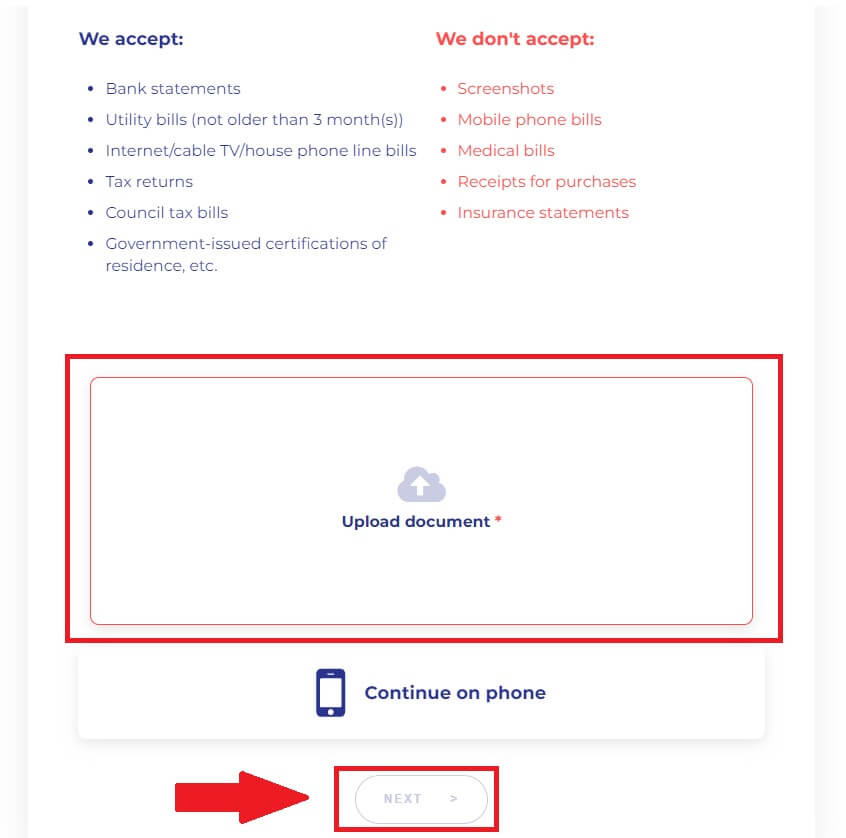

4. Upload your document and click [NEXT].

*Please refer to the acceptance document list below.

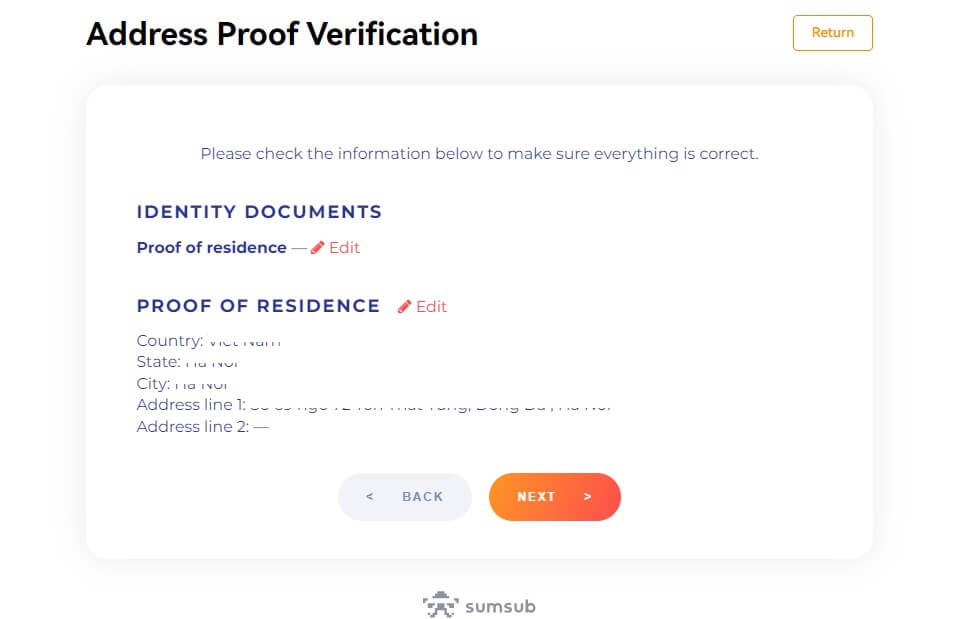

5. Lastly, check out your proof of residence information, then click [NEXT].

6. After that, your application has been submitted.

How to complete Identity Verification on BloFin? A step-by-step guide (App)

