How to Trade Crypto on BloFin

How to Trade Spot on BloFin (Website)

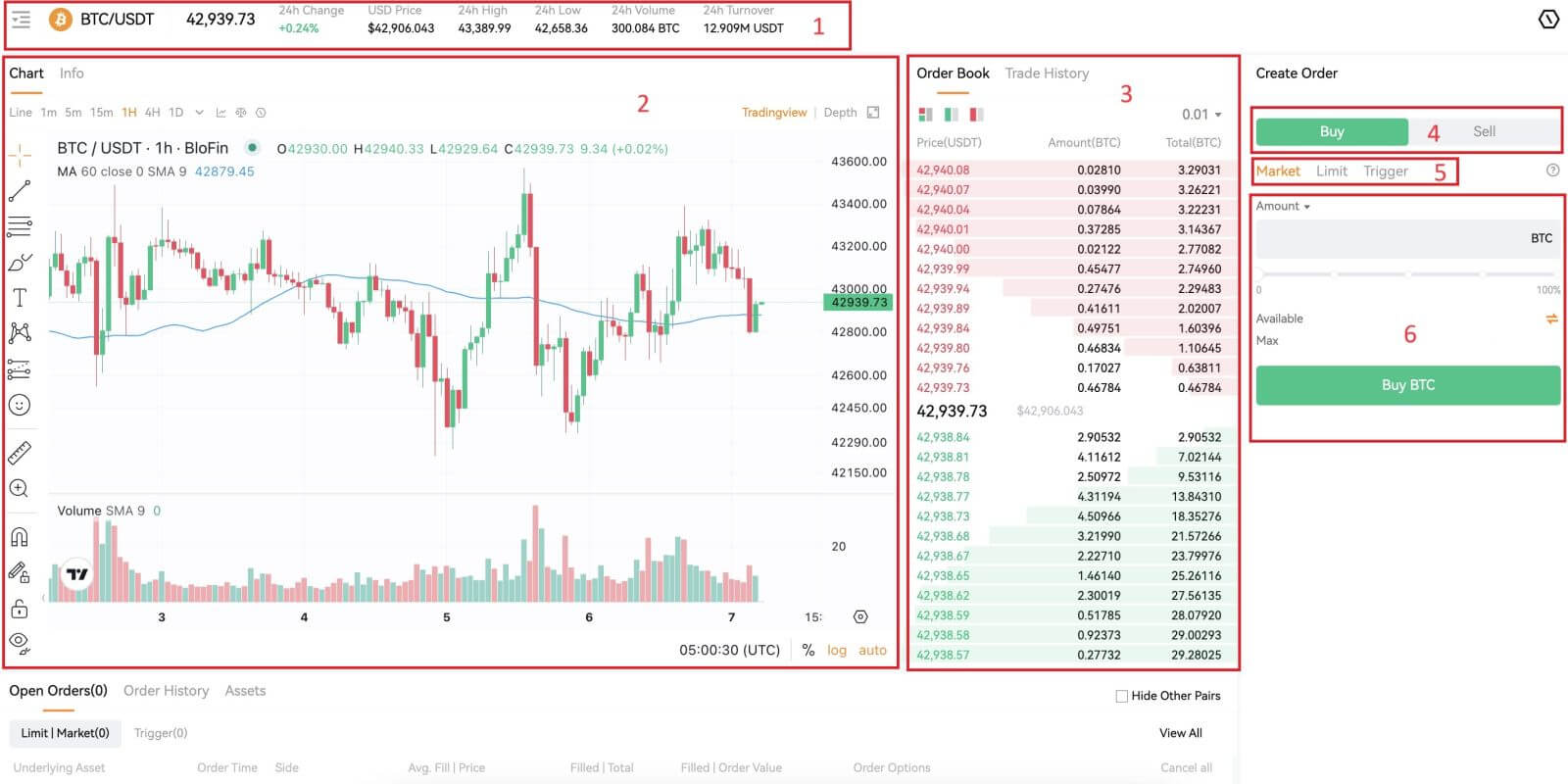

Step 1: Login to your BloFin account and click on [Spot]. Step 2: You will now find yourself on the trading page interface.

Step 2: You will now find yourself on the trading page interface.

- Market Price Trading volume of trading pair in 24 hours.

- Candlestick chart and Technical Indicators.

- Asks (Sell orders) book / Bids (Buy orders) book.

- Buy / Sell Cryptocurrency.

- Type of orders.

- Market latest completed transaction.

- Your Open Order / Order History / Assets.

