How to Deposit and Trade Crypto at BloFin

How to Deposit in BloFin

How to Buy Crypto on BloFin

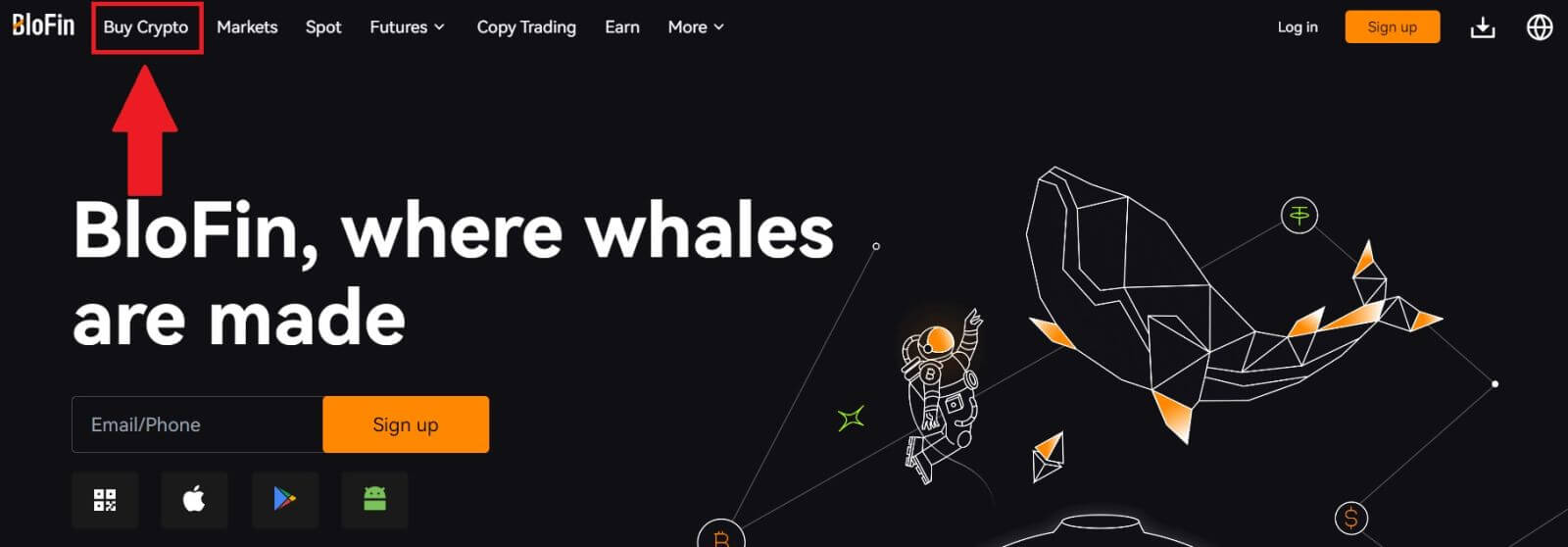

Buy Crypto on BloFin (Website)

1. Open the BloFin website and click on [Buy Crypto].

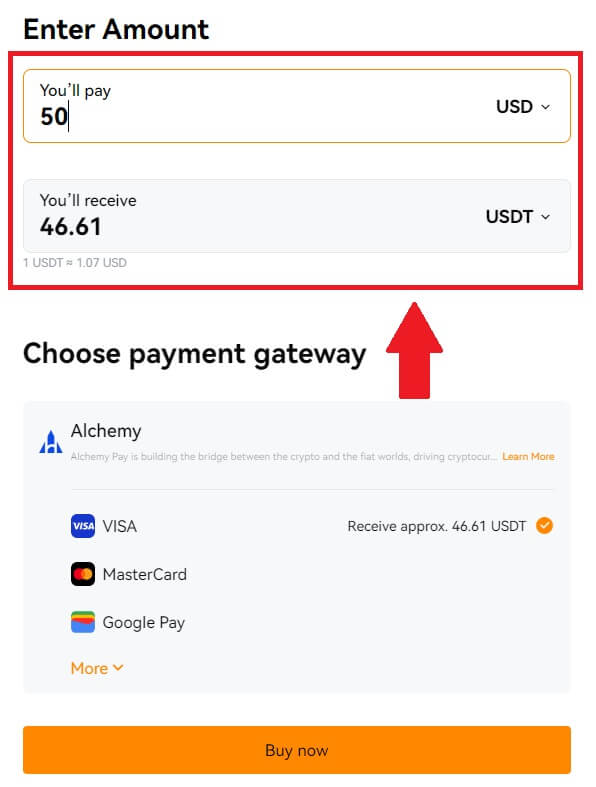

2. At the [Buy Crypto] transaction page, choose the fiat currency and enter the amount you will pay

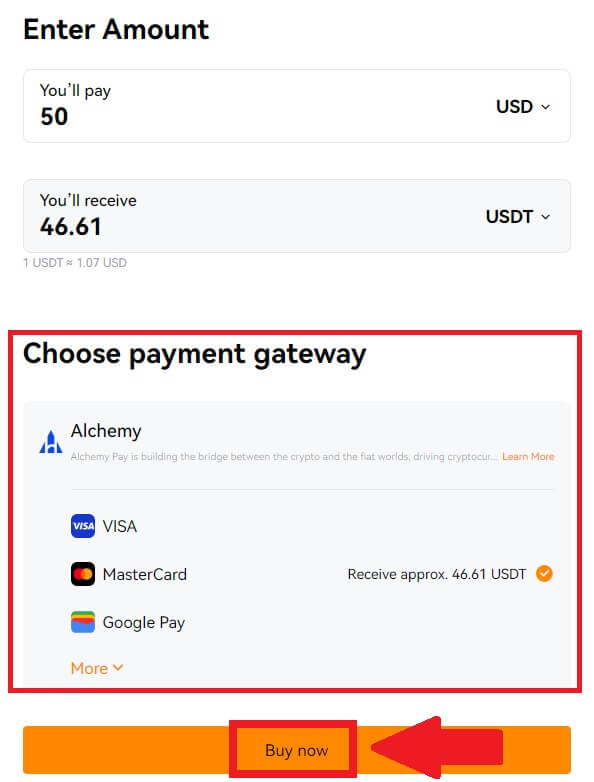

3. Select your payment gateway and click [Buy now]. Here, we’re using MasterCard as an example.

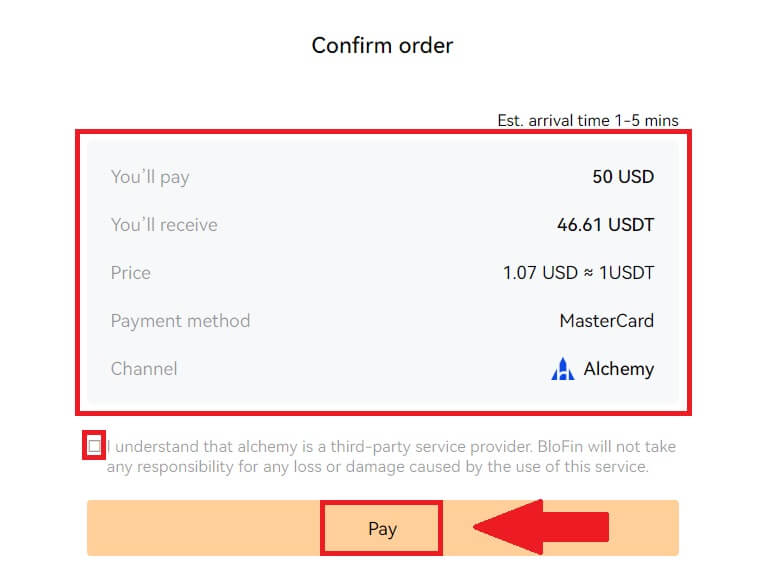

4. On the [Confirm order] page, carefully double-check the order details, read and tick the disclaimer, and then click [Pay].

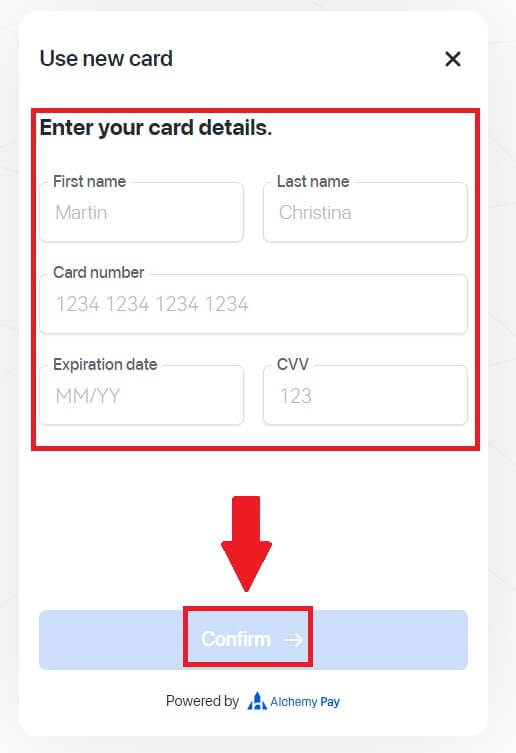

5. You will be guided to Alchemy to complete the payment and personal information.

Please fill in the information as required and click on [Confirm].