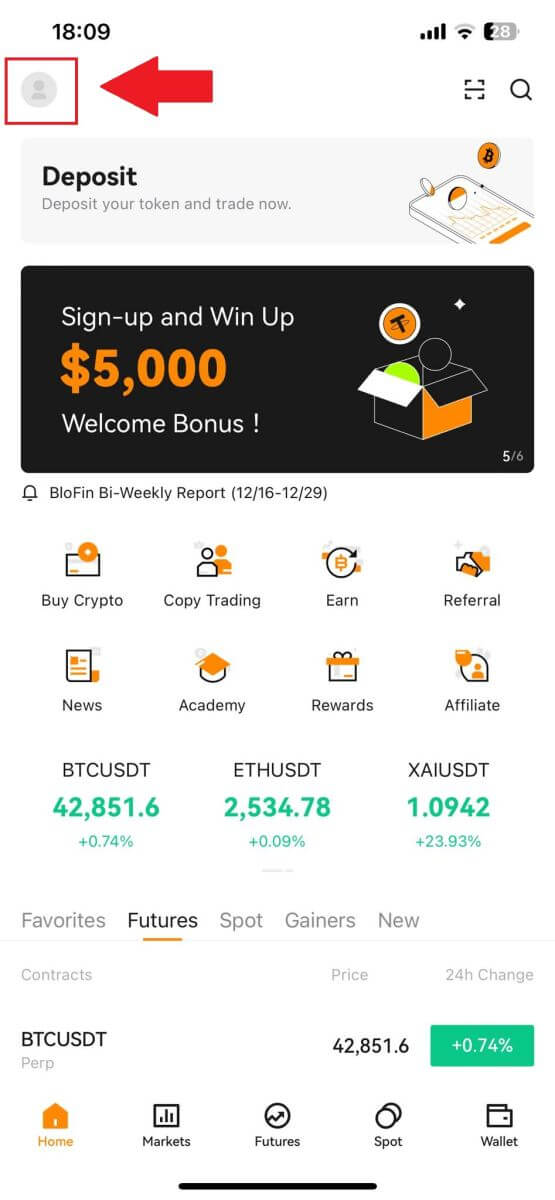

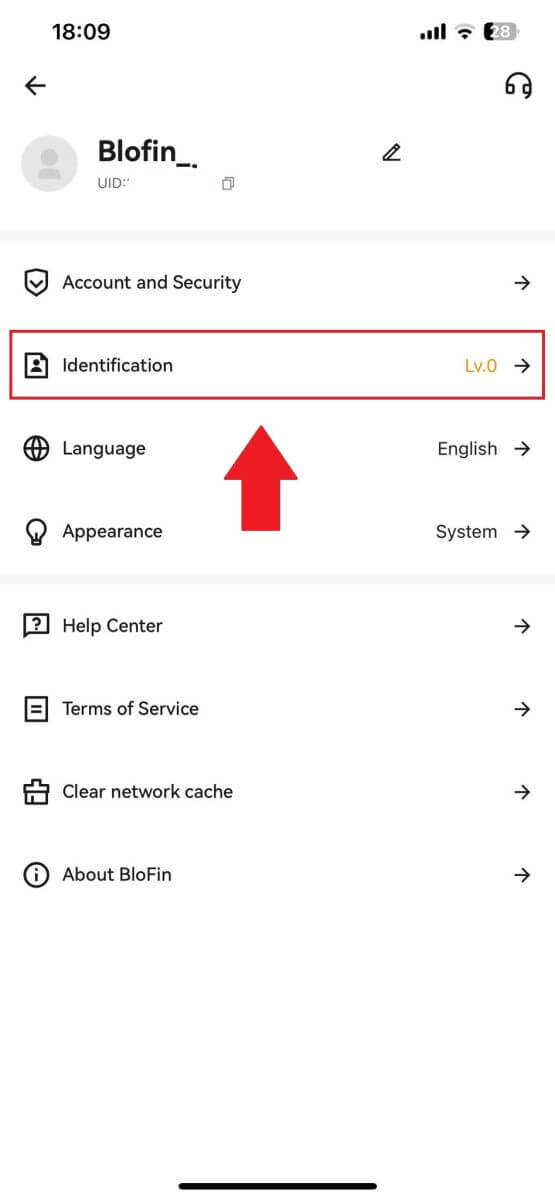

Personal Information Verification (Lv1) KYC on BloFin

1. Open your BloFin app, tap on the [Profile] icon, and select [Identification].

2. Choose [Personal Information Verification] to continue

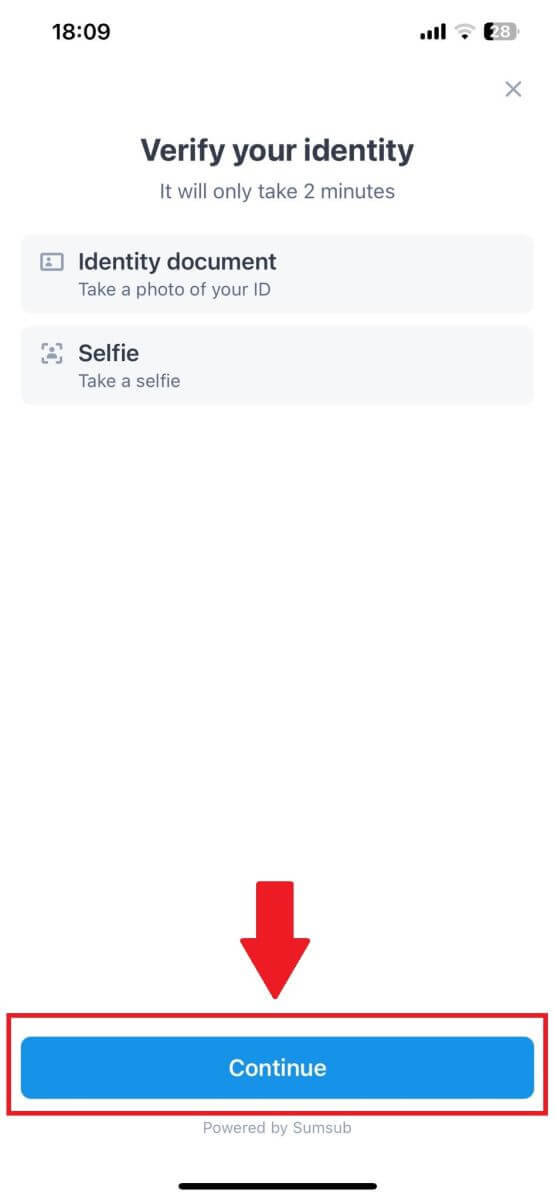

3. Continue your process by tapping [Continue].

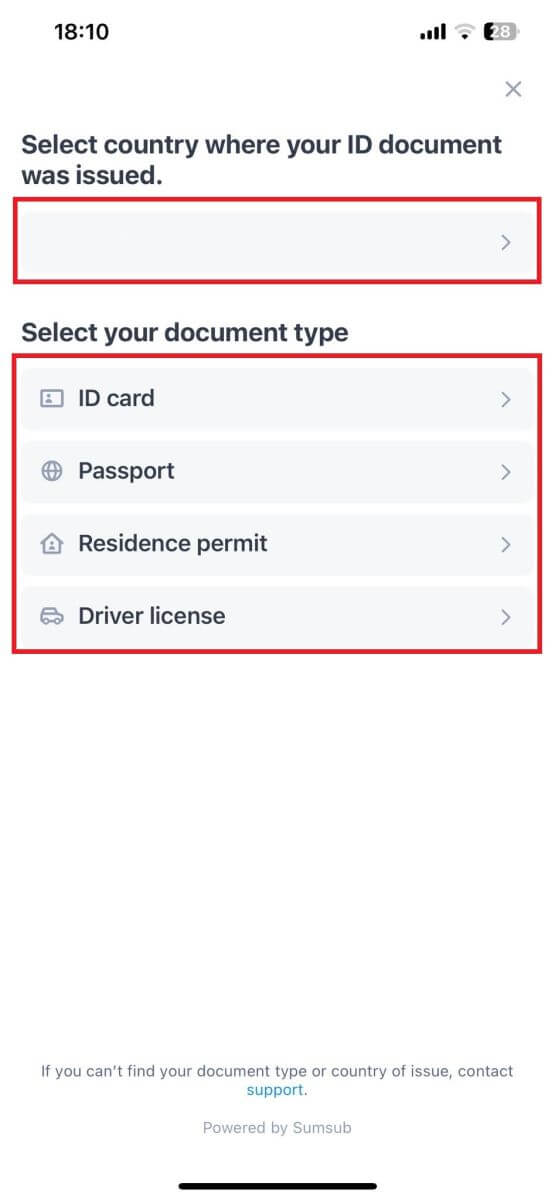

4. Access the verification page and indicate your issuing country. Select your [document type] to continue.

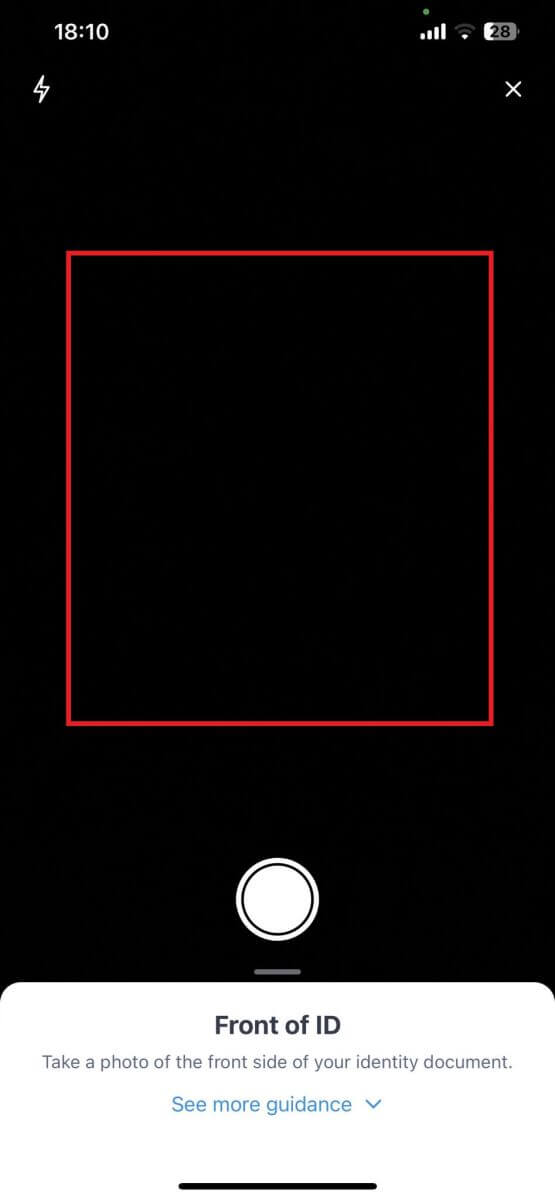