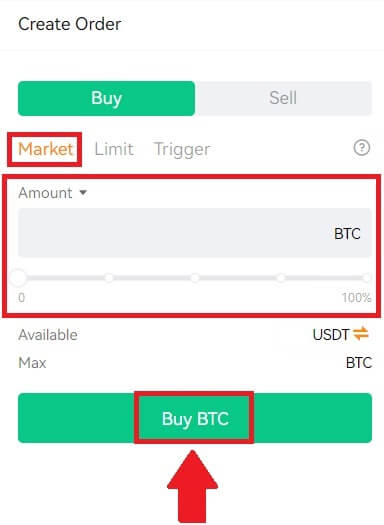

Step 3: Buy Crypto

Let’s look at buying some BTC.

Go to the buying / selling section (4), select [Buy] to buy BTC, choose your order type, and fill in the price and the amount for your order. Click on [Buy BTC] to complete the transaction.

Note:

- The default order type is a market order. You can use a market order if you want an order filled as soon as possible.

- The percentage bar below the amount refers to what percentage of your total USDT assets will be used to buy BTC.

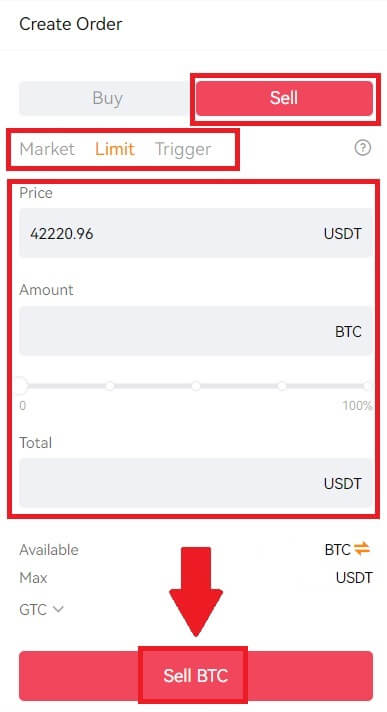

Step 4: Sell Crypto

On the contrary, when you have BTC in your spot account and hope to get USDT, at this time, you need to sell BTC to USDT.

Select [Sell] to create your order by entering the price and amount. After the order is filled, you will have USDT in your account.