Buy Crypto on BloFin (App)

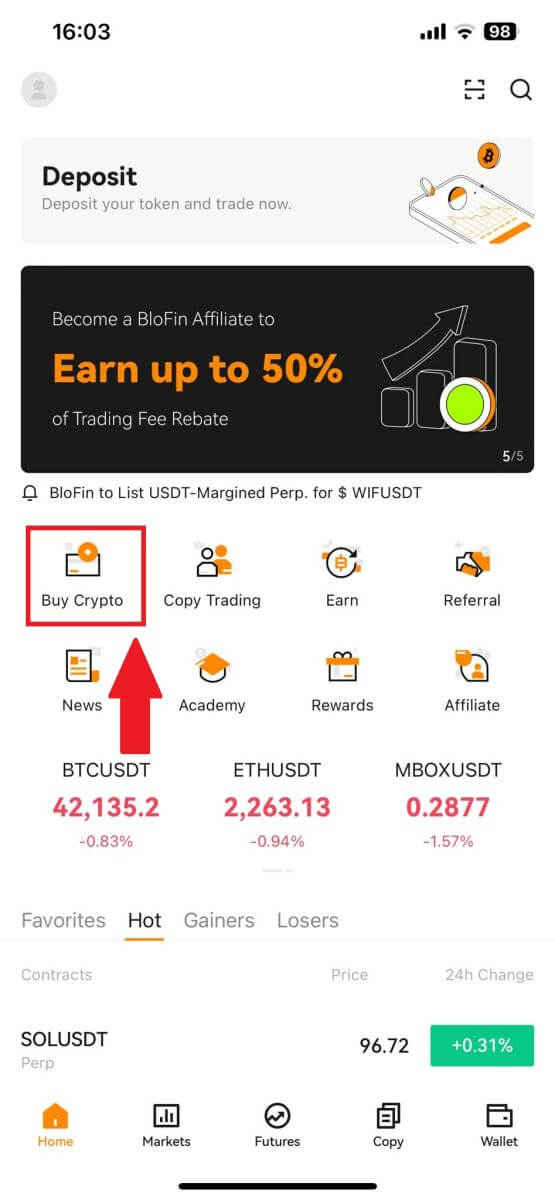

1. Open your BloFin app and tap on [Buy Crypto].

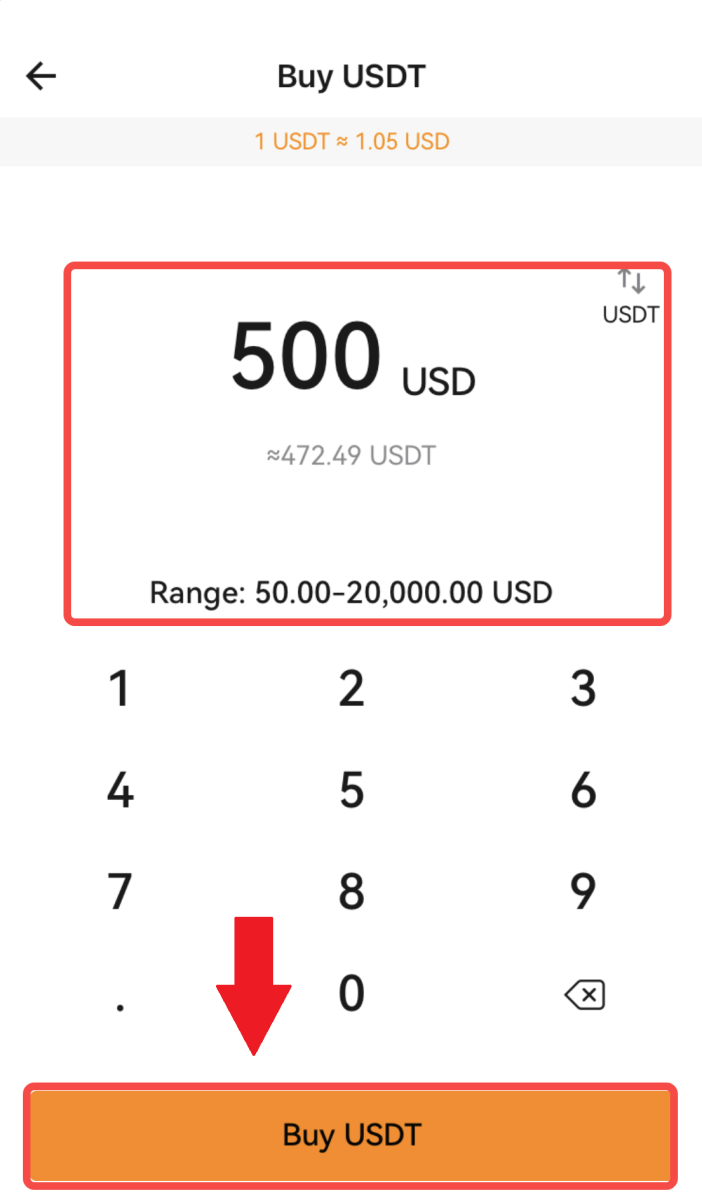

2. Choose the fiat currency, enter the amount you will pay, and click [Buy USDT].

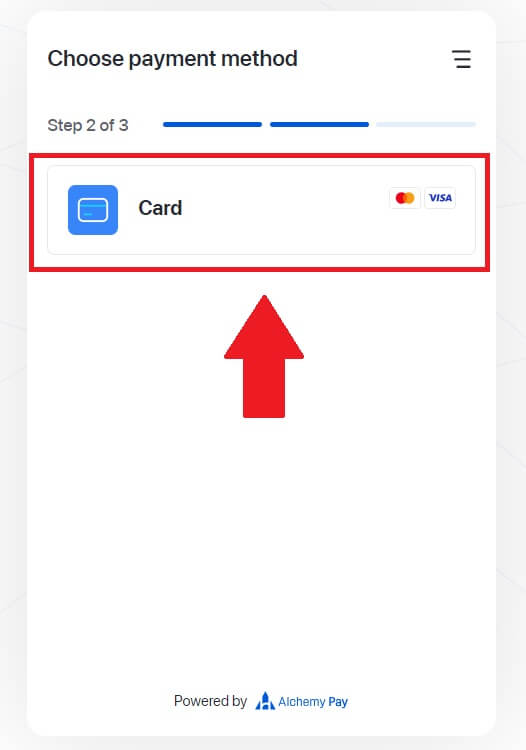

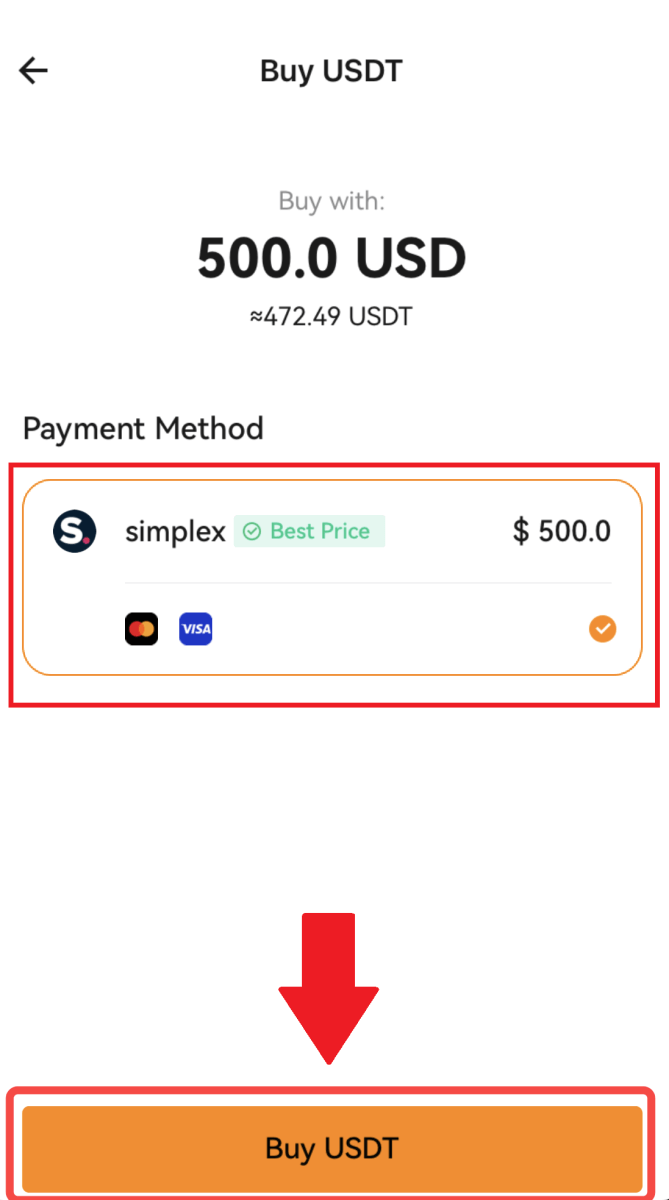

3. Choose the payment method and tap [Buy USDT] to continue.

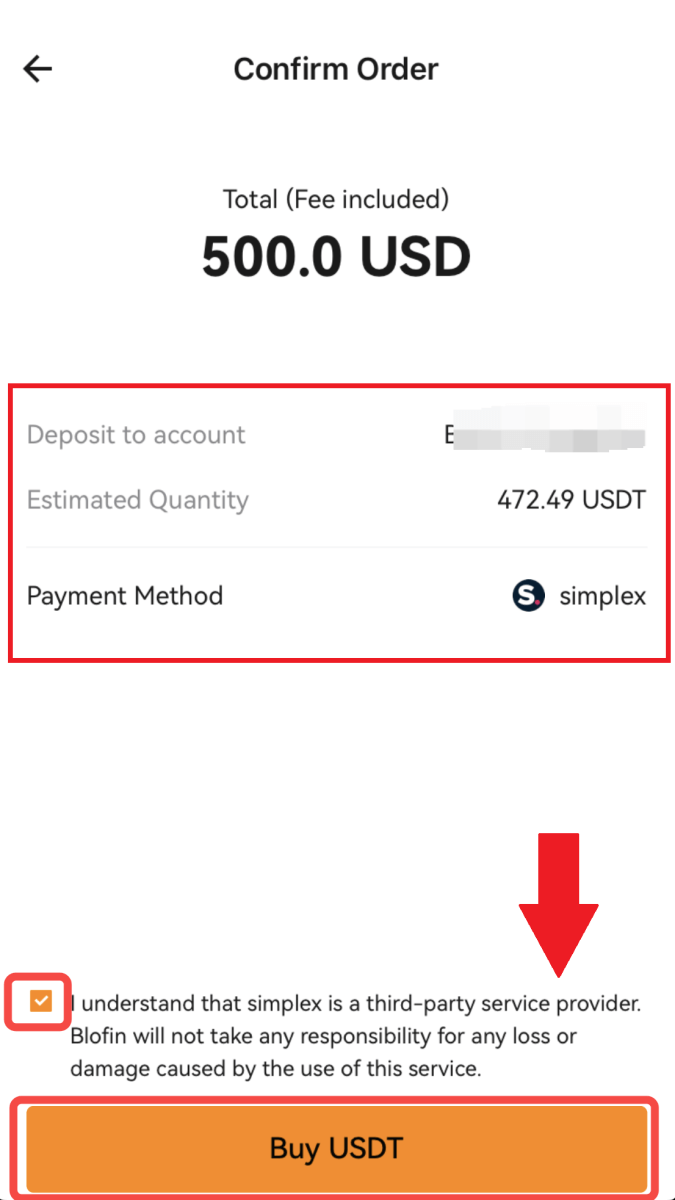

4. On the [Confirm Order] page, carefully double-check the order details, read and tick the disclaimer, and then click [Buy USDT].