5. Next, place and take both side of your ID-type photo on the frame to continue.

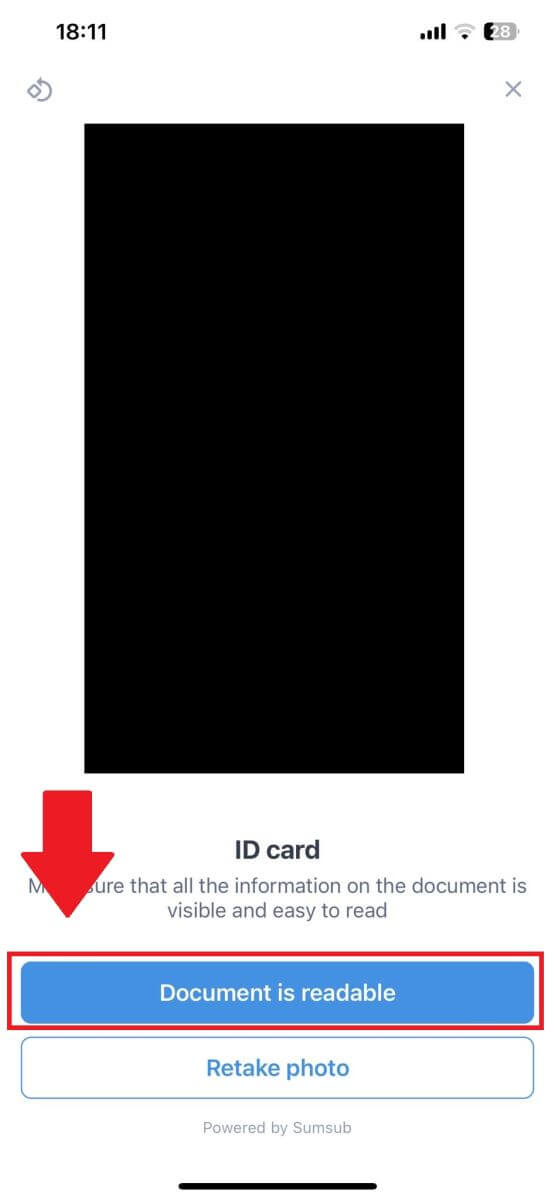

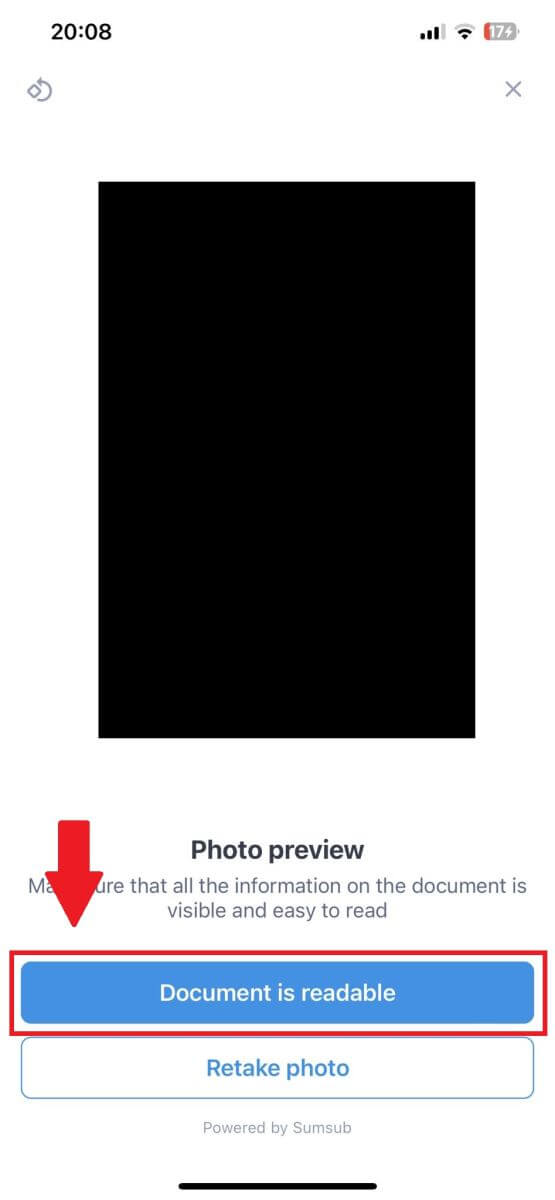

6. Make sure all the information in your photo is visible, and tap [Document is readable].

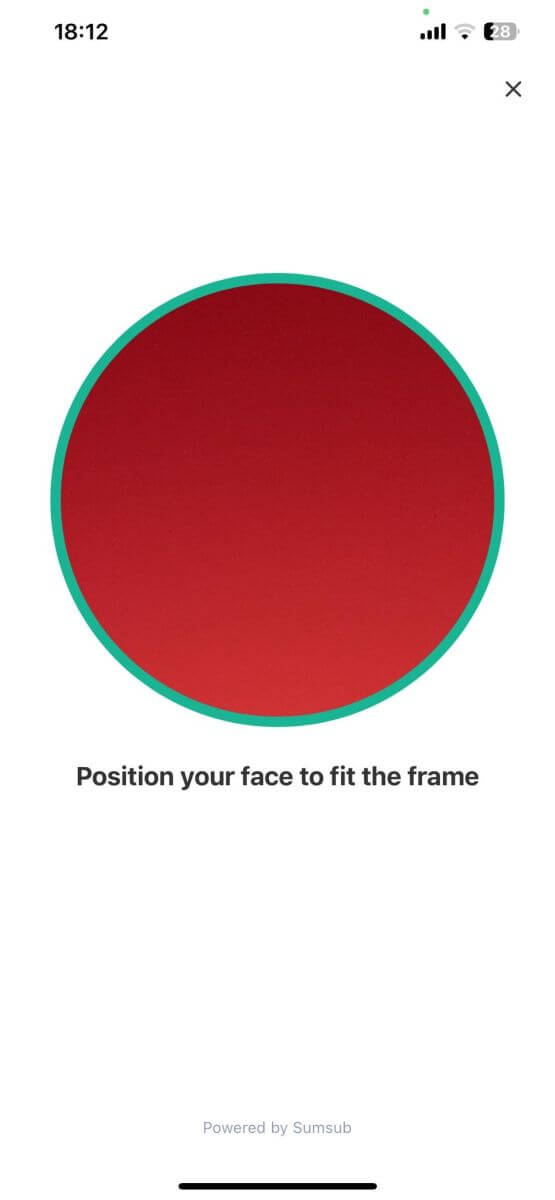

7. Next, take a selfie by putting your face into the frame to complete the process.

.

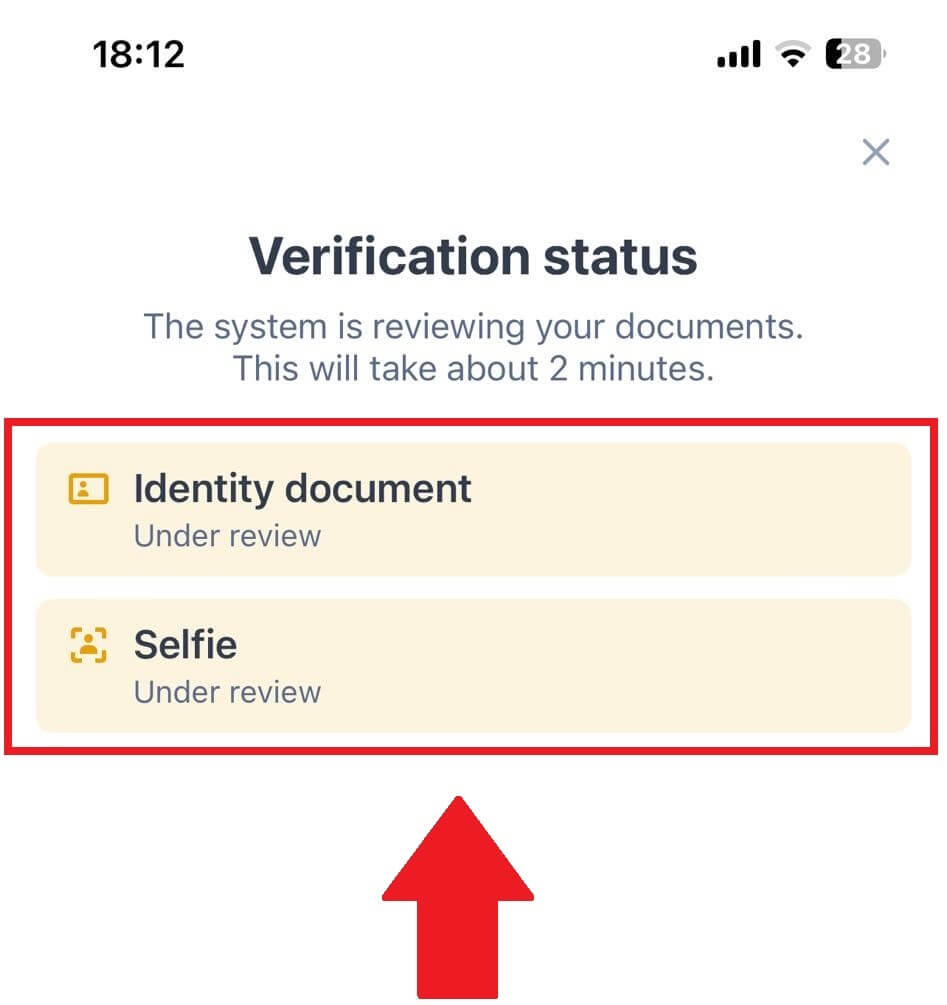

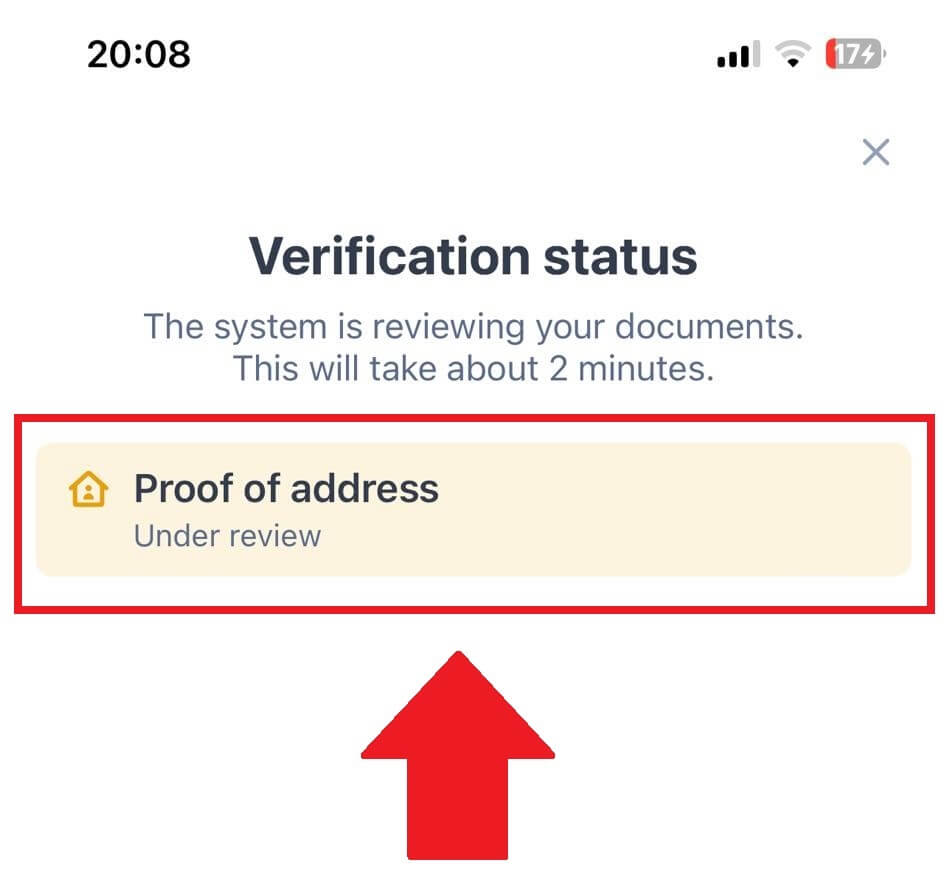

. 8. After that, your verification is under review. Wait for the confirmation email or access your profile to check the KYC status.