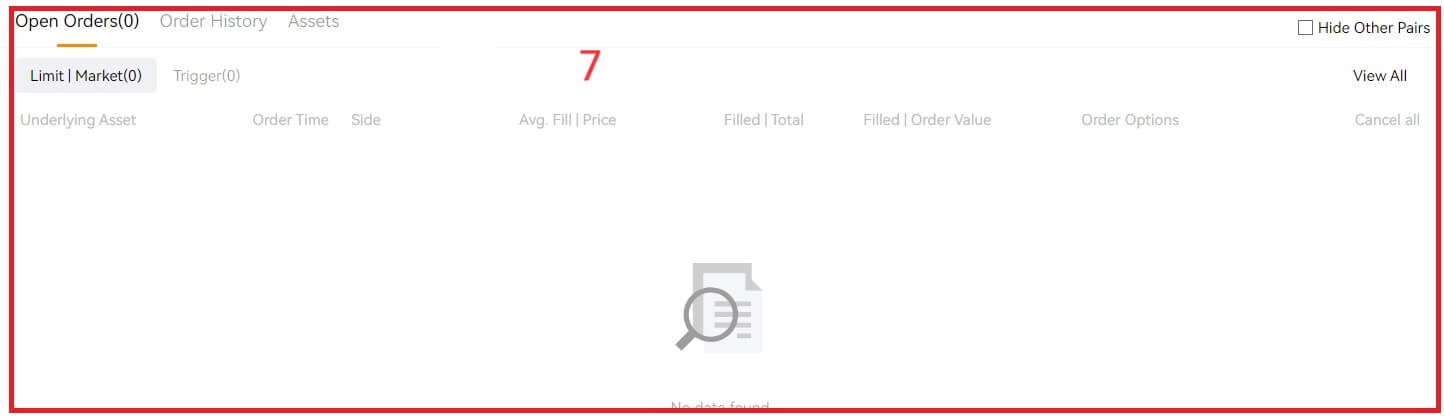

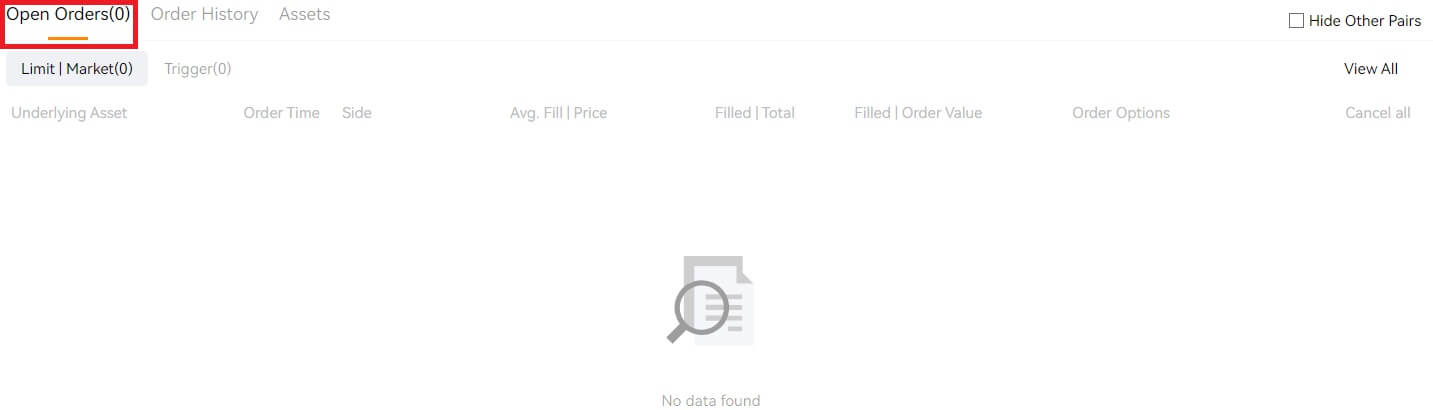

How do I view my market orders?

Once you submit the orders, you can view and edit your market orders under [Open Orders].