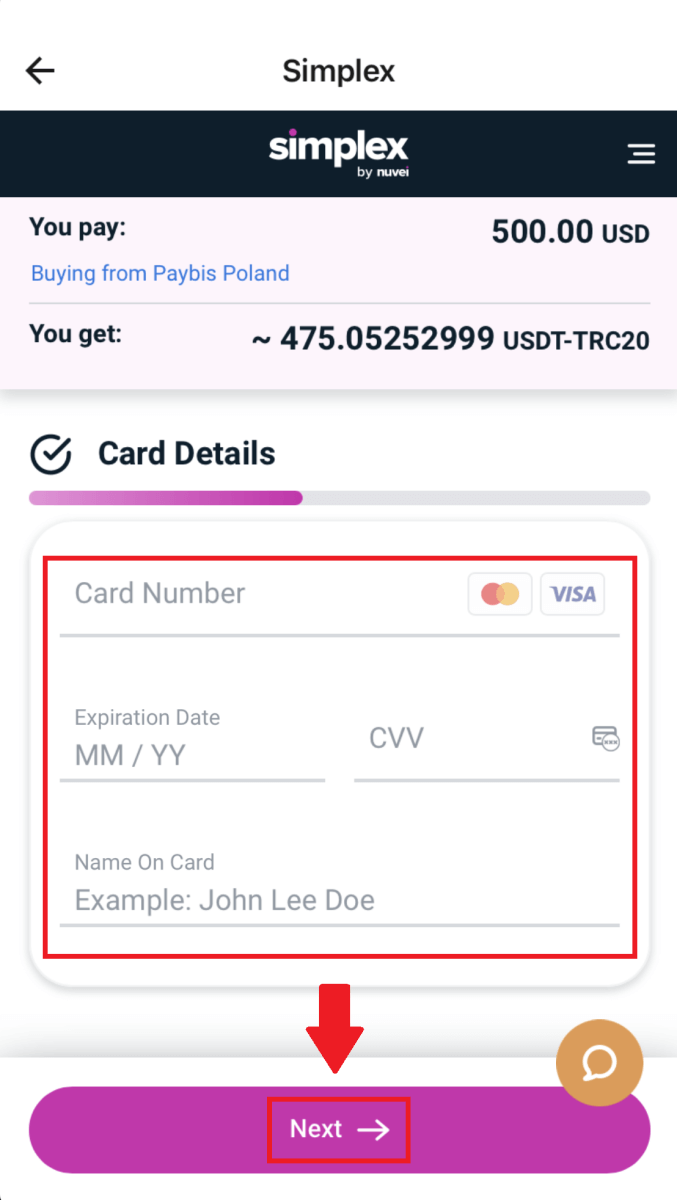

5. You will be redirected to Simplex to finalize the payment and provide personal information, then verify the details. Fill in the required information as instructed and click on [Next].

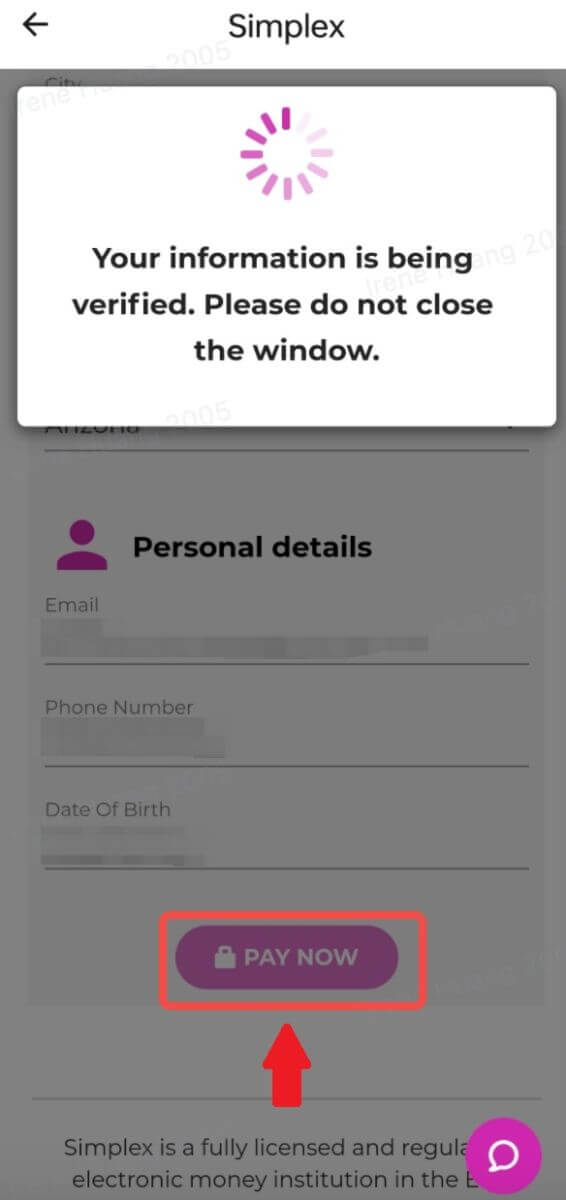

If you have already completed verification with Simplex, you can skip the following steps.

6. Once verification is done, click [Pay Now]. Your transaction is complete.

How to Deposit Crypto on BloFin

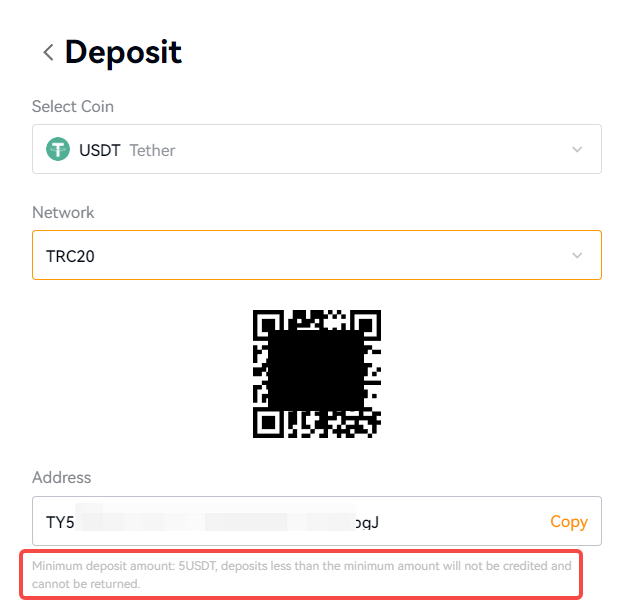

Deposit Crypto on BloFin (Website)

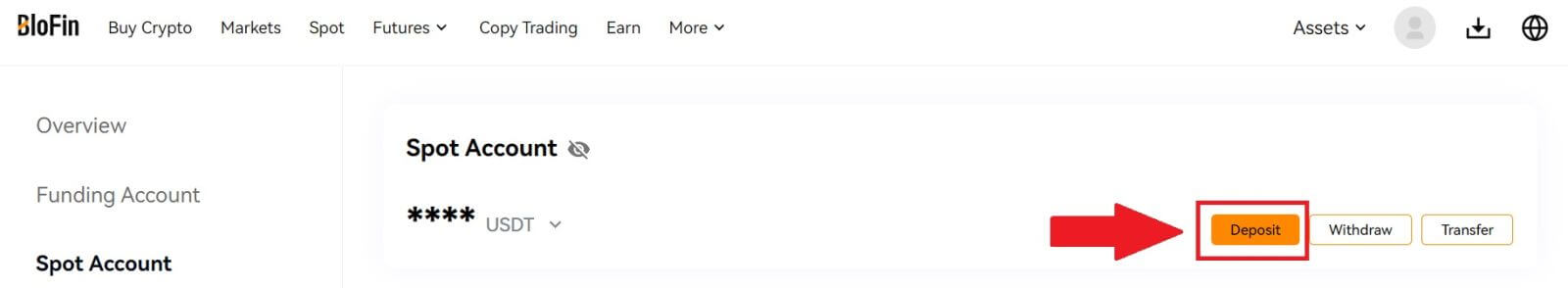

1. Log in to your BloFin account, click on [Assets], and select [Spot].

2. Click on [Deposit] to continue.

Note:

-

When clicking on the fields under Coin and Network, you can search for the preferred Coin and Network.

-

When choosing the network, ensure it matches the withdrawal platform’s network. For example, if you choose the TRC20 network on BloFin, select the TRC20 network on the withdrawal platform. Selecting the wrong network may result in fund loss.

-

Before depositing, check the token contract address. Ensure it matches the supported token contract address on BloFin; otherwise, your assets may be lost.

-

Be aware that there is a minimum deposit requirement for each token in different networks. Deposits below the minimum amount won’t be credited and cannot be returned.

3. Select the cryptocurrency that you want to deposit. Here, we’re using USDT as an example.

4. Choose your network and click the copy button or scan the QR code to obtain the deposit address. Paste this address into the withdrawal address field on the withdrawal platform.

Follow the provided instructions on the withdrawal platform to initiate the withdrawal request.