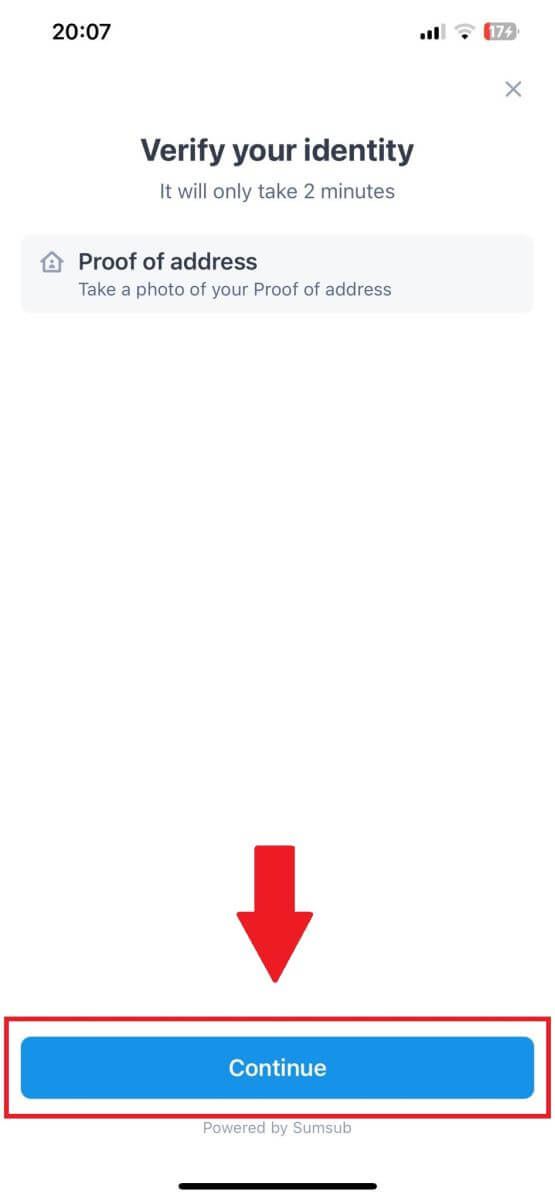

Address Proof Verification (Lv2) KYC on BloFin

1. Open your BloFin app, tap on the [Profile] icon, and select [Identification].

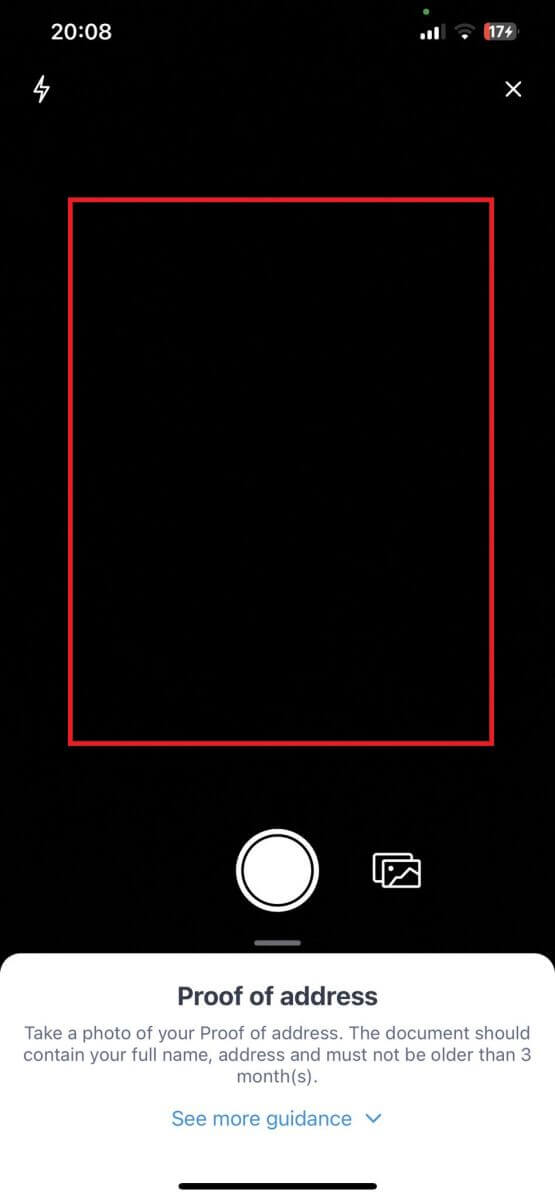

3. Take a picture of your Proof of address to continue.

4. Make sure all the information in your photo is visible, and tap [Document is readable].

5. After that, your verification is under review. Wait for the confirmation email or access your profile to check the KYC status.

Unable to upload photo during KYC Verification

If you encounter difficulties uploading photos or receive an error message during your KYC process, please consider the following verification points:- Ensure the image format is either JPG, JPEG, or PNG.

- Confirm that the image size is below 5 MB.

- Use a valid and original ID, such as a personal ID, driver’s license, or passport.

- Your valid ID must belong to a citizen of a country that allows unrestricted trading, as outlined in "II. Know-Your-Customer and Anti-Money-Laundering Policy" - "Trade Supervision" in the BloFin User Agreement.

- If your submission meets all the above criteria but KYC verification remains incomplete, it might be due to a temporary network issue. Please follow these steps for resolution:

- Wait for some time before resubmitting the application.

- Clear the cache in your browser and terminal.

- Submit the application through the website or app.

- Try using different browsers for the submission.

- Ensure your app is updated to the latest version.

Why can’t I receive the email verification code?

Please check and try again as follows:- Check the blocked mail spam and trash.

- Add the BloFin notification email address ([email protected]) to the email whitelist so that you can receive the email verification code.

- Wait for 15 minutes and try.

Common Errors During the KYC Process

- Taking unclear, blurry, or incomplete photos may result in unsuccessful KYC verification. When performing face recognition, please remove your hat (if applicable) and face the camera directly.

- KYC process is connected to a third-party public security database, and the system conducts automatic verification, which cannot be manually overridden. If you have special circumstances, such as changes in residency or identity documents, that prevent authentication, please contact online customer service for advice.

- If camera permissions are not granted for the app, you will be unable to take photos of your identity document or perform facial recognition.

Deposit

What is a tag or meme, and why do I need to enter it when depositing crypto?

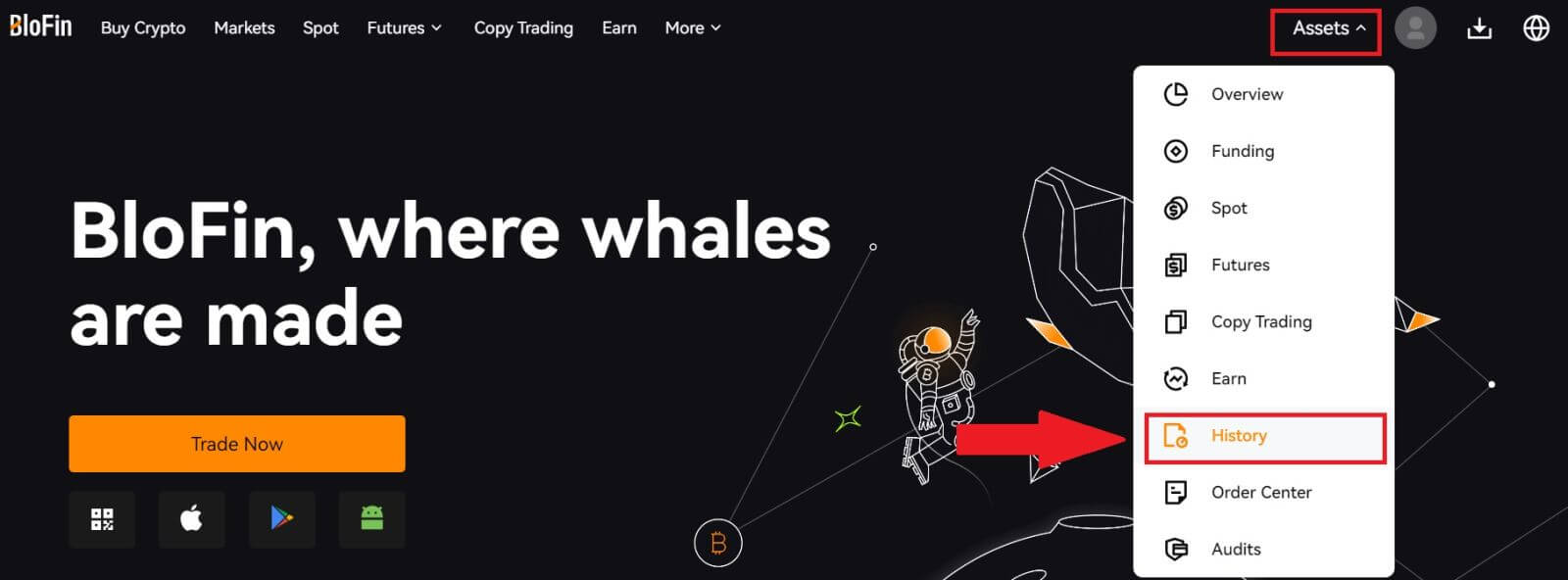

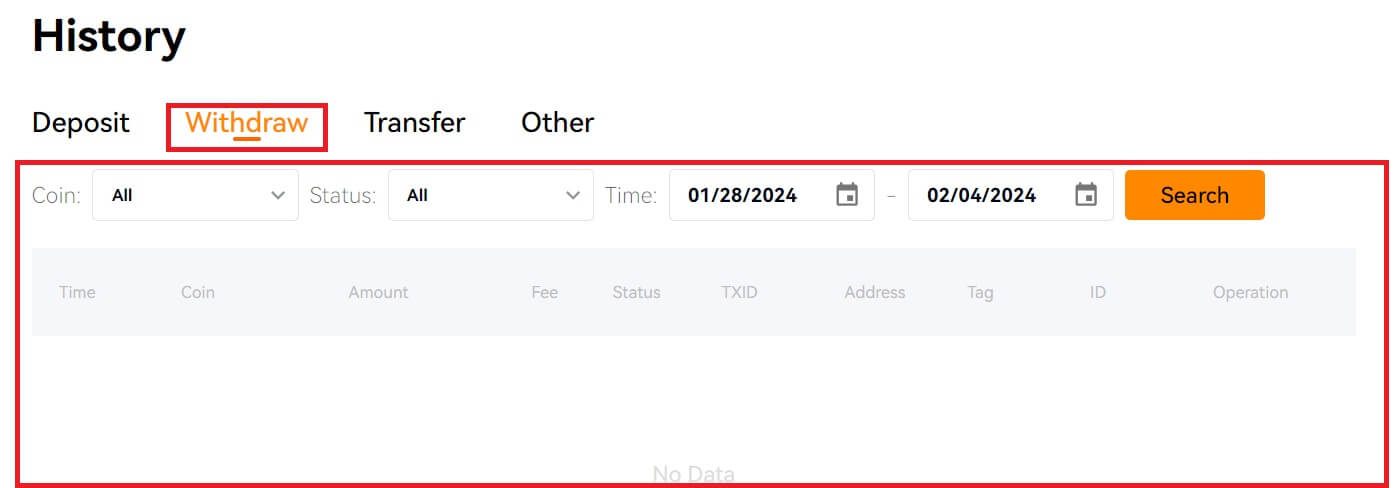

A tag or memo is a unique identifier assigned to each account for identifying a deposit and crediting the appropriate account. When depositing certain crypto, such as BNB, XEM, XLM, XRP, KAVA, ATOM, BAND, EOS, etc., you need to enter the respective tag or memo for it to be successfully credited.How to check my transaction history?