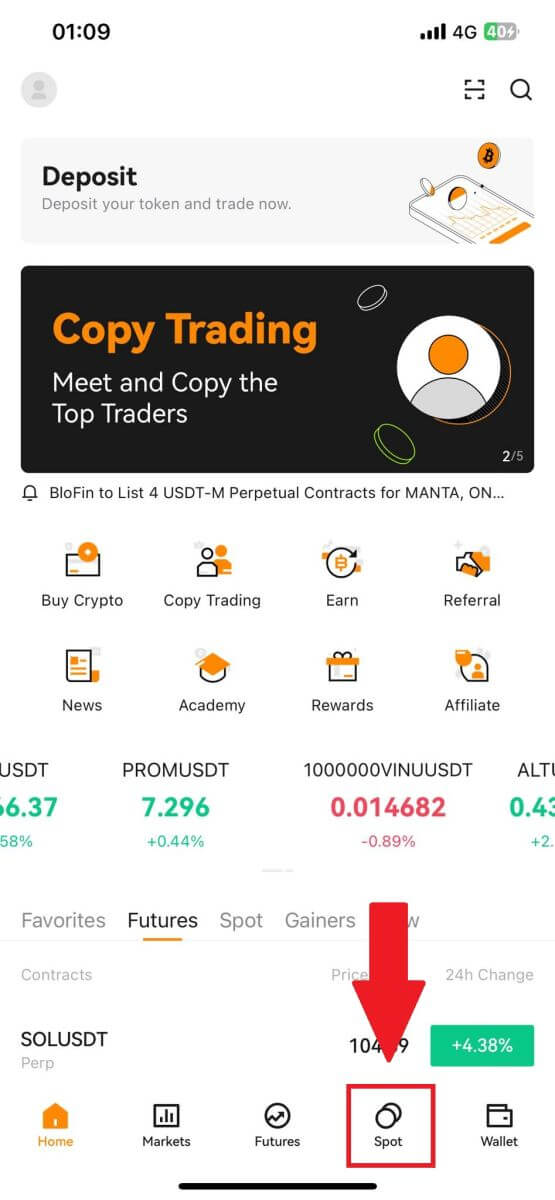

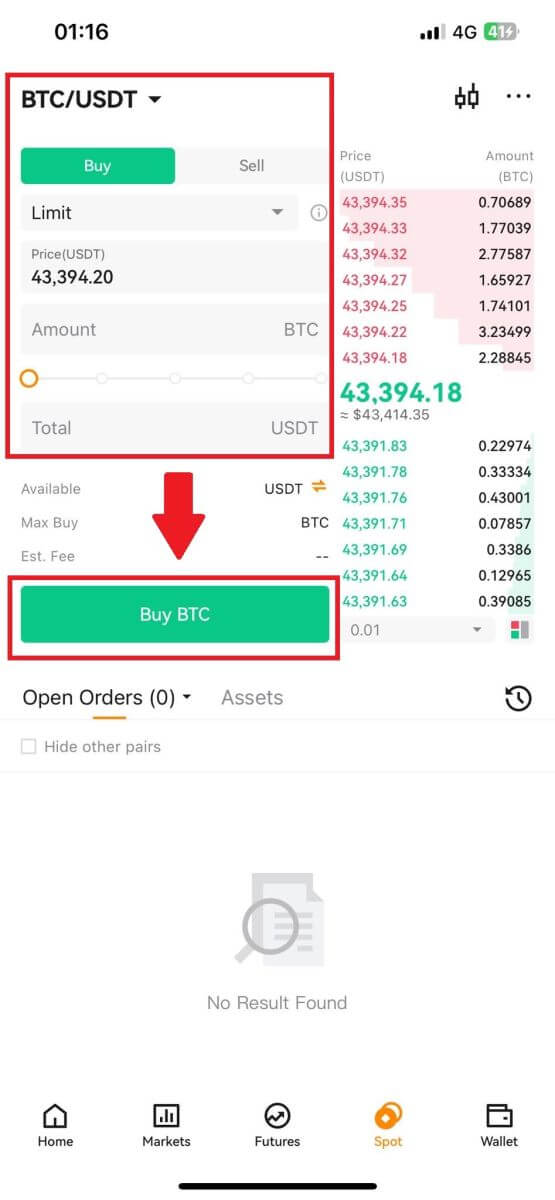

How to Trade Spot on BloFin (App)

1. Open your BloFin app, on the first page, tap on [Spot].

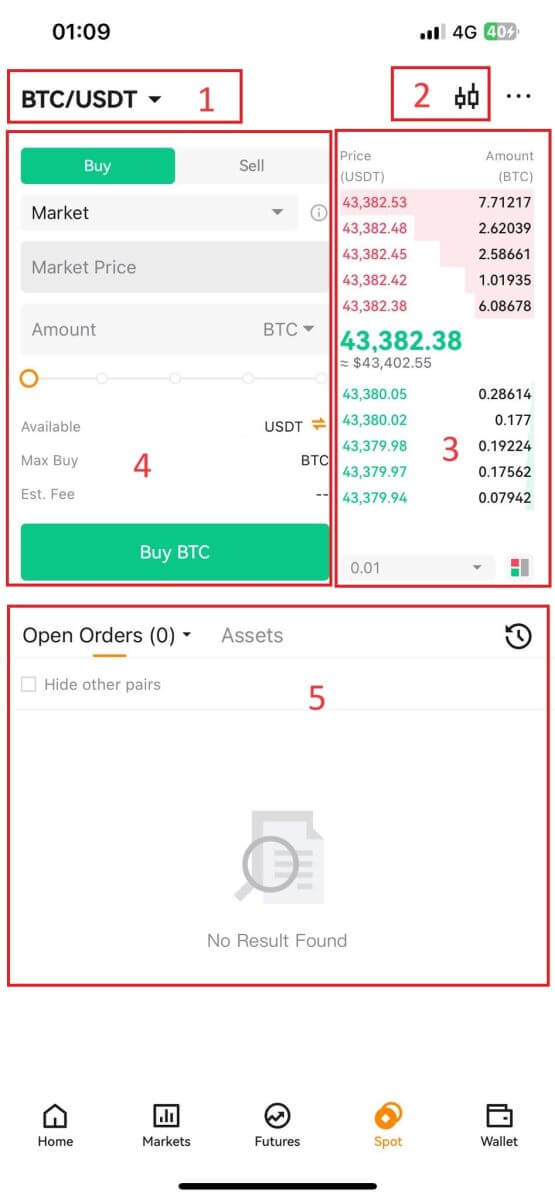

2. Here is the trading page interface.

- Market and Trading pairs.

- Real-time market candlestick chart, supported trading pairs of the cryptocurrency.

- Sell/Buy Order Book.

- Buy/Sell Cryptocurrency.

- Open orders.

3. As an example, we will make a [Limit order] trade to buy BTC.

Enter the order placing section of the trading interface, refer to the price in the buy/sell order section, and enter the appropriate BTC buying price and the quantity or trade amount.

Click [Buy BTC] to complete the order. (Same for sell order)

What is a Market Order?

A Market Order is an order type that is executed at the current market price. When you place a market order, you are essentially requesting to buy or sell a security or asset at the best available price in the market. The order is filled immediately at the prevailing market price, ensuring quick execution. Description

DescriptionIf the market price is $100, a buy or sell order is filled at around $100. The amount and price that your order is filled at depends on the actual transaction.

What is a Limit Order?

A limit order is an instruction to buy or sell an asset at a specified limit price, and it is not executed immediately like a market order. Instead, the limit order is activated only if the market price reaches or exceeds the designated limit price favorably. This allows traders to target specific buying or selling prices different from the current market rate.