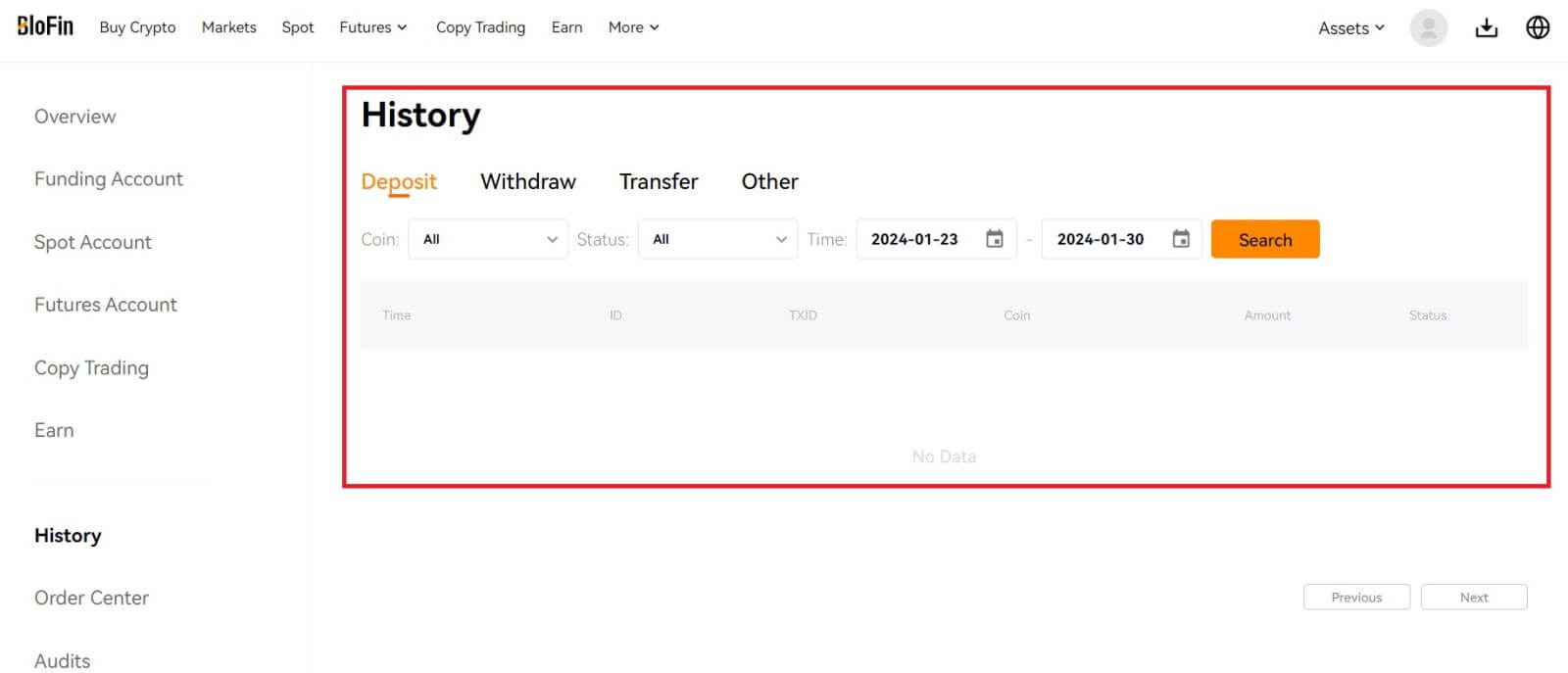

5. After that, you can find your recent deposit records in the [History] - [Deposit]

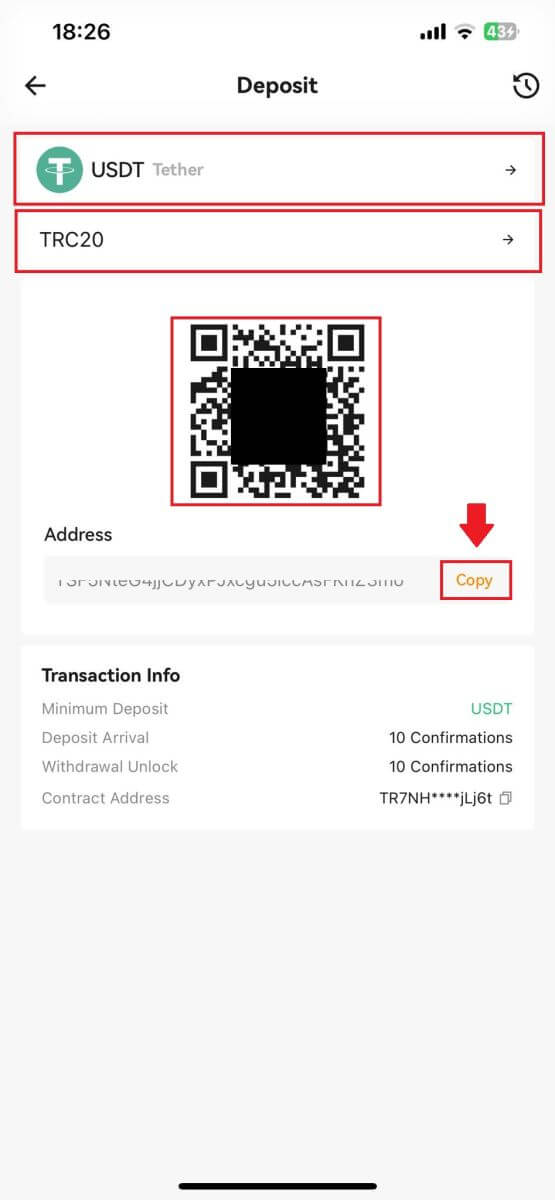

Deposit Crypto on BloFin (App)

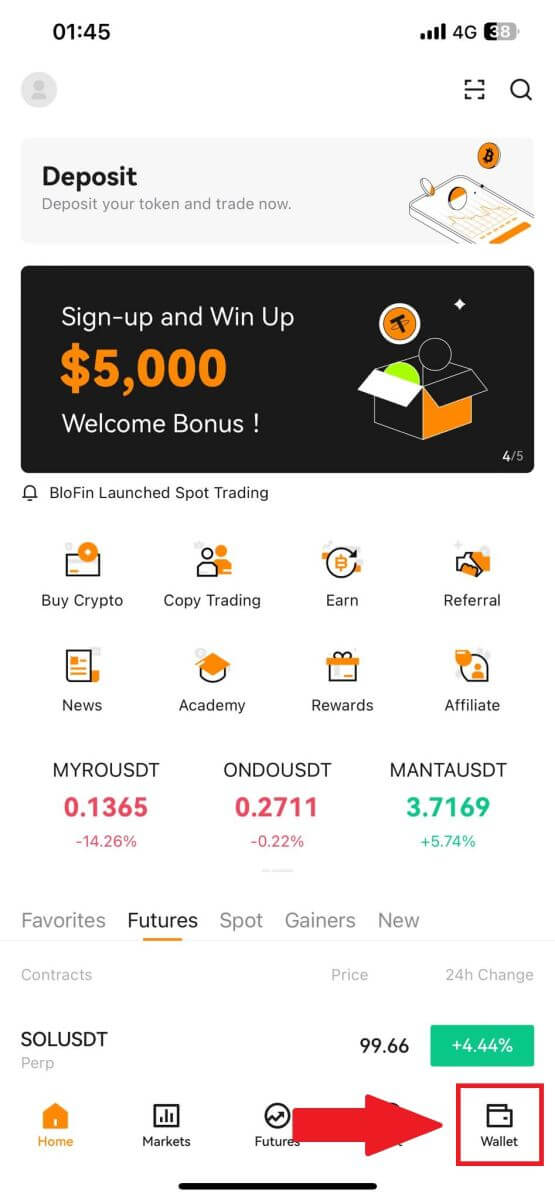

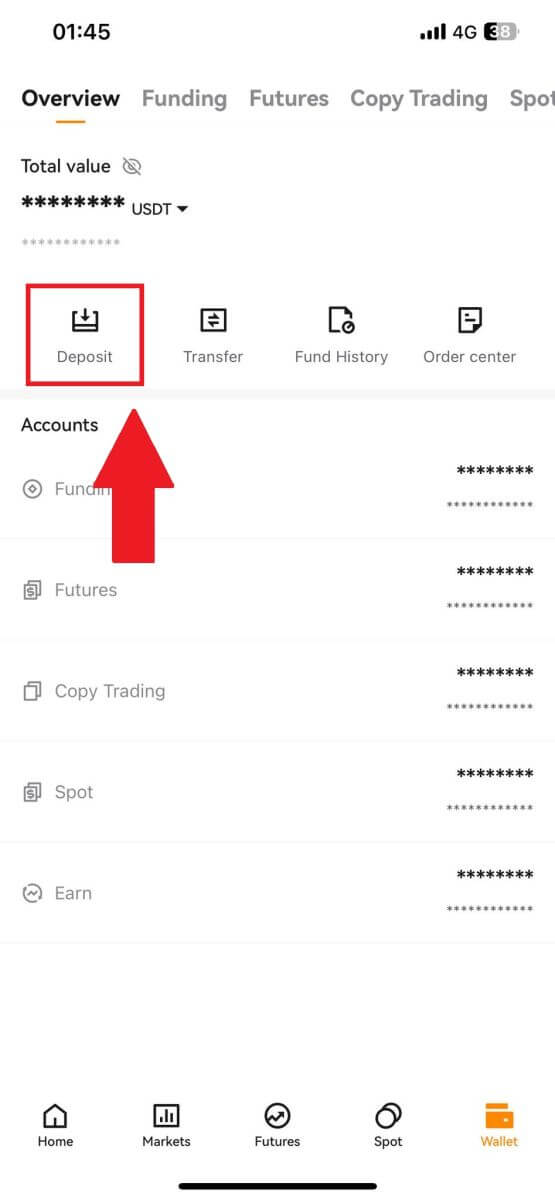

1. Open the BloFin app and tap on [Wallet].

2. Tap on [Deposit] to continue.

Note:

-

When clicking on the fields under Coin and Network, you can search for the preferred Coin and Network.

-

When choosing the network, ensure it matches the withdrawal platform’s network. For example, if you choose the TRC20 network on BloFin, select the TRC20 network on the withdrawal platform. Selecting the wrong network may result in fund losses.

-

Before depositing, check the token contract address. Ensure it matches the supported token contract address on BloFin; otherwise, your assets may be lost.

-

Be aware that there is a minimum deposit requirement for each token on different networks. Deposits below the minimum amount won’t be credited and cannot be returned.

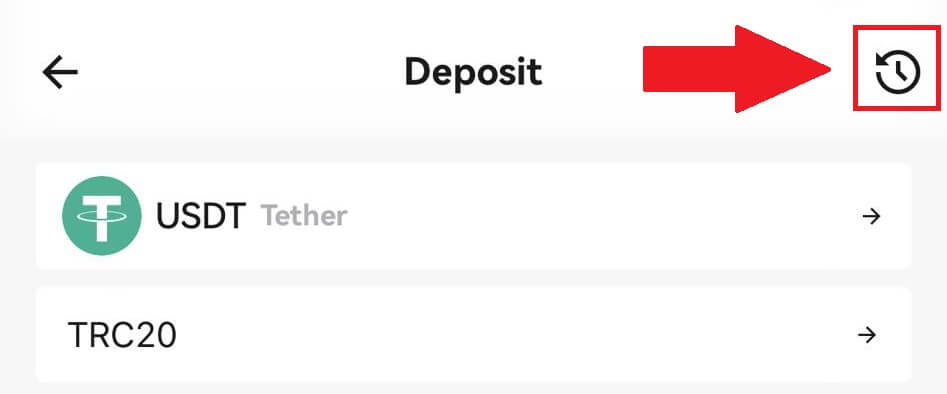

3. Upon being redirected to the next page, choose the cryptocurrency you want to deposit. In this example, we are using USDT-TRC20. Once you’ve selected a network, the deposit address and QR code will be displayed.