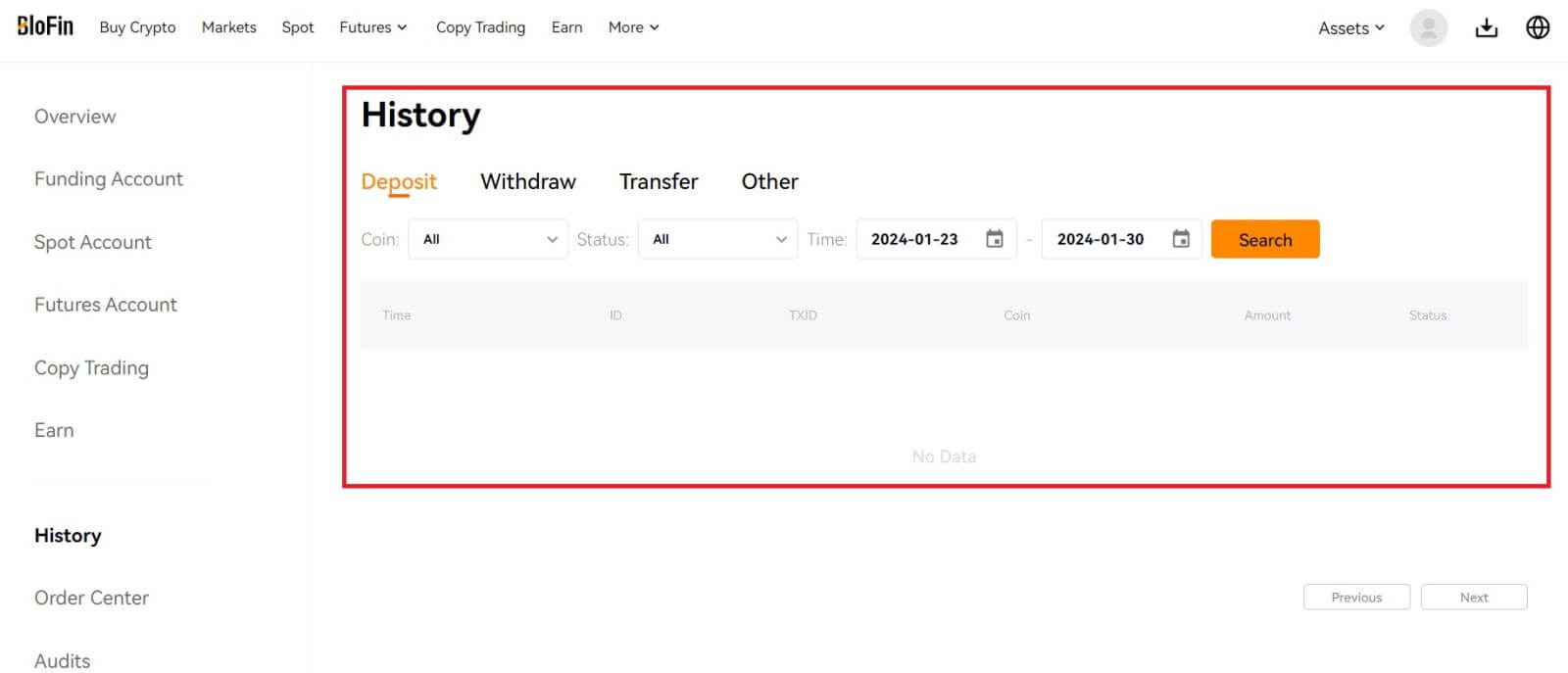

1. Log in to your BloFin account, click on [Assets], and select [History].

2. You can check the status of your deposit or withdrawal here.

Reasons for Uncredited Deposits

1. Insufficient number of block confirmations for a normal deposit

Under normal circumstances, each crypto requires a certain number of block confirmations before the transfer amount can be deposited into your BloFin account. To check the required number of block confirmations, please go to the deposit page of the corresponding crypto.

Please ensure that the cryptocurrency you intend to deposit on the BloFin platform matches the supported cryptocurrencies. Verify the full name of the crypto or its contract address to prevent any discrepancies. If inconsistencies are detected, the deposit may not be credited to your account. In such cases, submit a Wrong Deposit Recovery Application for assistance from the technical team in processing the return.

3. Depositing through an unsupported smart contract method

At present, some cryptocurrencies cannot be deposited on the BloFin platform using the smart contract method. Deposits made through smart contracts will not reflect in your BloFin account. As certain smart contract transfers necessitate manual processing, please promptly reach out to online customer service to submit your request for assistance.

4. Depositing to an incorrect crypto address or selecting the wrong deposit network

Ensure that you have accurately entered the deposit address and selected the correct deposit network before initiating the deposit. Failure to do so may result in the assets not being credited.

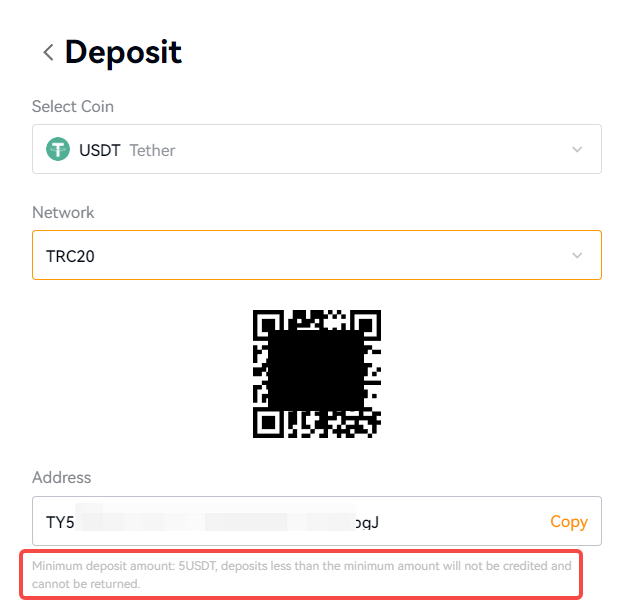

Is There A Minimum Or Maximum Amount For Deposit?

Minimum deposit requirement: Each cryptocurrency imposes a minimum deposit amount. Deposits below this minimum threshold will not be accepted. Please refer to the following list for the minimum deposit amounts of each token:

| Crypto | Blockchain Network | Minimum Deposit Amount |

| USDT | TRC20 | 1 USDT |

| ERC20 | 5 USDT | |

| BEP20 | 1 USDT | |

| Polygon | 1 USDT | |

| AVAX C-Chain | 1 USDT | |

| Solana | 1 USDT | |

| BTC | Bitcoin | 0.0005 BTC |

| BEP20 | 0.0005 BTC | |

| ETH | ERC20 | 0.005 ETH |

| BEP20 | 0.003 ETH | |

| BNB | BEP20 | 0.009 BNB |

| SOL | Solana | 0.01 SOL |

| XRP | Ripple (XRP) | 10 XRP |

| ADA | BEP20 | 5 ADA |

| DOGE | BEP20 | 10 DOGE |

| AVAX | AVAX C-Chain | 0.1 AVAX |

| TRX | BEP20 | 10 TRX |

| TRC20 | 10 TRX | |

| LINK | ERC20 | 1 LINK |

| BEP20 | 1 LINK | |

| MATIC | Polygon | 1 MATIC |

| DOT | ERC20 | 2 DOT |

| SHIB | ERC20 | 500,000 SHIB |

| BEP20 | 200,000 SHIB | |

| LTC | BEP20 | 0.01 LTC |

| BCH | BEP20 | 0.005 BCH |

| ATOM | BEP20 | 0.5 ATOM |

| UNI | ERC20 | 3 UNI |

| BEP20 | 1 UNI | |

| ETC | BEP20 | 0.05 ETC |

Note: Please ensure that you adhere to the minimum deposit amount specified on our deposit page for BloFin. Failure to meet this requirement will result in your deposit being declined.

Maximum Deposit Limit

Is there a maximum amount limit for deposit?

No, there is no maximum amount limit for deposit. But, please pay attention there is a limit for 24h withdrawal, which is depending on your KYC.

Trading

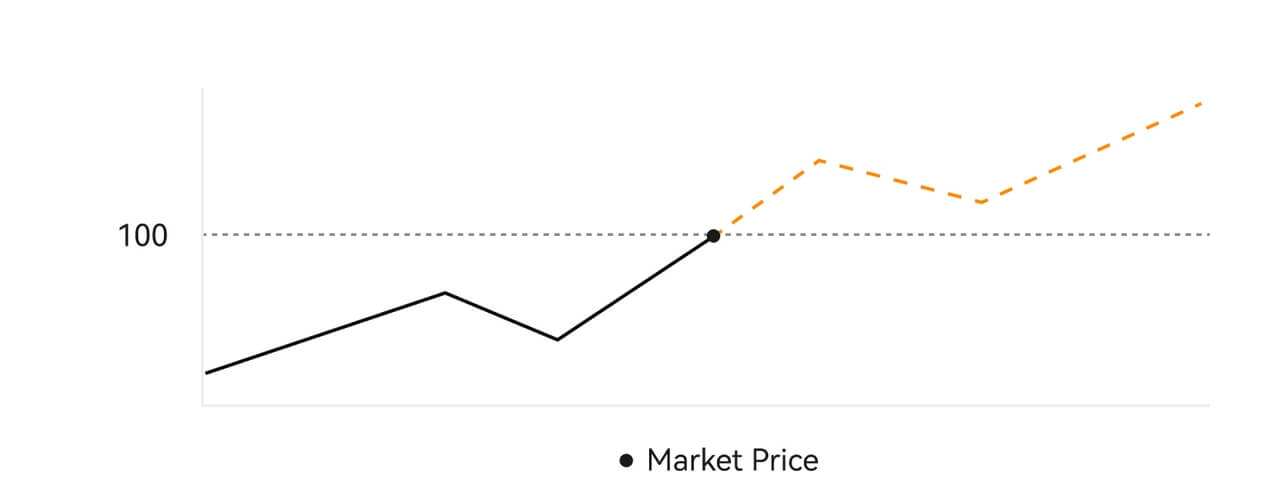

What is a Market Order?