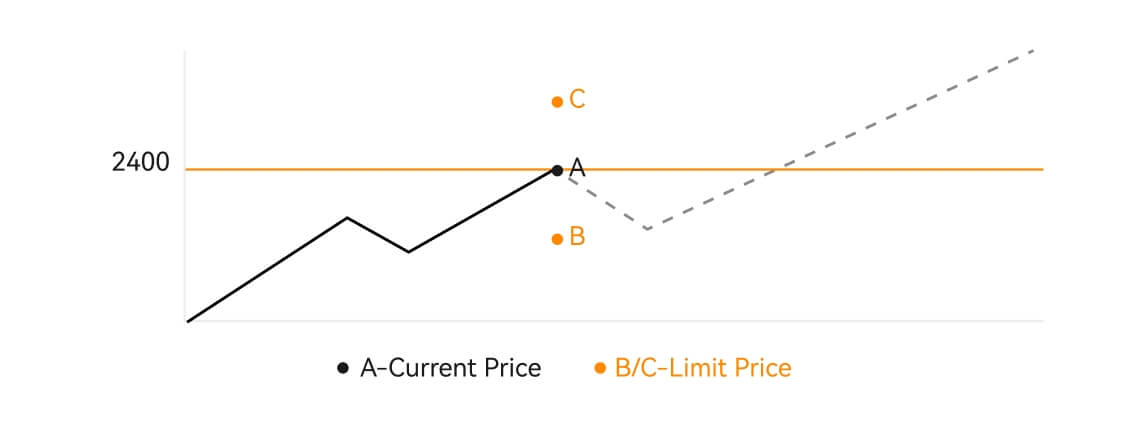

Limit Order illustration

When the Current Price (A) drops to the order’s Limit Price (C) or below the order will execute automatically. The order will be filled immediately if the buying price is above or equal to the current price. Therefore, the buying price of limit orders must be below the current price.

Buy Limit Order

Sell Limit Order

1) The current price in the above graph is 2400 (A). If a new buy/limit order is placed with a limit price of 1500 (C), the order will not execute until the price drops to 1500(C) or below.

2) Instead, if the buy/limit order is placed with a limit price of 3000(B)which is above the current price, the order will be filled with the counterparty price immediately. The executed price is around 2400, not 3000.

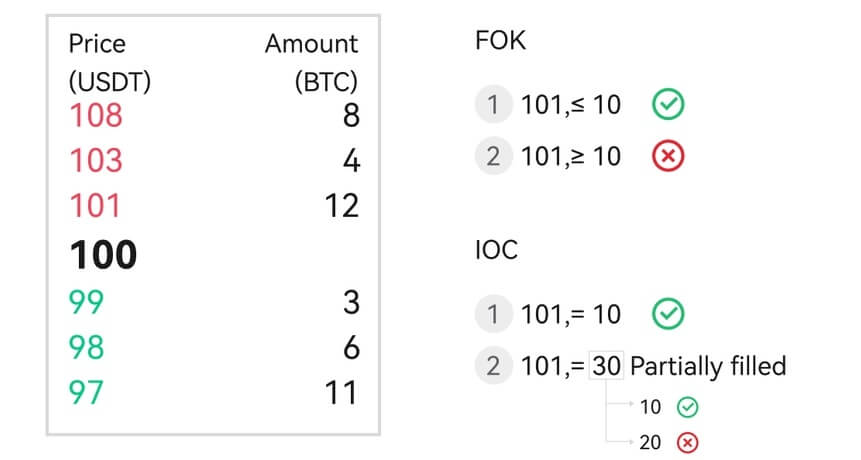

Post-only/FOK/IOC illustration

Description

Assume the market price is $100 and the lowest sell order is priced at$101 with an amount of 10.

FOK:

A buy order priced at $101 with an amount of 10 is filled.However, a buy order priced at $101 with an amount of 30 can’t be completely filled, so it’s canceled.

IOC:

A buy order priced at $101 with an amount of 10 is filled.A buy order priced at $101 with an amount of 30 is partially filled with an amount of 10.

Post-Only:

The current price is $2400 (A). At this point, place a Post Only Order. If the sell price (B) of order is lower than or equal to the current price, the sell order may be executed immediately, the order will be cancelled. Therefore, when a sell is required, the price (C) should be higher than the current price.