4. After initiating the withdrawal request, the token deposit needs to be confirmed by the block. Once confirmed, the deposit will be credited to your Funding account.

Please view the credited amount in your [Overview] or [Funding] account. You may also click on the records icon in the top right corner of the Deposit page to view your deposit history.

Frequently Asked Questions (FAQ)

What is a tag or meme, and why do I need to enter it when depositing crypto?

A tag or memo is a unique identifier assigned to each account for identifying a deposit and crediting the appropriate account. When depositing certain crypto, such as BNB, XEM, XLM, XRP, KAVA, ATOM, BAND, EOS, etc., you need to enter the respective tag or memo for it to be successfully credited.How to check my transaction history?

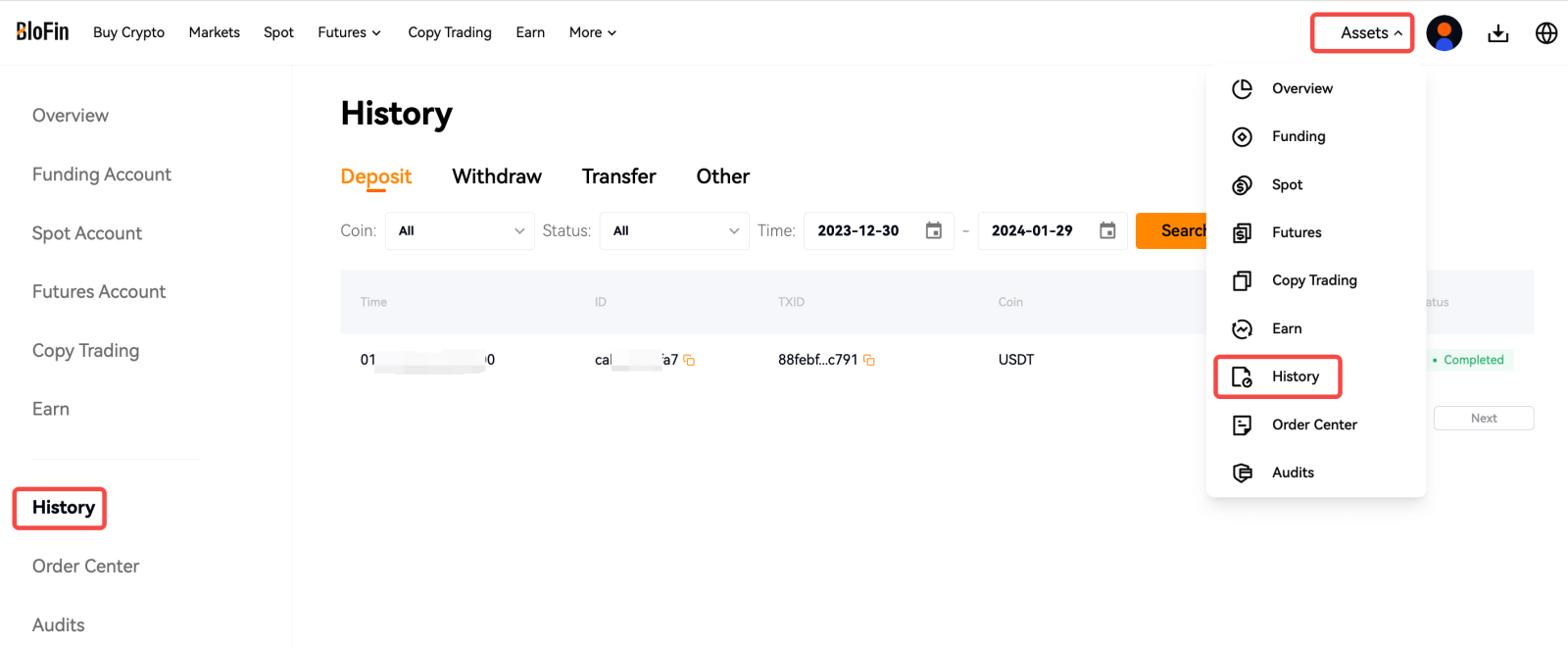

1. Log in to your BloFin account, click on [Assets], and select [History].

2. You can check the status of your deposit or withdrawal here.

Reasons for Uncredited Deposits

1. Insufficient number of block confirmations for a normal deposit

Under normal circumstances, each crypto requires a certain number of block confirmations before the transfer amount can be deposited into your BloFin account. To check the required number of block confirmations, please go to the deposit page of the corresponding crypto.

Please ensure that the cryptocurrency you intend to deposit on the BloFin platform matches the supported cryptocurrencies. Verify the full name of the crypto or its contract address to prevent any discrepancies. If inconsistencies are detected, the deposit may not be credited to your account. In such cases, submit a Wrong Deposit Recovery Application for assistance from the technical team in processing the return.

3. Depositing through an unsupported smart contract method

At present, some cryptocurrencies cannot be deposited on the BloFin platform using the smart contract method. Deposits made through smart contracts will not reflect in your BloFin account. As certain smart contract transfers necessitate manual processing, please promptly reach out to online customer service to submit your request for assistance.

4. Depositing to an incorrect crypto address or selecting the wrong deposit network

Ensure that you have accurately entered the deposit address and selected the correct deposit network before initiating the deposit. Failure to do so may result in the assets not being credited.

Is There A Minimum Or Maximum Amount For Deposit?

Minimum deposit requirement: Each cryptocurrency imposes a minimum deposit amount. Deposits below this minimum threshold will not be accepted. Please refer to the following list for the minimum deposit amounts of each token:

| Crypto | Blockchain Network | Minimum Deposit Amount |

| USDT | TRC20 | 1 USDT |

| ERC20 | 5 USDT | |

| BEP20 | 1 USDT | |

| Polygon | 1 USDT | |

| AVAX C-Chain | 1 USDT | |

| Solana | 1 USDT | |

| BTC | Bitcoin | 0.0005 BTC |

| BEP20 | 0.0005 BTC | |

| ETH | ERC20 | 0.005 ETH |

| BEP20 | 0.003 ETH | |

| BNB | BEP20 | 0.009 BNB |

| SOL | Solana | 0.01 SOL |

| XRP | Ripple (XRP) | 10 XRP |

| ADA | BEP20 | 5 ADA |

| DOGE | BEP20 | 10 DOGE |

| AVAX | AVAX C-Chain | 0.1 AVAX |

| TRX | BEP20 | 10 TRX |

| TRC20 | 10 TRX | |

| LINK | ERC20 | 1 LINK |

| BEP20 | 1 LINK | |

| MATIC | Polygon | 1 MATIC |

| DOT | ERC20 | 2 DOT |

| SHIB | ERC20 | 500,000 SHIB |

| BEP20 | 200,000 SHIB | |

| LTC | BEP20 | 0.01 LTC |

| BCH | BEP20 | 0.005 BCH |

| ATOM | BEP20 | 0.5 ATOM |

| UNI | ERC20 | 3 UNI |

| BEP20 | 1 UNI | |

| ETC | BEP20 | 0.05 ETC |

Note: Please ensure that you adhere to the minimum deposit amount specified on our deposit page for BloFin. Failure to meet this requirement will result in your deposit being declined.

Maximum Deposit Limit

Is there a maximum amount limit for deposit?

No, there is no maximum amount limit for deposit. But, please pay attention there is a limit for 24h withdrawal which is depending on your KYC.

How to Trade Crypto at BloFin

How to Trade Spot on BloFin (Website)

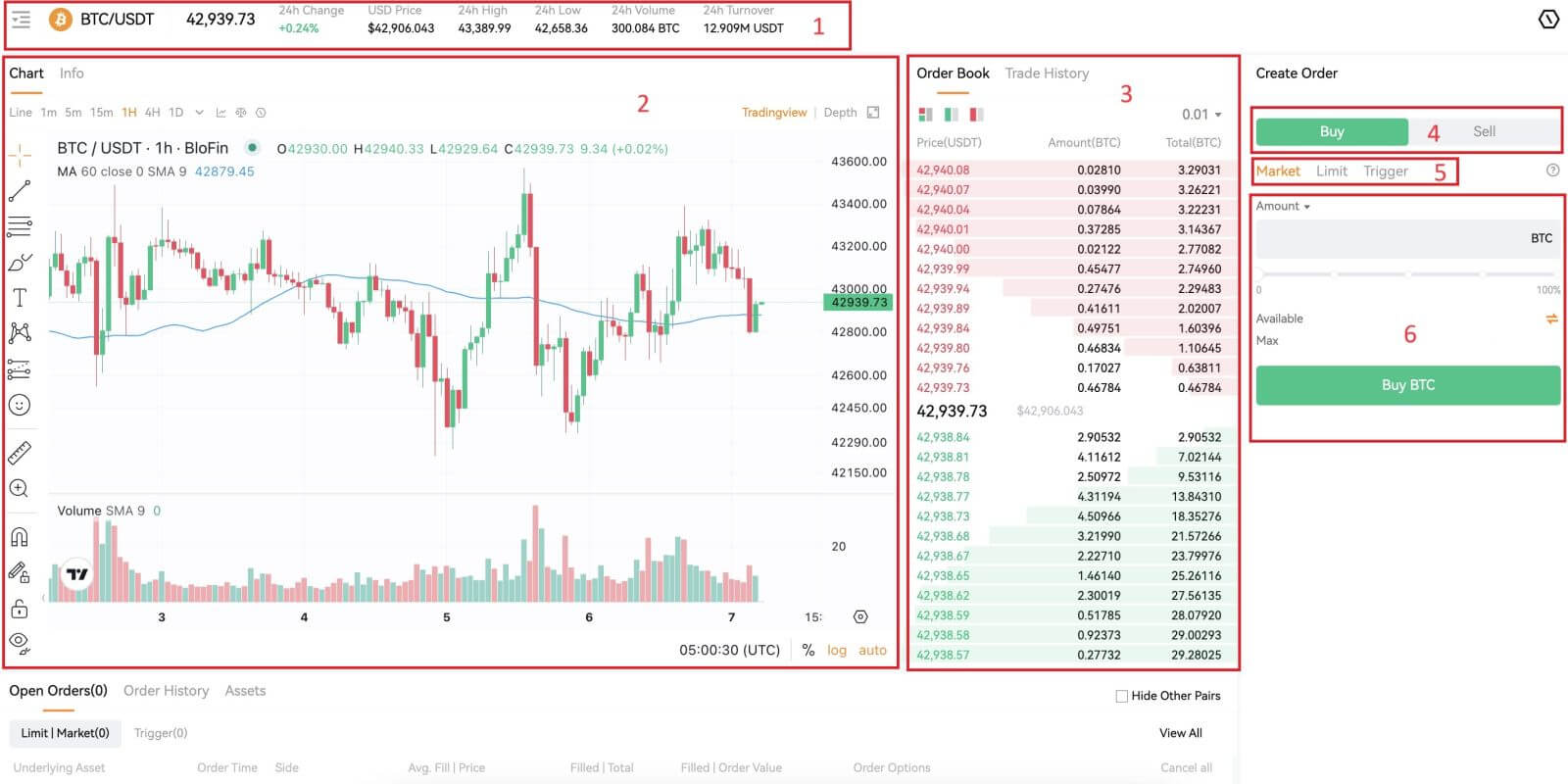

Step 1: Login to your BloFin account and click on [Spot]. Step 2: You will now find yourself on the trading page interface.