A Market Order is an order type that is executed at the current market price. When you place a market order, you are essentially requesting to buy or sell a security or asset at the best available price in the market. The order is filled immediately at the prevailing market price, ensuring quick execution. Description

DescriptionIf the market price is $100, a buy or sell order is filled at around $100. The amount and price that your order is filled at depends on the actual transaction.

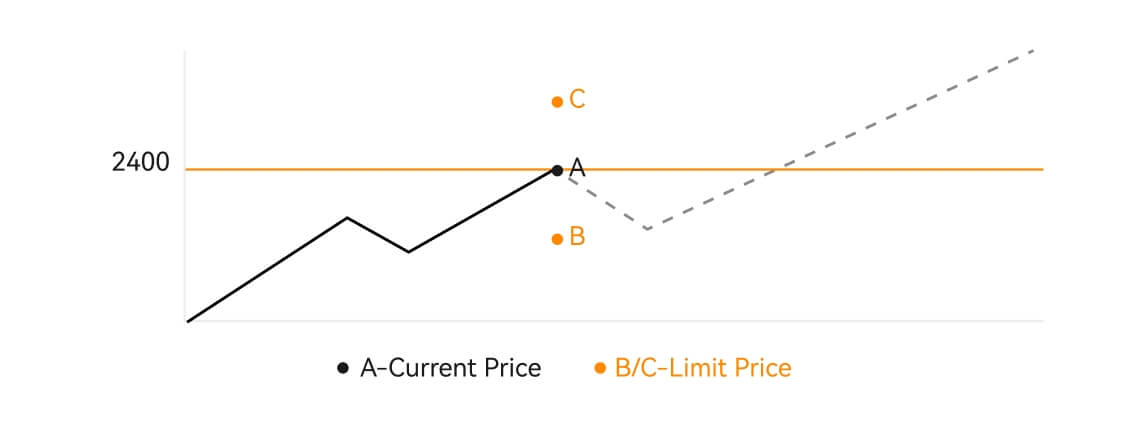

What is a Limit Order?

A limit order is an instruction to buy or sell an asset at a specified limit price, and it is not executed immediately like a market order. Instead, the limit order is activated only if the market price reaches or exceeds the designated limit price favorably. This allows traders to target specific buying or selling prices different from the current market rate.

Limit Order illustration

When the Current Price (A) drops to the order’s Limit Price (C) or below the order will execute automatically. The order will be filled immediately if the buying price is above or equal to the current price. Therefore, the buying price of limit orders must be below the current price.

Buy Limit Order

Sell Limit Order

1) The current price in the above graph is 2400 (A). If a new buy/limit order is placed with a limit price of 1500 (C), the order will not execute until the price drops to 1500(C) or below.

2) Instead, if the buy/limit order is placed with a limit price of 3000(B)which is above the current price, the order will be filled with the counterparty price immediately. The executed price is around 2400, not 3000.

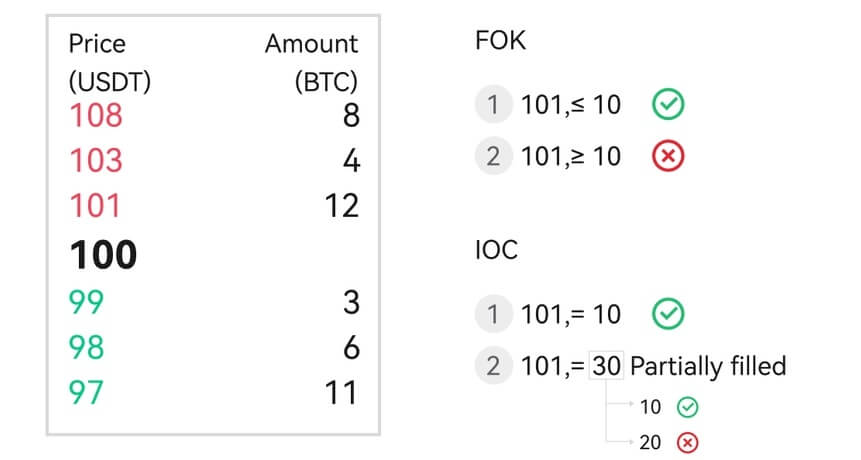

Post-only/FOK/IOC illustration

Description

Assume the market price is $100 and the lowest sell order is priced at$101 with an amount of 10.

FOK:

A buy order priced at $101 with an amount of 10 is filled.However, a buy order priced at $101 with an amount of 30 can’t be completely filled, so it’s canceled.

IOC:

A buy order priced at $101 with an amount of 10 is filled.A buy order priced at $101 with an amount of 30 is partially filled with an amount of 10.

Post-Only:

The current price is $2400 (A). At this point, place a Post Only Order. If the sell price (B) of order is lower than or equal to the current price, the sell order may be executed immediately, the order will be cancelled. Therefore, when a sell is required, the price (C) should be higher than the current price.

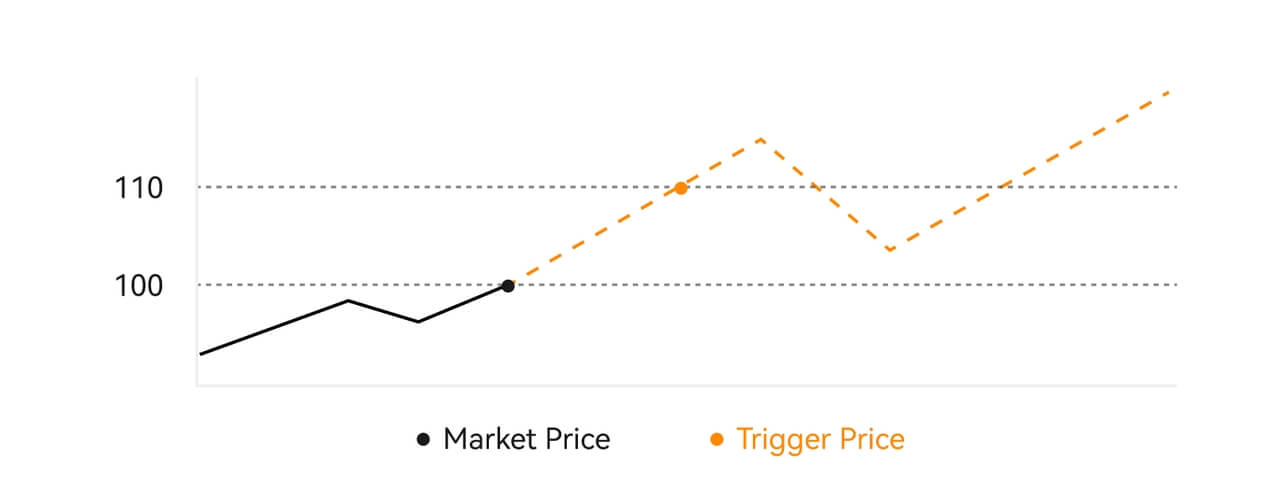

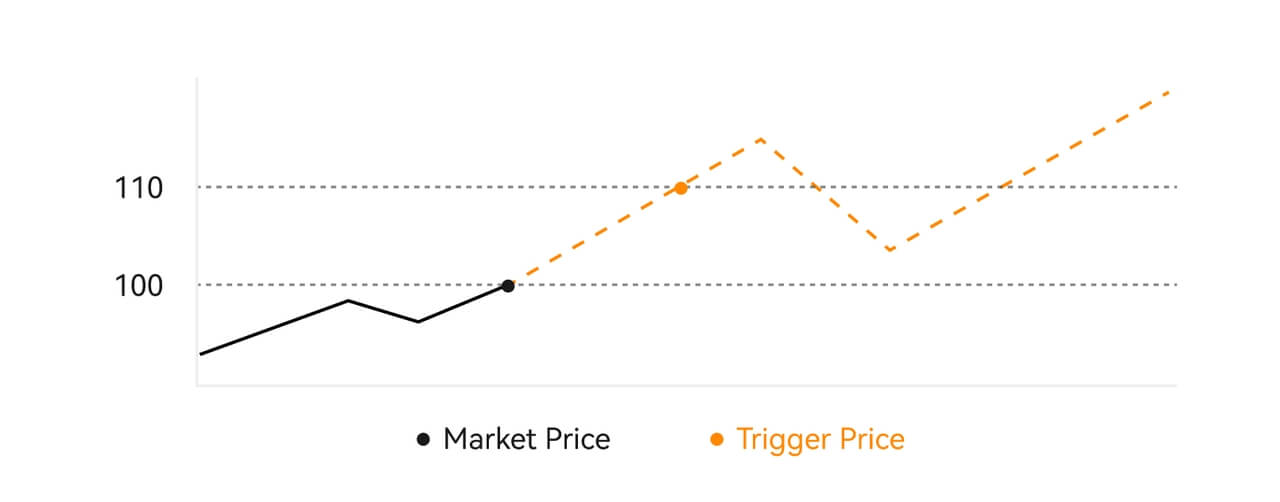

What is a Trigger Order?

A trigger order, alternatively termed a conditional or stop order, is a specific order type enacted only when predefined conditions or a designated trigger price are satisfied. This order allows you to establish a trigger price, and upon its attainment, the order becomes active and is dispatched to the market for execution. Subsequently, the order is transformed into either a market or limit order, carrying out the trade in accordance with the specified instructions.

For instance, you might configure a trigger order to sell a cryptocurrency like BTC if its price descends to a particular threshold. Once the BTC price hits or drops below the trigger price, the order is triggered, transforming into an active market or limit order to sell the BTC at the most favorable available price. Trigger orders serve the purpose of automating trade executions and mitigating risk by defining predetermined conditions for entering or exiting a position.

Description

Description

In a scenario where the market price is $100, a trigger order set with a trigger price of $110 is activated when the market price ascends to $110, subsequently becoming a corresponding market or limit order.