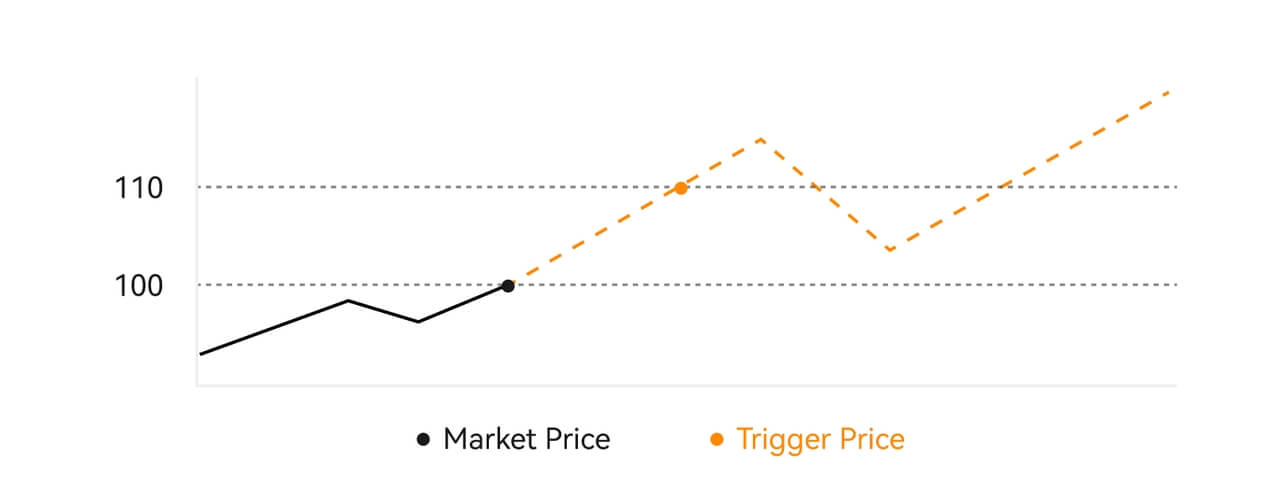

What is a Trigger Order?

A trigger order, alternatively termed a conditional or stop order, is a specific order type enacted only when predefined conditions or a designated trigger price are satisfied. This order allows you to establish a trigger price, and upon its attainment, the order becomes active and is dispatched to the market for execution. Subsequently, the order is transformed into either a market or limit order, carrying out the trade in accordance with the specified instructions.

For instance, you might configure a trigger order to sell a cryptocurrency like BTC if its price descends to a particular threshold. Once the BTC price hits or drops below the trigger price, the order is triggered, transforming into an active market or limit order to sell the BTC at the most favorable available price. Trigger orders serve the purpose of automating trade executions and mitigating risk by defining predetermined conditions for entering or exiting a position.