Step 2: You will now find yourself on the trading page interface.

- Market Price Trading volume of trading pair in 24 hours.

- Candlestick chart and Technical Indicators.

- Asks (Sell orders) book / Bids (Buy orders) book.

- Buy / Sell Cryptocurrency.

- Type of orders.

- Market latest completed transaction.

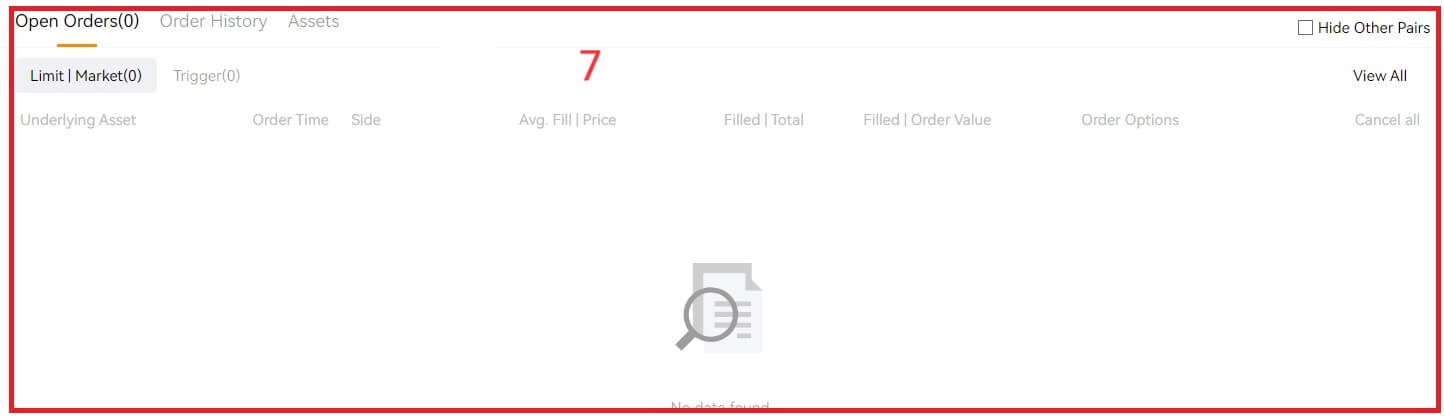

- Your Open Order / Order History / Assets.

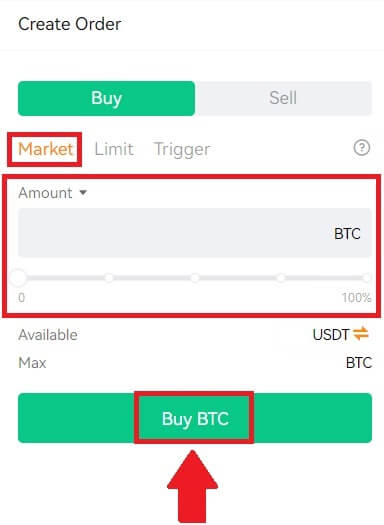

Step 3: Buy Crypto

Let’s look at buying some BTC.

Go to the buying / selling section (4), select [Buy] to buy BTC, choose your order type, and fill in the price and the amount for your order. Click on [Buy BTC] to complete the transaction.

Note:

- The default order type is a market order. You can use a market order if you want an order filled as soon as possible.

- The percentage bar below the amount refers to what percentage of your total USDT assets will be used to buy BTC.

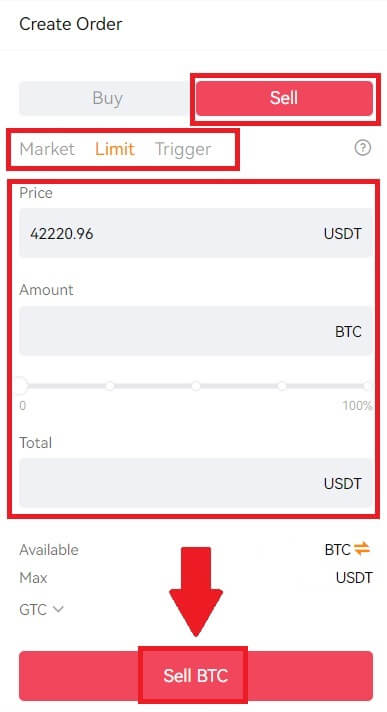

Step 4: Sell Crypto

On the contrary, when you have BTC in your spot account and hope to get USDT, at this time, you need to sell BTC to USDT.

Select [Sell] to create your order by entering the price and amount. After the order is filled, you will have USDT in your account.

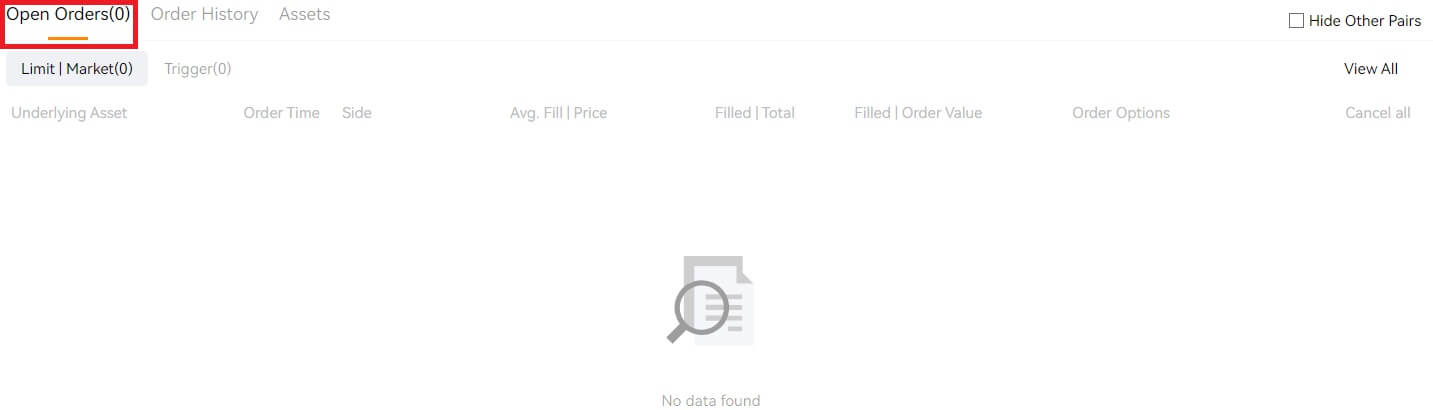

How do I view my market orders?

Once you submit the orders, you can view and edit your market orders under [Open Orders].