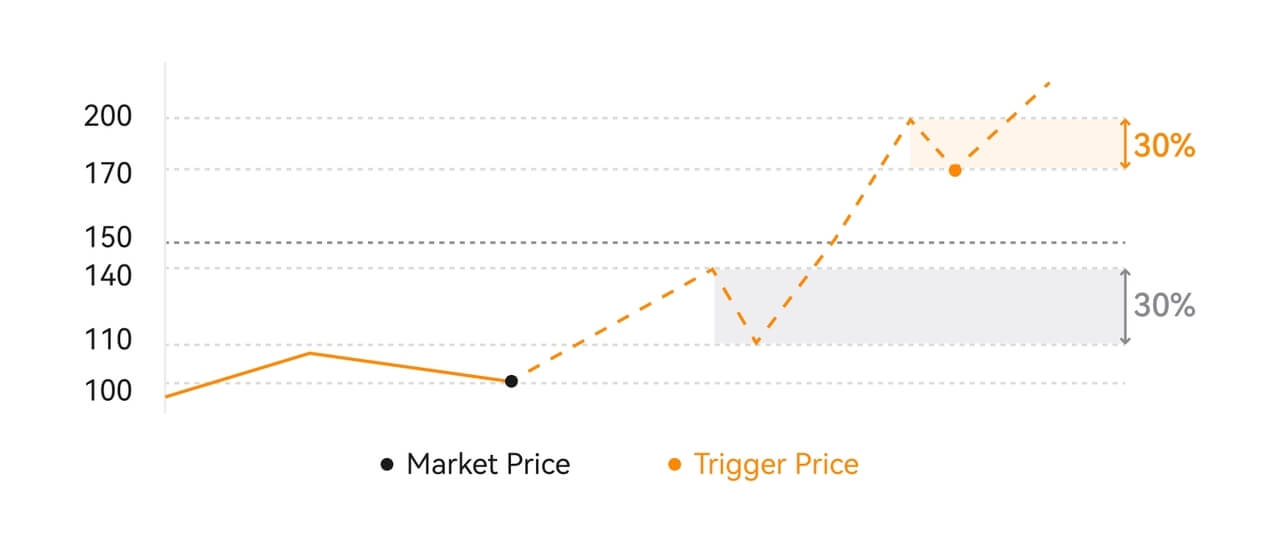

What is a Trailing Stop order?

A Trailing Stop order is a specific type of stop order that adjusts with changes in the market price. It allows you to set a predefined constant or percentage, and when the market price reaches this point, a market order is automatically executed.

Sell Illustration (percentage)

Description

Assume you are holding a long position with a market price of $100, and you set a trailing stop order to sell at a 10% loss. If the price drops by 10% from $100 to $90, your trailing stop order is triggered and converted into a market order to sell.

However, if the price rises to $150 and then drops 7% to $140, your trailing stop order is not triggered. If the price rises to $200 and then drops 10% to $180, your trailing stop order is triggered and converted into a market order to sell.

Sell Illustration (constant)

Description

In another scenario, with a long position at a market price of $100, if you set a trailing stop order to sell at a $30 loss, the order is triggered and converted into a market order when the price drops by $30 from $100 to $70.

If the price rises to $150 and then drops by $20 to $130, your trailing stop order is not triggered. However, if the price rises to $200 and then drops by $30 to $170, your trailing stop order is triggered and converted into a market order to sell.

Sell Illustration with activation price (constant) Description

Description

Assuming a long position with a market price of $100, setting a trailing stop order to sell at a $30 loss with an activation price of $150 adds an extra condition. If the price rises to $140 and then drops by $30 to $110, your trailing stop order is not triggered because it isn’t activated.

When the price rises to $150, your trailing stop order is activated. If the price continues rising to $200 and then drops by $30 to $170, your trailing stop order is triggered and converted into a market order to sell.

What is the Spot Trading Fee?

- Every successful trade on the BloFin Spot market incurs a trading fee.

- Maker Fee Rate: 0.1%

- Taker Fee Rate: 0.1%

What is Taker and Maker?

-

Taker: This applies to orders that immediately execute, either partially or fully, before entering the order book. Market orders are always Takers since they never go on the order book. The taker trades "take" volume off the order book.

-

Maker: Pertains to orders, like limit orders, that go on the order book either partially or fully. Subsequent trades originating from such orders are considered "maker" trades. These orders add volume to the order book, contributing to "making the market."

How are Trading Fees Calculated?

- Trading fees are charged for the received asset.

- Example: If you buy BTC/USDT, you receive BTC, and the fee is paid in BTC. If you sell BTC/USDT, you receive USDT, and the fee is paid in USDT.

Calculation Example:

-

Buying 1 BTC for 40,970 USDT:

- Trading Fee = 1 BTC * 0.1% = 0.001 BTC

-

Selling 1 BTC for 41,000 USDT:

- Trading Fee = (1 BTC * 41,000 USDT) * 0.1% = 41 USDT

How do perpetual futures contracts work?

Let’s take a hypothetical example to understand how perpetual futures work. Assume that a trader has some BTC. When they purchase the contract, they either want this sum to increase in line with the price of BTC/USDT or move in the opposite direction when they sell the contract. Considering that each contract is worth $1, if they purchase one contract at the price of $50.50, they must pay $1 in BTC. Instead, if they sell the contract, they get $1’s worth of BTC at the price they sold it for (it still applies if they sell before they acquire).It is important to note that the trader is purchasing contracts, not BTC or dollars. So, why should you trade crypto perpetual futures? And how can it be certain that the contract’s price will follow the BTC/USDT price?

The answer is via a funding mechanism. Users with long positions are paid the funding rate (compensated by users with short positions) when the contract price is lower than the price of BTC, giving them an incentive to purchase contracts, causing the contract price to rise and realign with the price of BTC/USDT. Similarly, users with short positions can purchase contracts to close their positions, which will likely cause the price of the contract to increase to match the price of BTC.

In contrast to this situation, the opposite occurs when the price of the contract is higher than the price of BTC - i.e., users with long positions pay users with short positions, encouraging sellers to sell the contract, which drives its price closer to the price of BTC. The difference between the contract price and the price of BTC determines how much funding rate one will receive or pay.

What is BloFin Futures Bonus and How does it Work?

BloFin futures bonus is a reward given to users through various marketing activities, promotions, and campaigns. The BloFin futures bonus allows you to try out BloFin futures trading in the real market with zero risk.Is futures bonus the same as receiving cryptocurrency or money?

No. Futures bonus is complimentary funds sent to your account. It can only be used to trade futures. Futures bonus cannot be transferred to your funding account or used for withdrawals. Profits generated from futures bonus can be withdrawn.

All futures bonus can expire after a predesignated time. The retrieve of futures bonus will then start.

How to find and claim your futures bonus?

Once claimed, the futures bonus will automatically go to your futures account.

How to use futures bonus?

Suppose you have received futures bonus issued to you in your futures account. You can then open USDT-M positions to use your futures bonus.

If you close a position with profits, you can keep, transfer, or withdraw the realized profits. However, please note that any operation to transfer or withdraw token assets will invalidate all futures bonuses in or available to your account immediately. Unclaimed futures bonuses in the Welcome Bonus Center will also be revoked.

Rules of Use

- Futures bonus can only be used for trading futures in BloFin;

- Futures bonus cannot be moved, withdrawn, or used for any other purpose outside futures account.

- Transfer or withdraw of token assets will trigger the retrieve of all futures bonuses;

- Futures bonus can be used to offset 100% futures trading fees, 50% losses/funding fees;

- Futures bonus can be used as a margin to open a position;

- When both of the following conditions are met, your maximum leverage is 5x:

- Your total deposit is less than $30

- Your total deposit is less than half of your futures bonus

- Futures bonus will always expire after a predesignated time. The default futures bonus validity period is 7 days. Validity periods can be varied according to different campaigns. BloFin reserves the right to adjust the periods based on the campaign terms and conditions.

- After transferring assets out from futures account, the available amount should be no less than the total futures bonuses.

- If we detect any cheating behavior, your account can be temporarily banned for withdrawal.

- BloFin reserves the right to change the terms and conditions of this program at any time.

What are the differences between perpetual futures contracts and margin trading?

Perpetual futures contracts and margin trading are both ways for traders to increase their exposure to the cryptocurrency markets, but there are some key differences between the two.- Timeframe: Perpetual futures contracts do not have an expiration date, while margin trading is typically done over a shorter timeframe, with traders borrowing funds to open a position for a specific period of time.

- Settlement: Perpetual futures contracts settle based on the index price of the underlying cryptocurrency, while margin trading settles based on the price of the cryptocurrency at the time the position is closed.

- Leverage: Both perpetual futures contracts and margin trading allow traders to use leverage to increase their exposure to the markets. However, perpetual futures contracts typically offer higher levels of leverage than margin trading, which can increase both potential profits and potential losses.

- Fees: Perpetual futures contracts typically have a funding fee that is paid by traders who hold their positions open for an extended period of time. Margin trading, on the other hand, typically involves paying interest on the borrowed funds.

- Collateral: Perpetual futures contracts require traders to deposit a certain amount of cryptocurrency as collateral to open a position, while margin trading requires traders to deposit funds as collateral.

Withdrawal

Why hasn’t my withdrawal arrived?

Transferring funds involves the following steps:

- Withdrawal transaction initiated by BloFin.

- Confirmation of the blockchain network.

- Depositing on the corresponding platform.

Normally, a TxID (transaction ID) will be generated within 30–60 minutes, indicating that our platform has successfully completed the withdrawal operation and that the transactions are pending on the blockchain.

However, it might still take some time for a particular transaction to be confirmed by the blockchain and, later, by the corresponding platform.

Due to possible network congestion, there might be a significant delay in processing your transaction. You may use the transaction ID (TxID) to look up the status of the transfer with a blockchain explorer.

- If the blockchain explorer shows that the transaction is unconfirmed, please wait for the process to be completed.

- If the blockchain explorer shows that the transaction is already confirmed, it means that your funds have been sent out successfully from BloFin, and we are unable to provide any further assistance on this matter. You will need to contact the owner or support team of the target address and seek further assistance.

Important Guidelines for Cryptocurrency Withdrawals on BloFin Platform

- For crypto that support multiple chains such as USDT, please make sure to choose the corresponding network when making withdrawal requests.