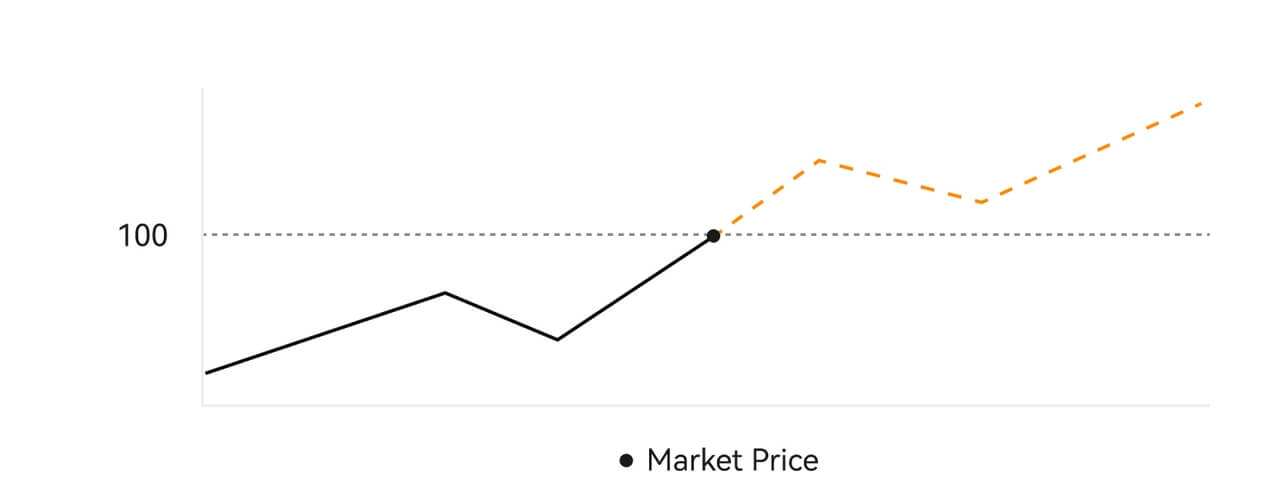

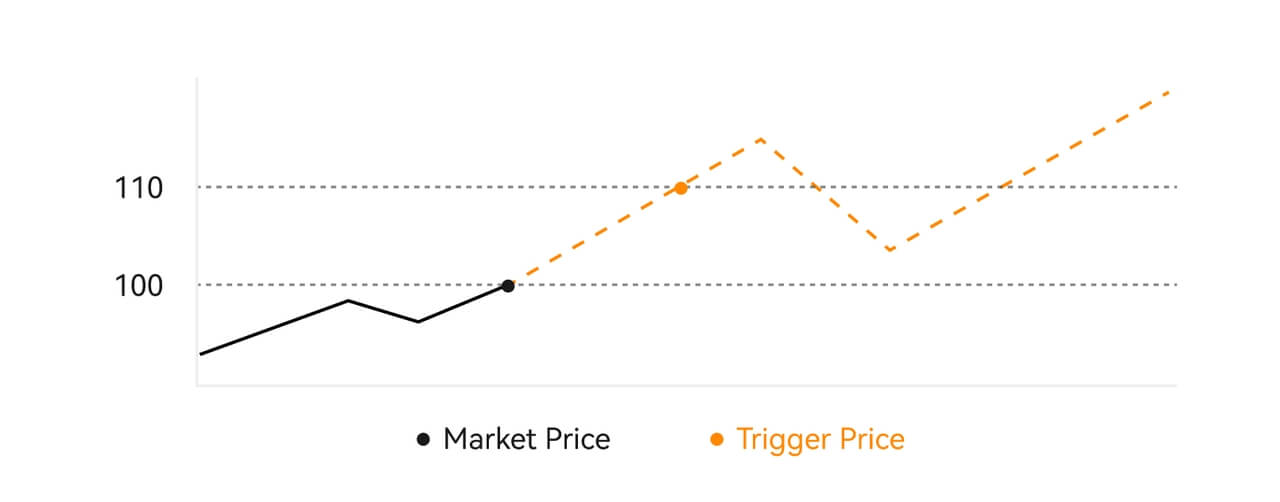

Description

Description

In a scenario where the market price is $100, a trigger order set with a trigger price of $110 is activated when the market price ascends to $110, subsequently becoming a corresponding market or limit order.

What is a Trailing Stop order?

A Trailing Stop order is a specific type of stop order that adjusts with changes in the market price. It allows you to set a predefined constant or percentage, and when the market price reaches this point, a market order is automatically executed.

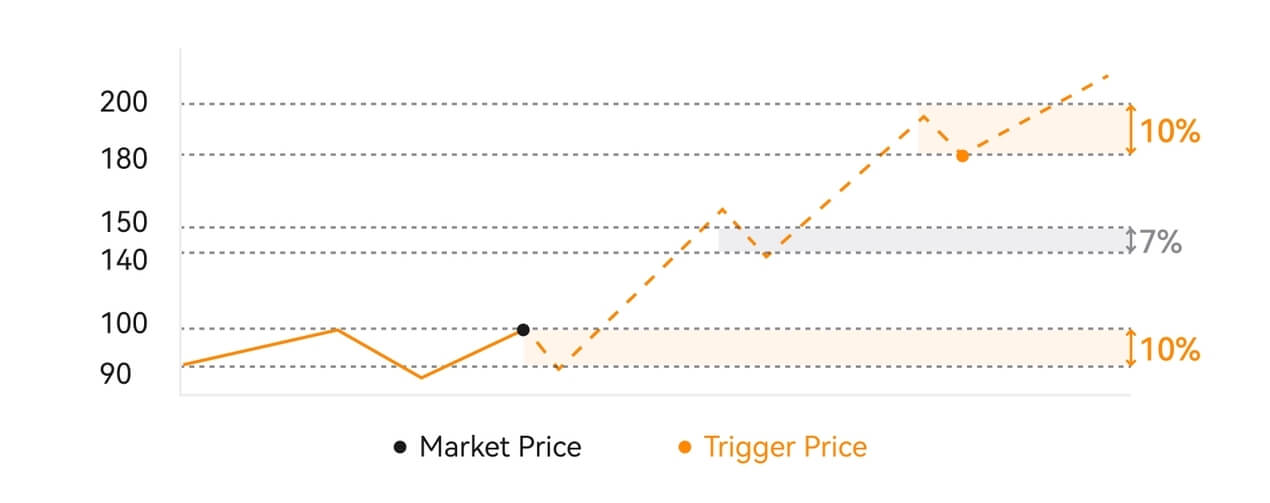

Sell Illustration (percentage)

Description

Assume you are holding a long position with a market price of $100, and you set a trailing stop order to sell at a 10% loss. If the price drops by 10% from $100 to $90, your trailing stop order is triggered and converted into a market order to sell.