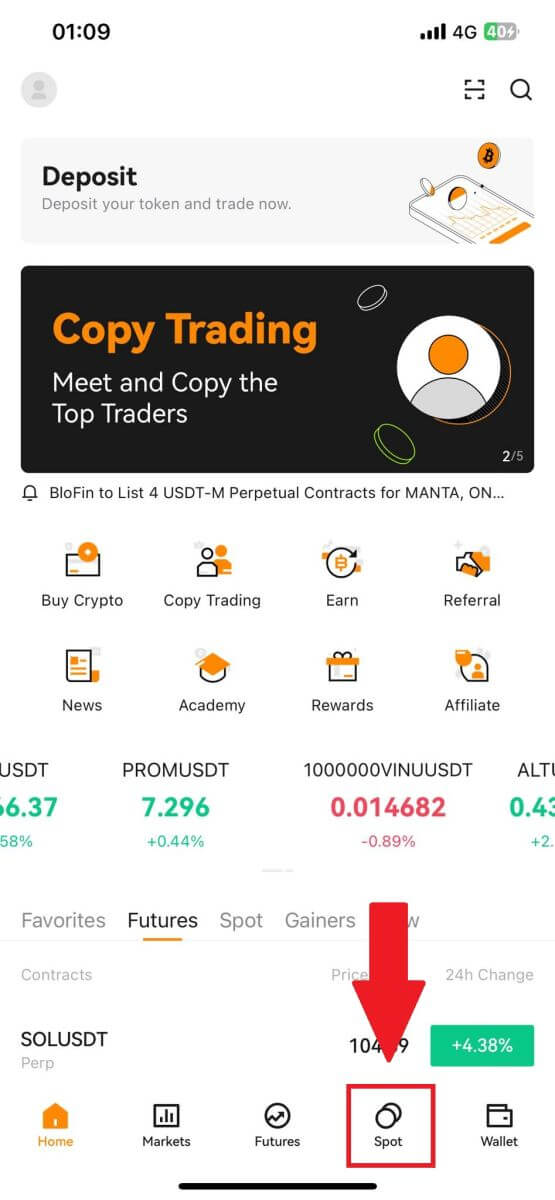

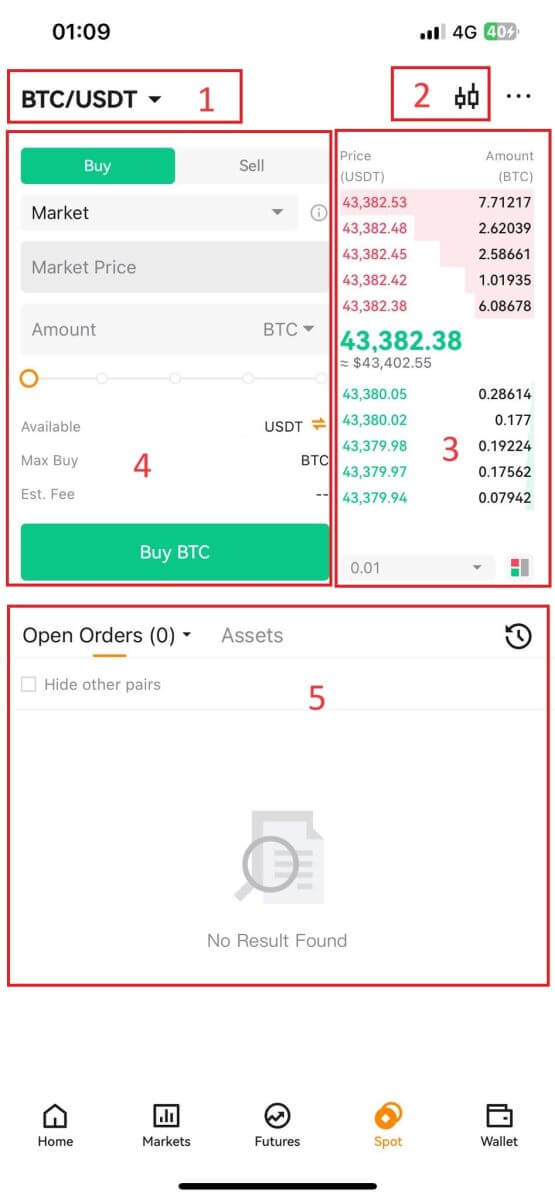

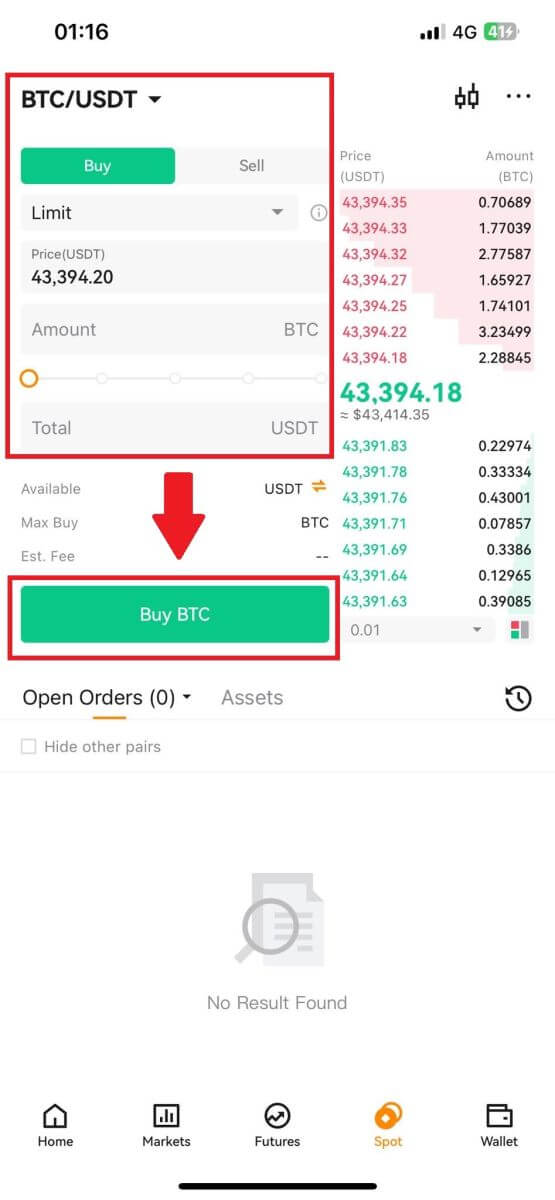

How to Trade Spot on BloFin (App)

1. Open your BloFin app, on the first page, tap on [Spot].

2. Here is the trading page interface.

- Market and Trading pairs.

- Real-time market candlestick chart, supported trading pairs of the cryptocurrency.

- Sell/Buy Order Book.

- Buy/Sell Cryptocurrency.

- Open orders.

3. As an example, we will make a [Limit order] trade to buy BTC.

Enter the order placing section of the trading interface, refer to the price in the buy/sell order section, and enter the appropriate BTC buying price and the quantity or trade amount.

Click [Buy BTC] to complete the order. (Same for sell order)

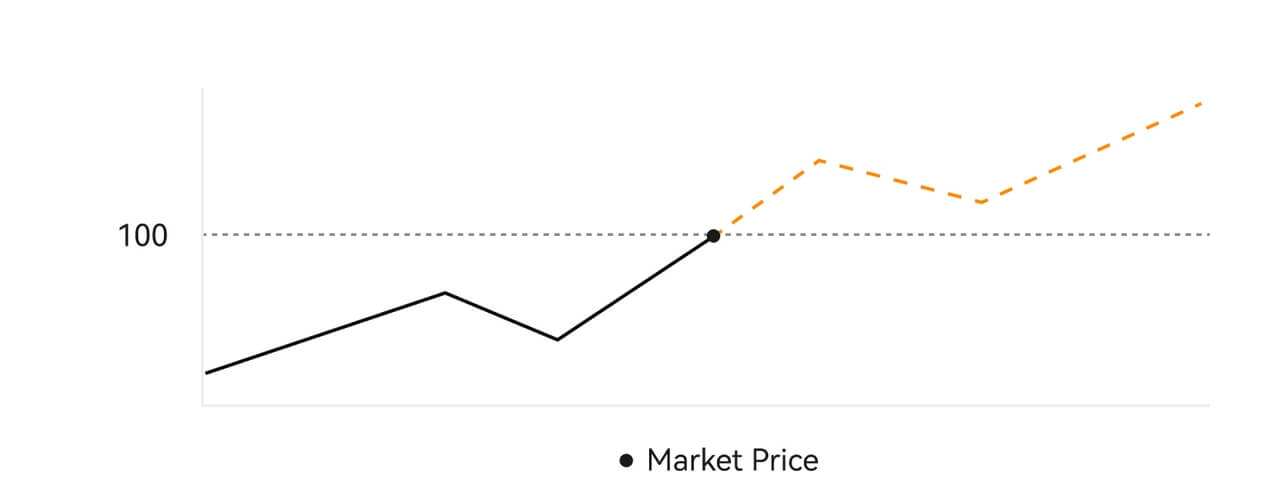

What is a Market Order?

A Market Order is an order type that is executed at the current market price. When you place a market order, you are essentially requesting to buy or sell a security or asset at the best available price in the market. The order is filled immediately at the prevailing market price, ensuring quick execution. Description

DescriptionIf the market price is $100, a buy or sell order is filled at around $100. The amount and price that your order is filled at depends on the actual transaction.

What is a Limit Order?

A limit order is an instruction to buy or sell an asset at a specified limit price, and it is not executed immediately like a market order. Instead, the limit order is activated only if the market price reaches or exceeds the designated limit price favorably. This allows traders to target specific buying or selling prices different from the current market rate.

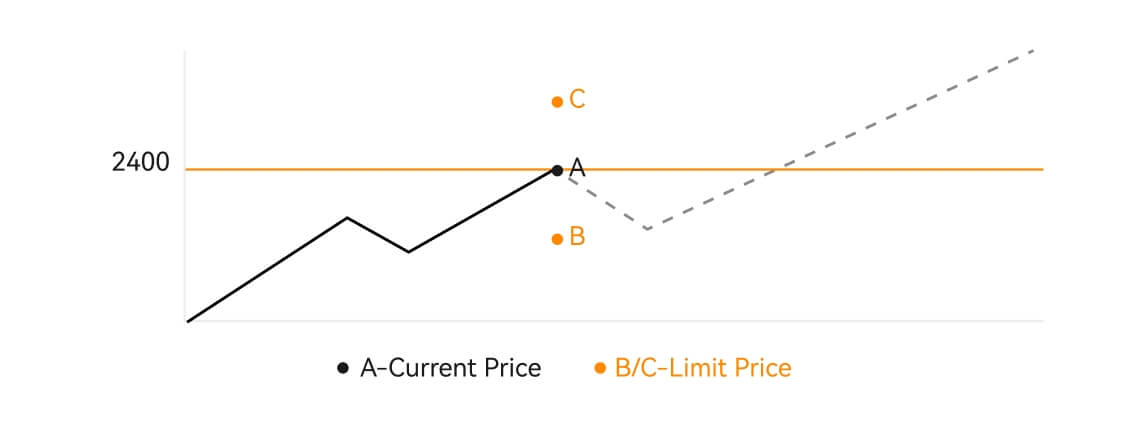

Limit Order illustration

When the Current Price (A) drops to the order’s Limit Price (C) or below the order will execute automatically. The order will be filled immediately if the buying price is above or equal to the current price. Therefore, the buying price of limit orders must be below the current price.

Buy Limit Order

Sell Limit Order

1) The current price in the above graph is 2400 (A). If a new buy/limit order is placed with a limit price of 1500 (C), the order will not execute until the price drops to 1500(C) or below.

2) Instead, if the buy/limit order is placed with a limit price of 3000(B)which is above the current price, the order will be filled with the counterparty price immediately. The executed price is around 2400, not 3000.

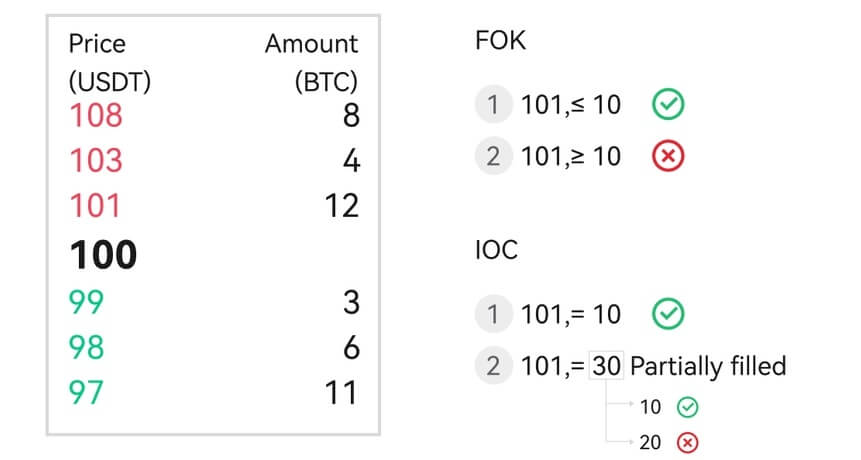

Post-only/FOK/IOC illustration

Description

Assume the market price is $100 and the lowest sell order is priced at$101 with an amount of 10.