- If the withdrawal crypto requires a MEMO, please make sure to copy the correct MEMO from the receiving platform and enter it accurately. Otherwise, the assets may be lost after the withdrawal.

- After entering the address, if the page indicates that the address is invalid, please check the address or contact our online customer service for further assistance.

- Withdrawal fees vary for each crypto and can be viewed after selecting the crypto on the withdrawal page.

- You can see the minimum withdrawal amount and withdrawal fees for the corresponding crypto on the withdrawal page.

How do I check the transaction status on the blockchain?

1. Log in to your Gate.io, click on [Assets], and select [History].

2. Here, you can view your transaction status.

Is There A Minimum Withdrawal Limit Required For Each Crypto?

Each cryptocurrency has a minimum withdrawal requirement. If the withdrawal amount falls below this minimum, it will not be processed. For BloFin, please ensure that your withdrawal meets or exceeds the minimum amount specified on our Withdraw page.

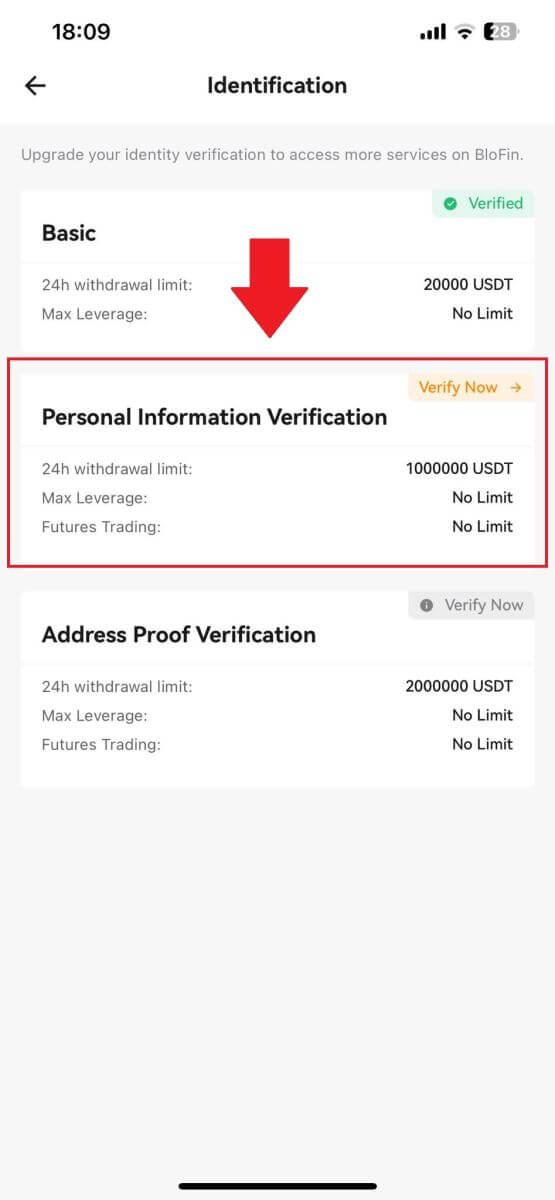

Is there a withdrawal limit?

Yes, there is a withdrawal limit based on the level of KYC (Know Your Customer) completion:

- Without KYC: 20,000 USDT withdrawal limit within a 24-hour period.

- L1 (Level 1): 1,000,000 USDT withdrawal limit within a 24-hour period.

- L2 (Level 2): 2,000,000 USDT withdrawal limit within a 24-hour period.

How Much Are The Withdrawal Fees?

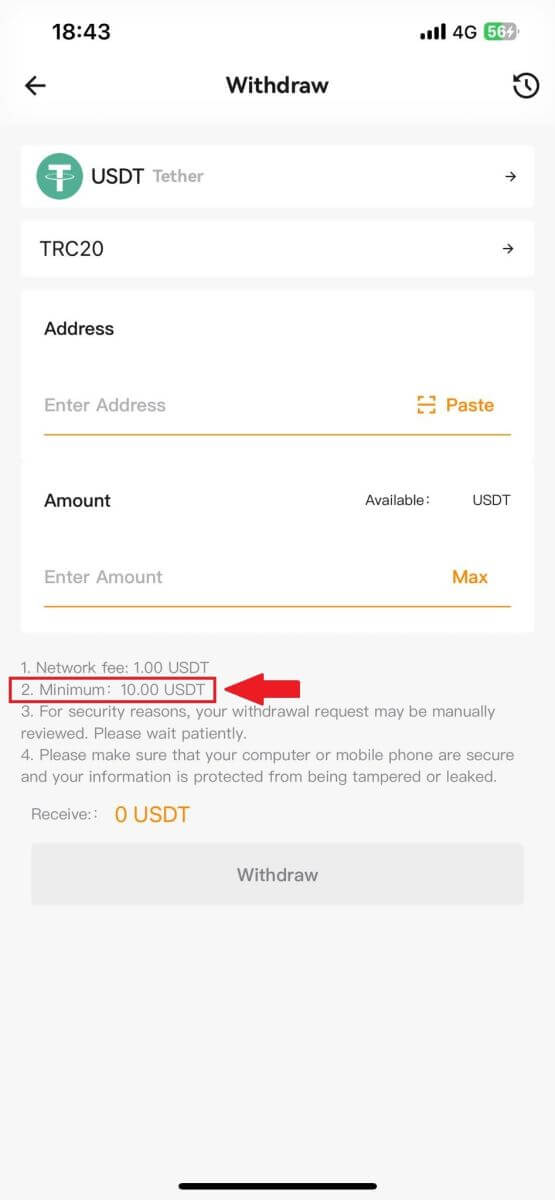

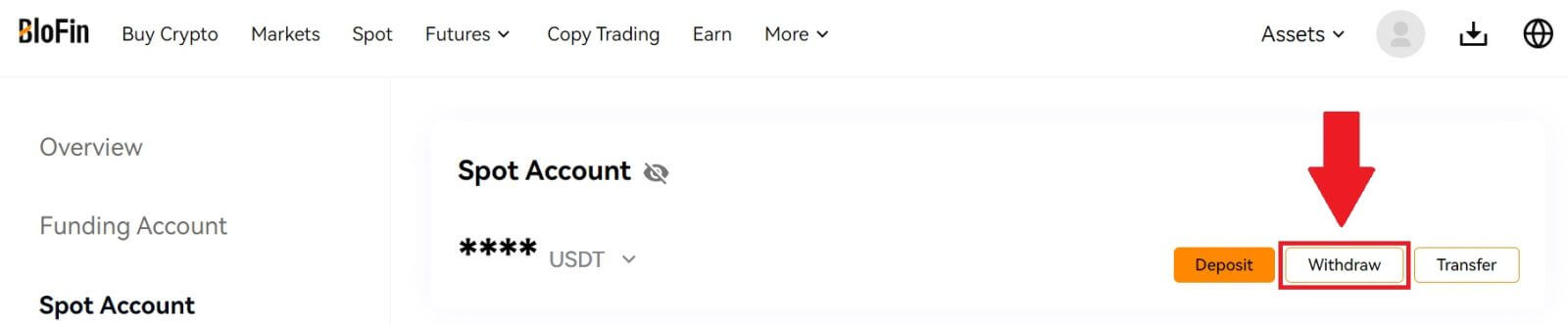

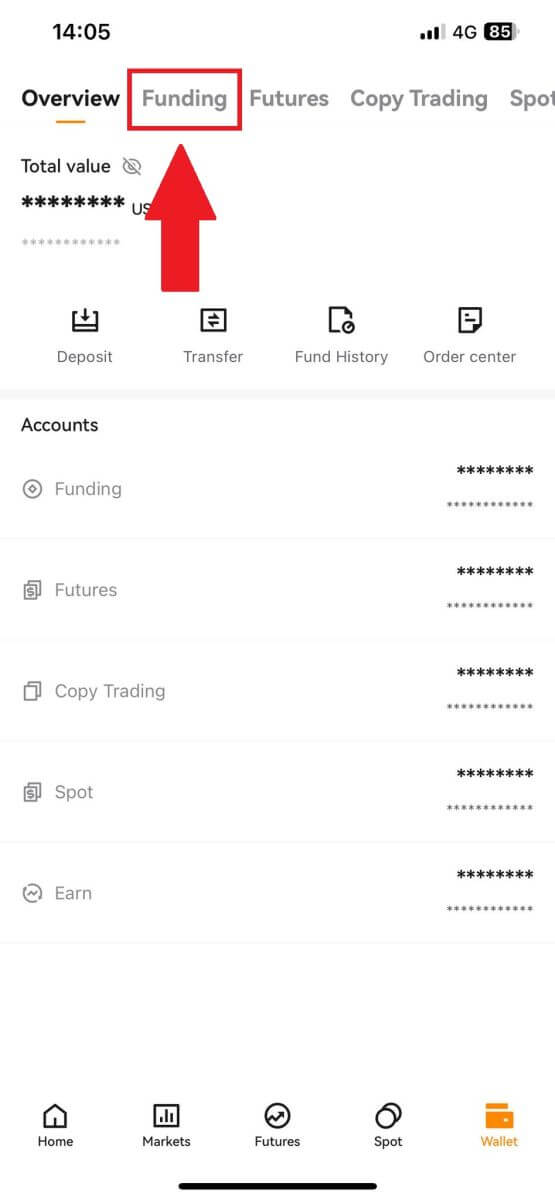

Please be advised that withdrawal fees are subject to variation based on blockchain conditions. To access information regarding withdrawal fees, please navigate to the [Wallet] page on the mobile application or the [Assets] menu on the website. From there, select [Funding], proceed to [Withdraw], and choose the desired [Coin] and [Network]. This will allow you to view the withdrawal fee directly on the page.

Web

App

Why do you need to pay for the fee?

Withdrawal fees are paid to blockchain miners or validators who verify and process transactions. This ensures transaction processing and network integrity.