However, if the price rises to $150 and then drops 7% to $140, your trailing stop order is not triggered. If the price rises to $200 and then drops 10% to $180, your trailing stop order is triggered and converted into a market order to sell.

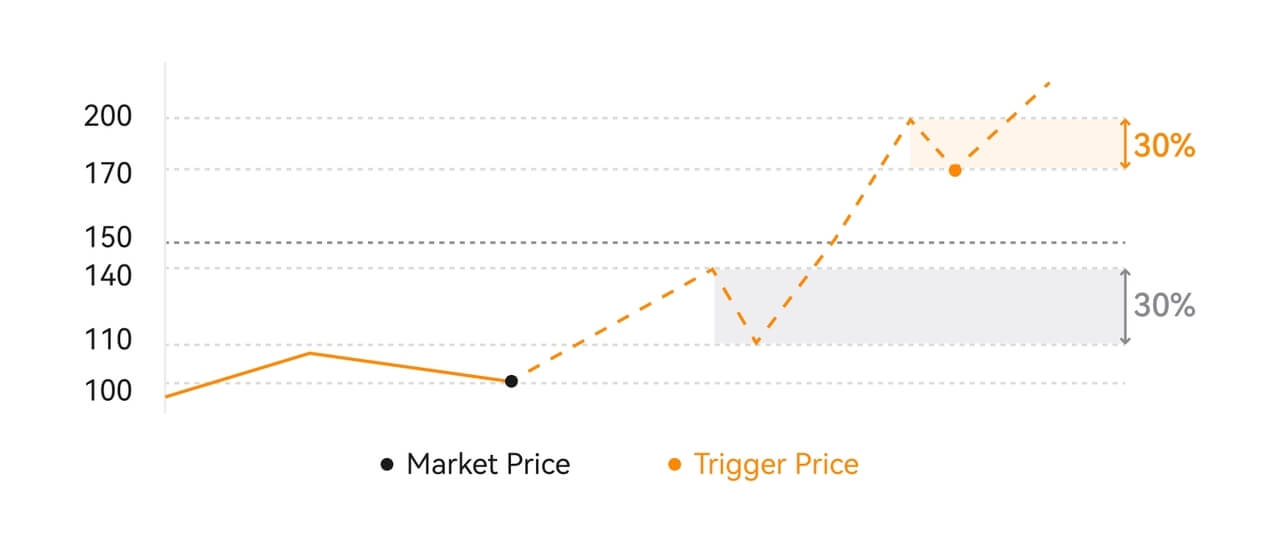

Sell Illustration (constant)

Description

In another scenario, with a long position at a market price of $100, if you set a trailing stop order to sell at a $30 loss, the order is triggered and converted into a market order when the price drops by $30 from $100 to $70.

If the price rises to $150 and then drops by $20 to $130, your trailing stop order is not triggered. However, if the price rises to $200 and then drops by $30 to $170, your trailing stop order is triggered and converted into a market order to sell.

Sell Illustration with activation price (constant) Description

Description

Assuming a long position with a market price of $100, setting a trailing stop order to sell at a $30 loss with an activation price of $150 adds an extra condition. If the price rises to $140 and then drops by $30 to $110, your trailing stop order is not triggered because it isn’t activated.

When the price rises to $150, your trailing stop order is activated. If the price continues rising to $200 and then drops by $30 to $170, your trailing stop order is triggered and converted into a market order to sell.

Frequently Asked Questions (FAQ)

What is the Spot Trading Fee?

- Every successful trade on the BloFin Spot market incurs a trading fee.

- Maker Fee Rate: 0.1%

- Taker Fee Rate: 0.1%

What is Taker and Maker?

-

Taker: This applies to orders that immediately execute, either partially or fully, before entering the order book. Market orders are always Takers since they never go on the order book. The taker trades "take" volume off the order book.

-

Maker: Pertains to orders, like limit orders, that go on the order book either partially or fully. Subsequent trades originating from such orders are considered "maker" trades. These orders add volume to the order book, contributing to "making the market."

How are Trading Fees Calculated?

- Trading fees are charged for the received asset.

- Example: If you buy BTC/USDT, you receive BTC, and the fee is paid in BTC. If you sell BTC/USDT, you receive USDT, and the fee is paid in USDT.

Calculation Example:

-

Buying 1 BTC for 40,970 USDT:

- Trading Fee = 1 BTC * 0.1% = 0.001 BTC

-

Selling 1 BTC for 41,000 USDT:

- Trading Fee = (1 BTC * 41,000 USDT) * 0.1% = 41 USDT