FOK:

A buy order priced at $101 with an amount of 10 is filled.However, a buy order priced at $101 with an amount of 30 can’t be completely filled, so it’s canceled.

IOC:

A buy order priced at $101 with an amount of 10 is filled.A buy order priced at $101 with an amount of 30 is partially filled with an amount of 10.

Post-Only:

The current price is $2400 (A). At this point, place a Post Only Order. If the sell price (B) of order is lower than or equal to the current price, the sell order may be executed immediately, the order will be cancelled. Therefore, when a sell is required, the price (C) should be higher than the current price.

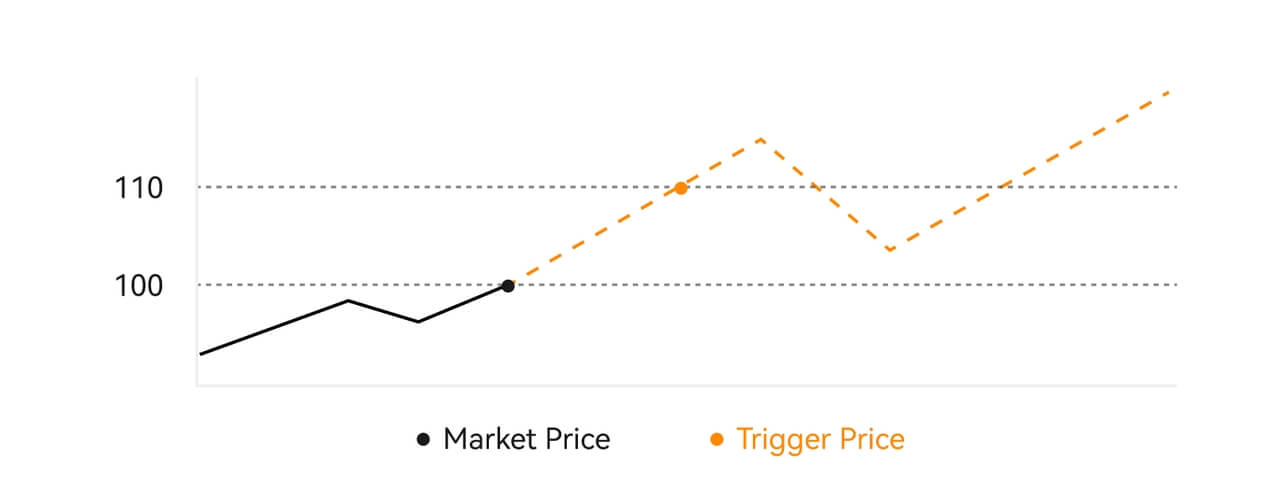

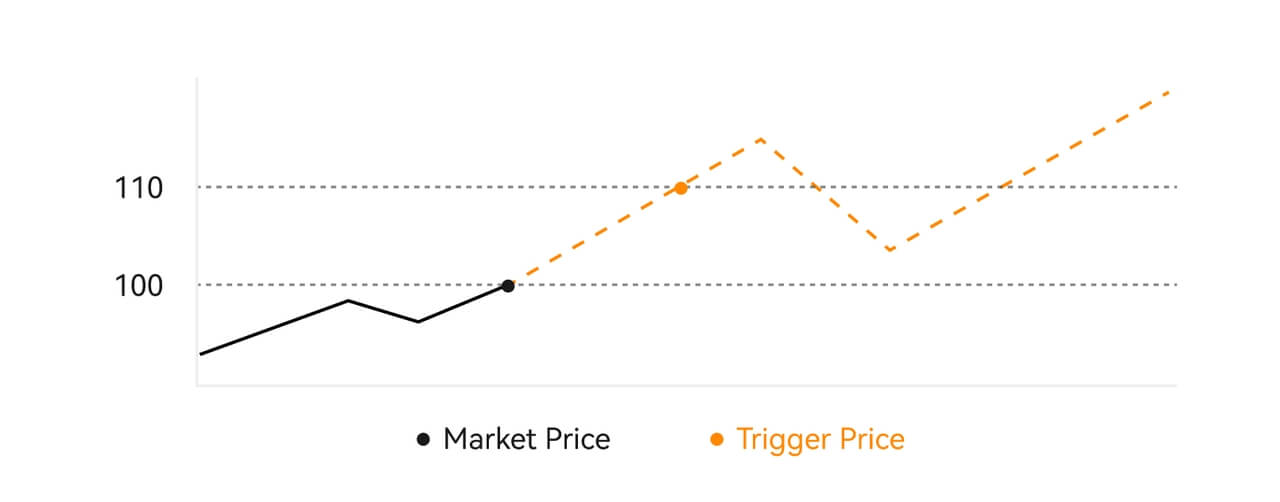

What is a Trigger Order?

A trigger order, alternatively termed a conditional or stop order, is a specific order type enacted only when predefined conditions or a designated trigger price are satisfied. This order allows you to establish a trigger price, and upon its attainment, the order becomes active and is dispatched to the market for execution. Subsequently, the order is transformed into either a market or limit order, carrying out the trade in accordance with the specified instructions.

For instance, you might configure a trigger order to sell a cryptocurrency like BTC if its price descends to a particular threshold. Once the BTC price hits or drops below the trigger price, the order is triggered, transforming into an active market or limit order to sell the BTC at the most favorable available price. Trigger orders serve the purpose of automating trade executions and mitigating risk by defining predetermined conditions for entering or exiting a position.

Description

Description

In a scenario where the market price is $100, a trigger order set with a trigger price of $110 is activated when the market price ascends to $110, subsequently becoming a corresponding market or limit order.

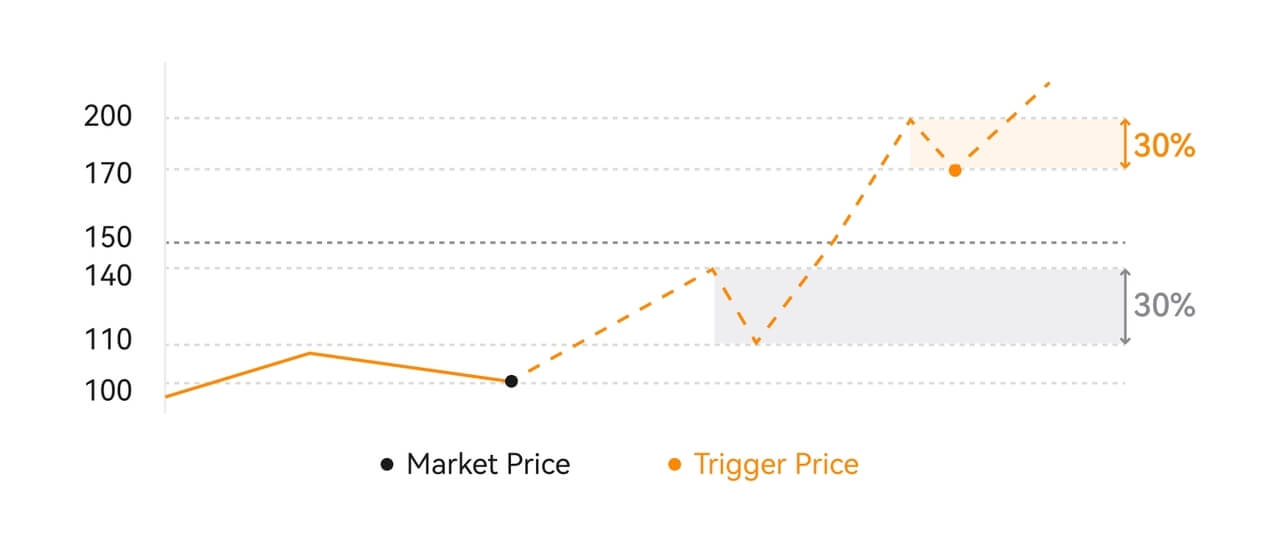

What is a Trailing Stop order?

A Trailing Stop order is a specific type of stop order that adjusts with changes in the market price. It allows you to set a predefined constant or percentage, and when the market price reaches this point, a market order is automatically executed.

Sell Illustration (percentage)

Description

Assume you are holding a long position with a market price of $100, and you set a trailing stop order to sell at a 10% loss. If the price drops by 10% from $100 to $90, your trailing stop order is triggered and converted into a market order to sell.

However, if the price rises to $150 and then drops 7% to $140, your trailing stop order is not triggered. If the price rises to $200 and then drops 10% to $180, your trailing stop order is triggered and converted into a market order to sell.

Sell Illustration (constant)

Description

In another scenario, with a long position at a market price of $100, if you set a trailing stop order to sell at a $30 loss, the order is triggered and converted into a market order when the price drops by $30 from $100 to $70.

If the price rises to $150 and then drops by $20 to $130, your trailing stop order is not triggered. However, if the price rises to $200 and then drops by $30 to $170, your trailing stop order is triggered and converted into a market order to sell.

Sell Illustration with activation price (constant) Description

Description

Assuming a long position with a market price of $100, setting a trailing stop order to sell at a $30 loss with an activation price of $150 adds an extra condition. If the price rises to $140 and then drops by $30 to $110, your trailing stop order is not triggered because it isn’t activated.

When the price rises to $150, your trailing stop order is activated. If the price continues rising to $200 and then drops by $30 to $170, your trailing stop order is triggered and converted into a market order to sell.

Frequently Asked Questions (FAQ)

What is the Spot Trading Fee?

- Every successful trade on the BloFin Spot market incurs a trading fee.

- Maker Fee Rate: 0.1%

- Taker Fee Rate: 0.1%

What is Taker and Maker?

-

Taker: This applies to orders that immediately execute, either partially or fully, before entering the order book. Market orders are always Takers since they never go on the order book. The taker trades "take" volume off the order book.

-

Maker: Pertains to orders, like limit orders, that go on the order book either partially or fully. Subsequent trades originating from such orders are considered "maker" trades. These orders add volume to the order book, contributing to "making the market."

How are Trading Fees Calculated?

- Trading fees are charged for the received asset.

- Example: If you buy BTC/USDT, you receive BTC, and the fee is paid in BTC. If you sell BTC/USDT, you receive USDT, and the fee is paid in USDT.

Calculation Example:

-

Buying 1 BTC for 40,970 USDT:

- Trading Fee = 1 BTC * 0.1% = 0.001 BTC

-

Selling 1 BTC for 41,000 USDT:

- Trading Fee = (1 BTC * 41,000 USDT) * 0.1% = 41 USDT